|

Getting your Trinity Audio player ready...

|

Solana’s price remains under pressure, experiencing an 8% drop in the past week and over 31% in the last month. While technical indicators suggest signs of recovery, the bearish trend persists as SOL continues to trade below key resistance levels.

Solana’s TVL Hits Lowest Level Since November 2024

Solana’s Total Value Locked (TVL) recently fell to $9.90 billion on February 17, marking its lowest point since November 14, 2024. Although it has rebounded slightly to $10.3 billion, this remains a sharp 30% decline from $14.2 billion on January 18. This drop signals waning investor confidence, exacerbated by concerns over Solana’s ecosystem, including accusations of being too extractive and controversies surrounding the LIBRA meme coin launch.

TVL is a critical metric for evaluating liquidity in Solana’s DeFi space. A continued downtrend in TVL could further pressure SOL’s price, while a rebound may indicate renewed investor interest.

Technical Indicators: Signs of Recovery Amid Bearish Pressure

Solana’s Ichimoku Cloud chart reflects a dominant bearish trend, with SOL trading below the red cloud. However, the price has moved above the Tenkan-sen (conversion line) and Kijun-sen (base line), suggesting a weakening bearish momentum. To confirm a trend reversal, SOL must break above the thick red cloud acting as strong resistance.

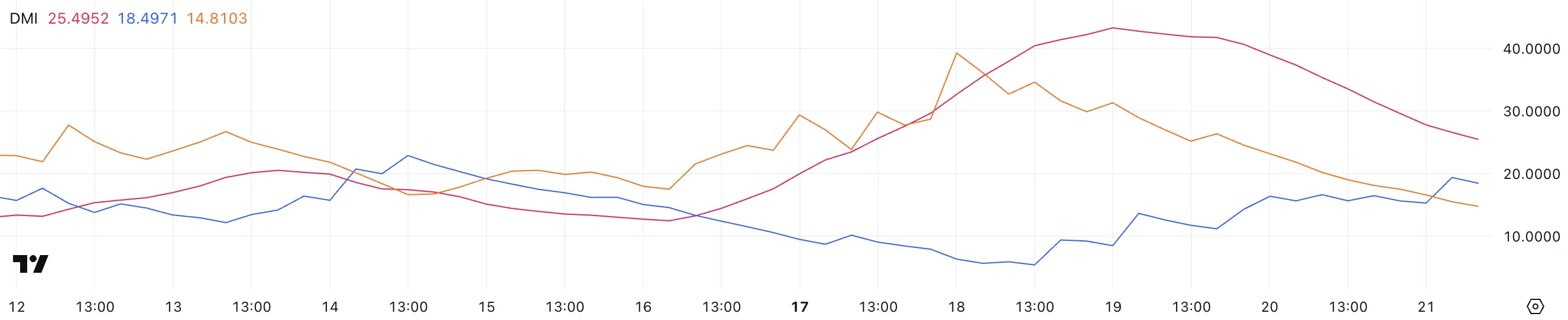

The Directional Movement Index (DMI) indicates a shifting trend. The Average Directional Index (ADX) has dropped from 43 to 25.4, signaling weakening bearish strength. The +DI has risen to 18.4, surpassing the -DI at 14.8, indicating that buying pressure is increasing. A continued upward movement in +DI could confirm a reversal.

Can SOL Reclaim $200?

Solana’s Exponential Moving Averages (EMA) remain bearish, with short-term EMAs below long-term EMAs. However, a slight shift in momentum, accompanied by a 4% price increase, suggests weakening selling pressure. If SOL can break resistance at $183, it could climb to $197 and potentially test $220.

Also Read: Solana Whale Stakes $23.58M in SOL: Is a Price Bottom Near?

Conversely, failure to sustain buying pressure could lead to a retest of $159, with further downside risks extending to $147, its lowest level since October 2024.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!