|

Getting your Trinity Audio player ready...

|

Solana (SOL) has been making headlines as it attempts to rebound from recent price lows. The cryptocurrency is currently trading at $140.02, up 2.60% in the past 24 hours. While this indicates a potential bullish trend, key resistance levels remain a significant hurdle.

Key Resistance Levels and Potential Targets

SOL’s price action suggests a consolidation phase near the $135.524 mark. A successful breach of this level could trigger a bullish rally, with the next target at $148.058. If momentum continues, SOL could even test the $161.97 high seen in July.

However, a failure to break through the resistance could lead to a retest of the lower support at around $127.60, posing short-term risks for traders.

On-chain data reveals a significant increase in whale accumulation, with holders of over $5 million in stablecoins controlling 61.63% of the total supply. This suggests growing confidence in SOL’s potential for an upward movement.

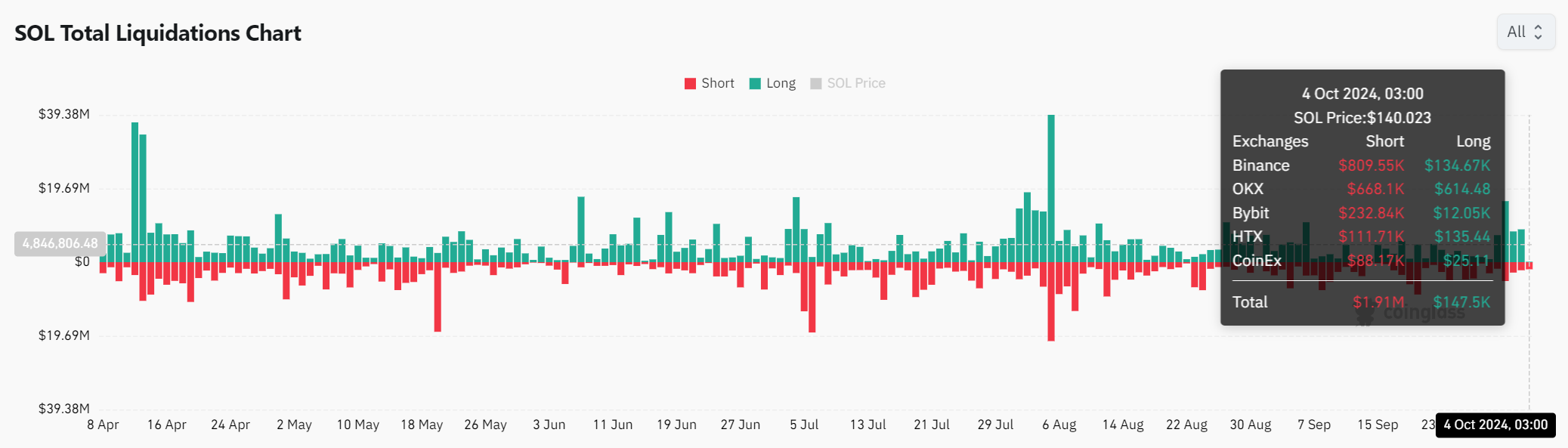

Liquidations and Short-Squeezes

Recent liquidation data indicates that $1.91 million in short positions have been liquidated compared to just $147.5K in longs. This suggests that short traders are becoming increasingly cautious, potentially anticipating a bullish breakout.

If this trend continues, the growing liquidation of shorts could further fuel SOL’s upward momentum, increasing volatility in the near term.

Also Read: Solana’s DEX Advantage – Outperforming Ethereum Amidst Market Downturn

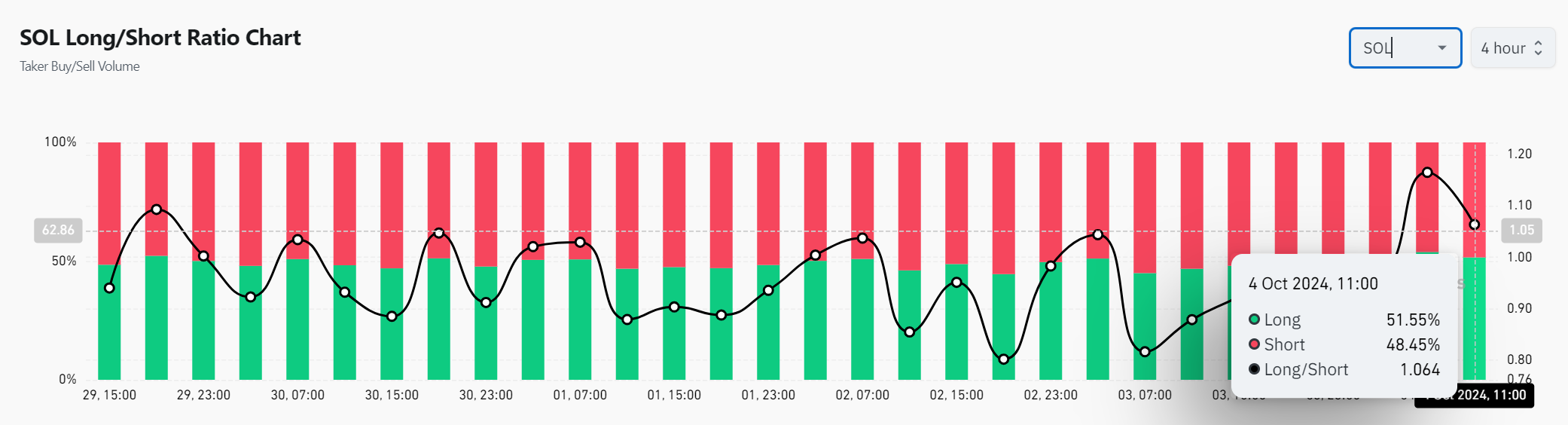

Long/Short Ratio and Market Sentiment

The long/short ratio currently stands at 51.55% in favor of longs, reflecting a growing bullish sentiment among traders. However, with 48.45% still betting against Solana, the market remains divided.

This suggests that volatility can be expected, and traders should closely monitor these ratios. If the longs continue to dominate, SOL could see significant upside, but swift reversals remain a possibility.

Solana appears to be on the cusp of a potential breakout. The combination of whale accumulation, liquidations, and a growing bullish sentiment suggests that SOL has the potential to surpass key resistance levels and ignite a significant rally.

However, the market remains divided, and traders should be prepared for potential volatility. If SOL can successfully break through the resistance, $148.058 and $161.97 would be the next key targets.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

Crypto and blockchain enthusiast.