|

Getting your Trinity Audio player ready...

|

The weekend saw Solana (SOL) endure choppy price action, extending a recent downturn that has left investors on edge. Following a 7.22% drop over the past week, the cryptocurrency slipped another 3.22% in the last 24 hours, settling at $235. This bearish trend signals growing fatigue in the market, as buyers seem hesitant and are holding off until clearer signals emerge.

While some analysts view the pullback as a routine market correction, others are more cautious, suggesting it could signal the beginning of a deeper slide for Solana. The crypto market is infamous for its volatility, and SOL is no exception. With the market sentiment currently in flux, the next move remains uncertain.

Solana Clears Low-Leverage Liquidity – A Potential Rebound?

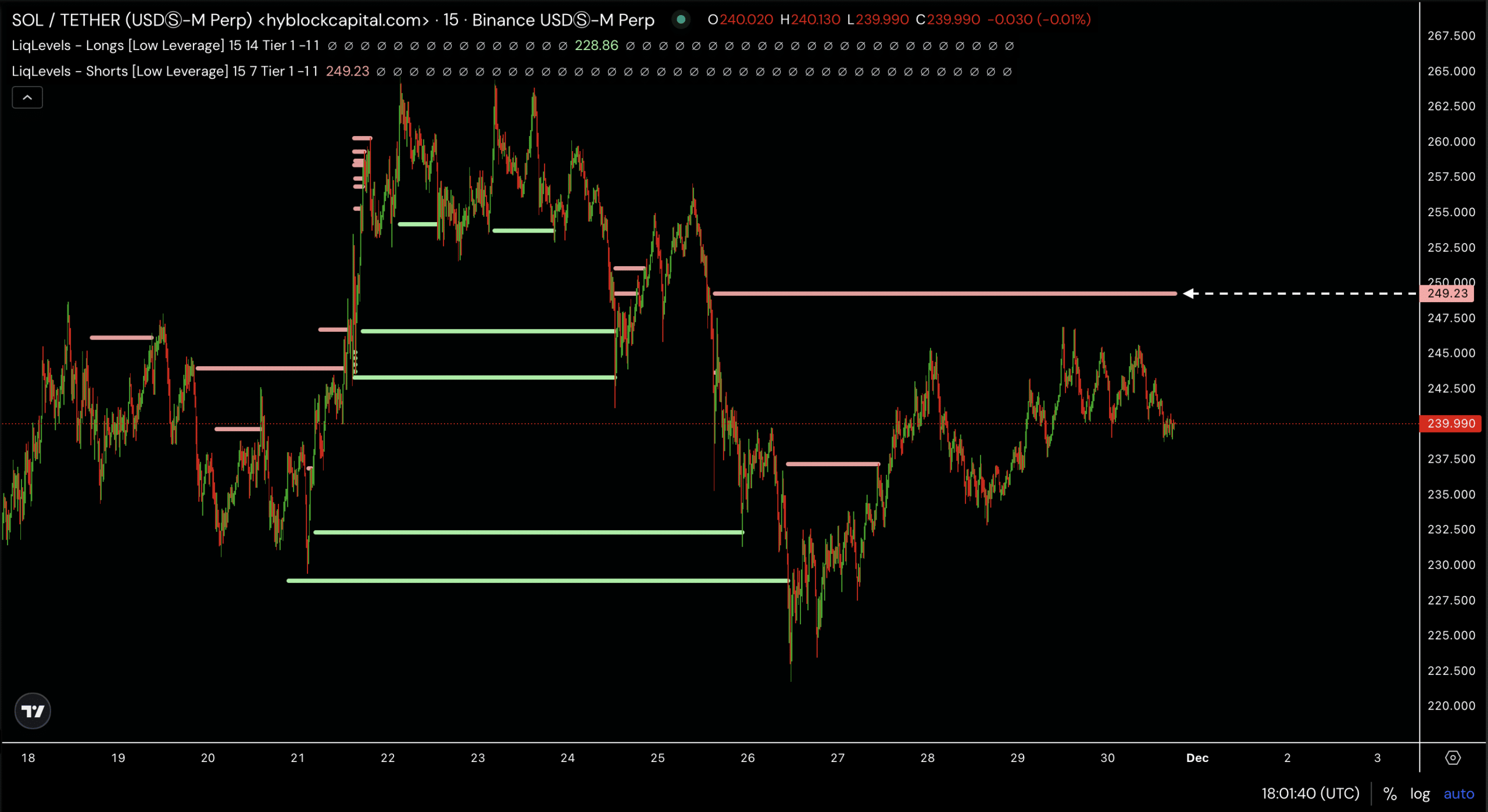

Despite the recent declines, some market observers see potential for a rebound. According to Hyblock, Solana is navigating through a low-leverage liquidity phase, marked by a downward price trend. This behavior often suggests that SOL is clearing out lower-leverage liquidity levels, which could set the stage for an upward price movement.

$SOL is playing the low-leverage liquidity game.

— Hyblock (@hyblockcapital) November 30, 2024

The next level lies above at $249 🎯 pic.twitter.com/VZdmJbJs74

Hyblock’s analysis indicates that the next key target for Solana lies above $249, where a significant liquidity cluster could fuel a potential rally. However, this scenario is not guaranteed, as the outlook remains mixed. Various market indicators offer conflicting signals—some pointing to further downside while others suggest that SOL could be primed for a rebound.

