|

Getting your Trinity Audio player ready...

|

Solana’s ecosystem is heating up, with key metrics pointing towards a potential bullish breakout. The blockchain has witnessed a surge in DeFi activity, highlighted by Jito’s dominance in staking and Jupiter Exchange’s leadership in derivatives.

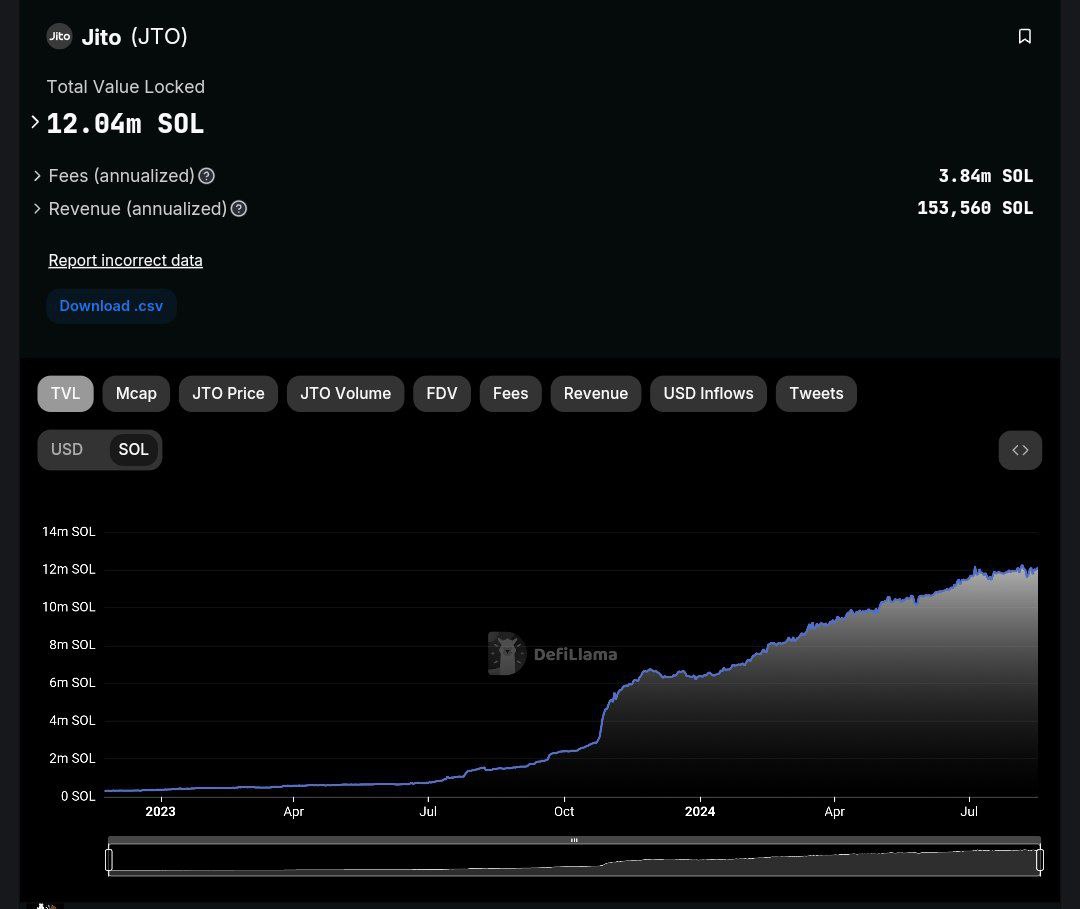

Jito, Solana’s top staking protocol by TVL, has surpassed 12 million SOL in locked value, driven by MEV staking rewards and increasing Liquid Staked Token (LST) adoption. Meanwhile, Jupiter Exchange has claimed the top spot as the leading derivatives protocol across all chains, surpassing rivals like GMX and DYDX.

These developments underscore Solana’s growing DeFi ecosystem, which often correlates with increased blockchain activity and potential price appreciation. The cryptocurrency itself has been consolidating around the $120-$210 price range for several months, forming a potential wedge pattern that suggests institutional accumulation.

Technical analysis indicates a bullish bias on the 4-hour and 8-hour charts, with a potential target of $204. While short-term fluctuations might occur, the longer-term trend appears positive.

Moreover, Solana’s Open Interest (OI) has been rising, mirroring Ethereum’s behavior before its historic bull run in late 2020. This could be a bullish indicator, suggesting potential price appreciation towards the $500 level.

However, it’s essential to approach these projections with caution. While the fundamentals look promising, the cryptocurrency market remains volatile, and unforeseen events could impact price movements. Investors should conduct thorough research and consider consulting with financial advisors before making investment decisions.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

Crypto and blockchain enthusiast.