|

Getting your Trinity Audio player ready...

|

Solana (SOL) has once again encountered resistance at the $205 level, a short-term hurdle that has held firm for over a week. Despite notable gains towards the end of 2024, the asset continues to exhibit high volatility on the daily chart, keeping traders on edge.

Key Support and Resistance Levels

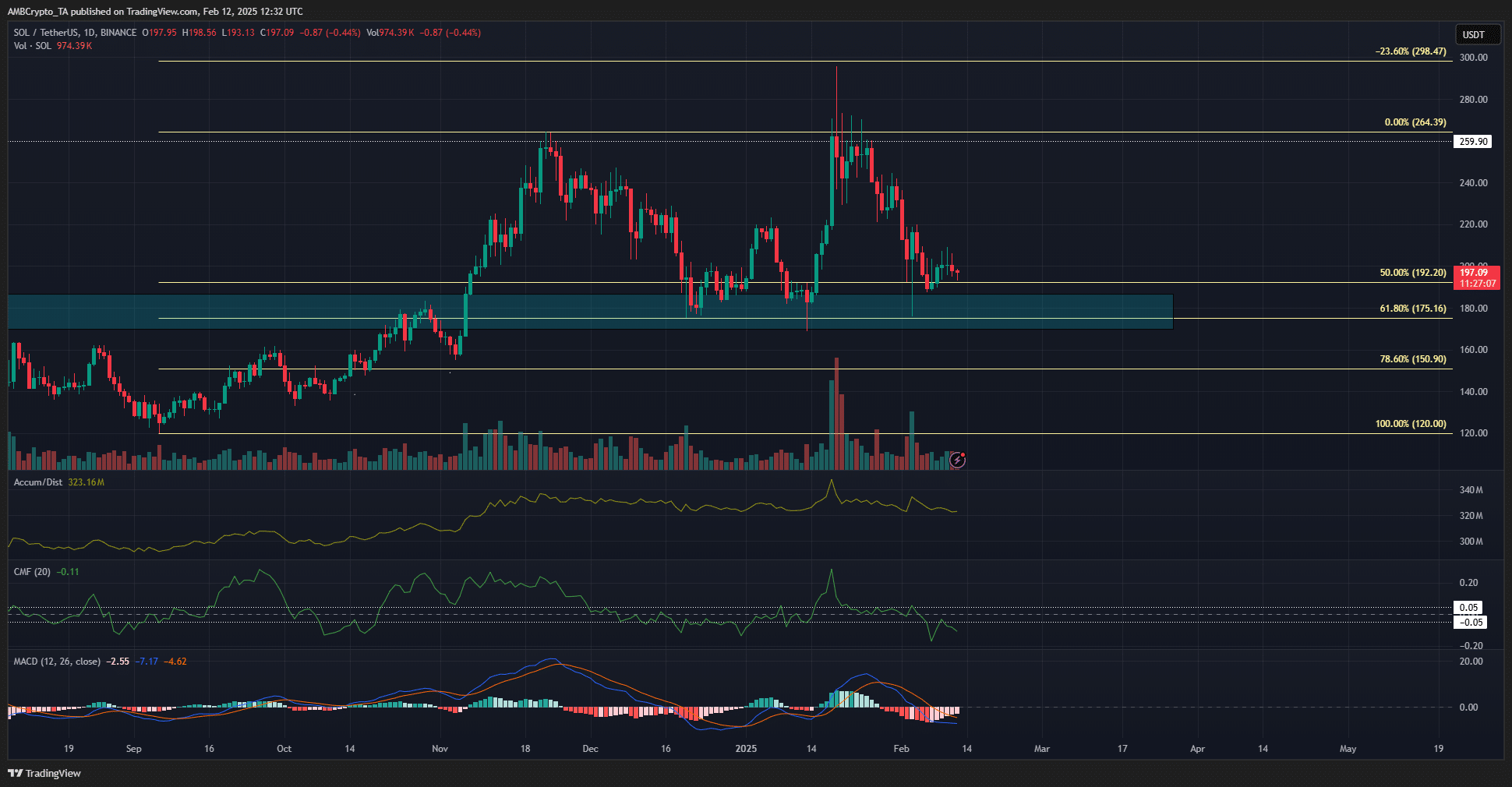

Since November, SOL has oscillated between $180 and $260, with neither price level seeing a decisive breakthrough. At press time, the bullish order block at $180 remained a crucial support zone, preventing further downside.

Encouragingly, a high percentage of long positions among top traders suggests short-term optimism. Whale activity also hints at a potential bullish resurgence, though a strong push past $220 remains elusive.

Technical Indicators Signal Caution

Despite a recent bounce from $188, Solana bulls have struggled to regain lost momentum. The Chaikin Money Flow (CMF) remains below -0.05, indicating substantial capital outflows. Similarly, the Accumulation/Distribution (A/D) indicator has lacked a clear trend since November, mirroring SOL’s range-bound price action.

Additionally, the Moving Average Convergence Divergence (MACD) is currently below zero, reinforcing bearish momentum on the daily chart. Since Solana’s drop below $242 in late January, the market structure has leaned bearish.

Long-Term Outlook Remains Bullish

Despite prevailing short-term bearish sentiment, Solana maintains a bullish long-term trajectory. Key Fibonacci retracement levels at $175 and $150 remain intact, indicating that as long as SOL holds above these levels, another rally toward $260 and beyond could be in the cards.

Notably, the three-month liquidation heatmap reveals a significant concentration of liquidation levels in the $160-$165 range. This liquidity zone could act as a magnet, drawing SOL’s price downward before a potential recovery.

Also Read: SEC Acknowledges Spot Solana ETF Filings, A Major Step Toward Institutional Adoption

What’s Next for SOL?

Swing traders should closely monitor the $190 support zone, as a break below this level could accelerate selling pressure. Additionally, broader market sentiment, particularly Bitcoin’s price action, could heavily influence Solana’s trajectory. A dip toward $150-$160 may present a compelling buying opportunity for long-term investors who believe the bull cycle is still in play.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!