Heavy Selling Activity and Bearish Market Sentiment

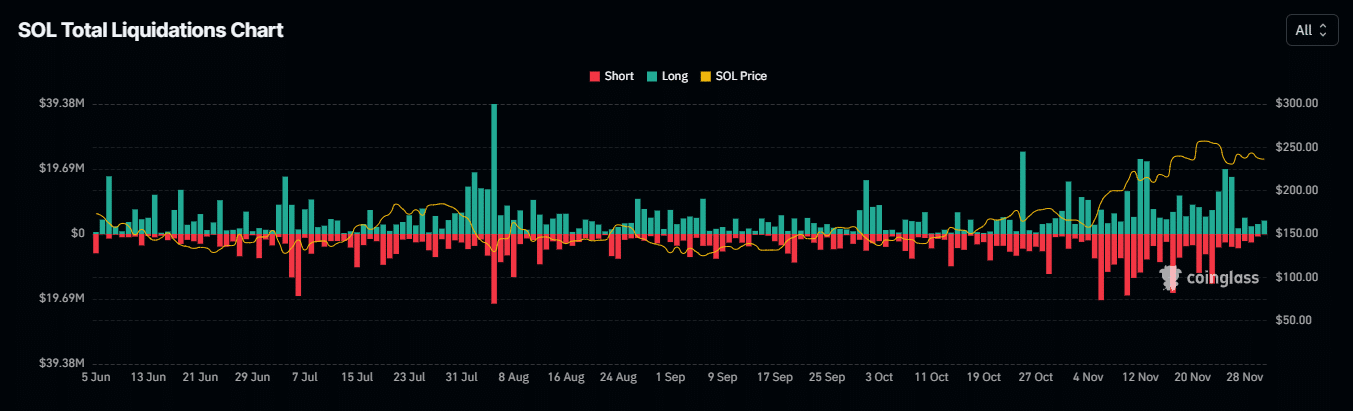

On-chain metrics reflect the ongoing sell-off, with a noticeable decline in trading volume. Volume has decreased by 9.75%, now sitting at $3.72 billion. Coinglass’s Long-to-Short Liquidation model reveals a bearish tilt in the derivatives market, with the long-to-short ratio at 0.8681, signaling that short (sell) contracts significantly outnumber long (buy) contracts.

This imbalance highlights a market that favors downside momentum. Over the past 24 hours, long positions worth $6.4 million have been liquidated, compared to just $348,600 in short liquidations, underscoring the current dominance of bearish sentiment. With selling pressure mounting, the risk of further declines remains, suggesting that Solana may not be out of the woods just yet.

Bullish Signs Amid Market Volatility

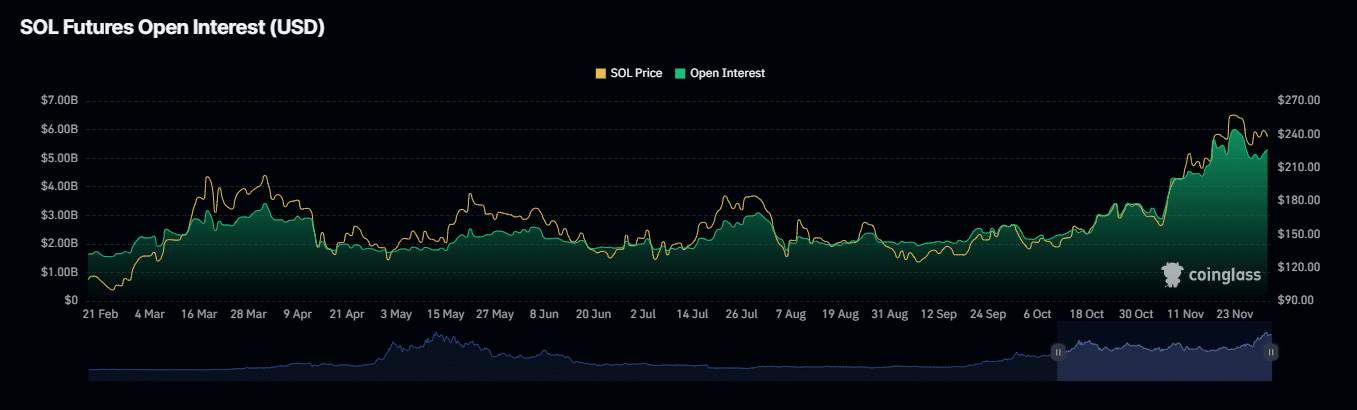

Despite the prevailing bearish sentiment, there are signs of life from the bulls. Open Interest, a key metric for measuring trader confidence, has increased by 2.89%, bringing its total to $5.28 billion. This uptick suggests that traders are regaining some confidence, potentially signaling that the market is gearing up for a rally.

Additionally, Exchange Netflow data reveals a shift favoring the bulls, as significant liquidity—mainly in the form of SOL—moves from exchanges to private wallets. This outflow could create a supply squeeze, adding upward pressure on prices and increasing the likelihood that the current dip is simply a retracement before a potential recovery.

Also Read: Solana (SOL) Surges 40% in November: DApp Success and Bullish Patterns Signal $1,300 Potential

Solana Faces Crossroads

Solana’s current price action is a reflection of the broader uncertainty in the crypto market. While bearish forces dominate at the moment, bullish signals—such as increased Open Interest and liquidity outflows—suggest that a rebound could be on the horizon. For now, SOL remains at a crossroads, with traders waiting for clearer signals before committing to a particular direction. As the market continues to grapple with mixed indicators, Solana’s fate will likely depend on the broader sentiment and whether buyers return in force.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

Crypto and blockchain enthusiast.