|

Getting your Trinity Audio player ready...

|

Solana (SOL), the high-performance blockchain platform, has been experiencing a downward trend in recent weeks. The cryptocurrency’s price has fallen below key moving averages, indicating a potential for an extended decline.

Solana’s one-day chart reveals that its price has fallen below both the 20-day exponential moving average (EMA) and the 50-day simple moving average (SMA) on August 27th. This suggests that SOL is struggling to break above resistance levels, reinforcing the bearish sentiment in the market.

Currently, SOL’s 20-day EMA stands at $147.72, and its 50-day SMA is at $155.74. The inability to stay above these moving averages indicates strong selling pressure and a lack of buying interest to drive the price higher.

Negative RSI and Funding Rate Confirm Bearish Trend

Solana’s Relative Strength Index (RSI) has also declined, further confirming the low buying pressure. The RSI, which is at 40.89 and trending downward, suggests that market participants are more inclined to sell rather than accumulate SOL.

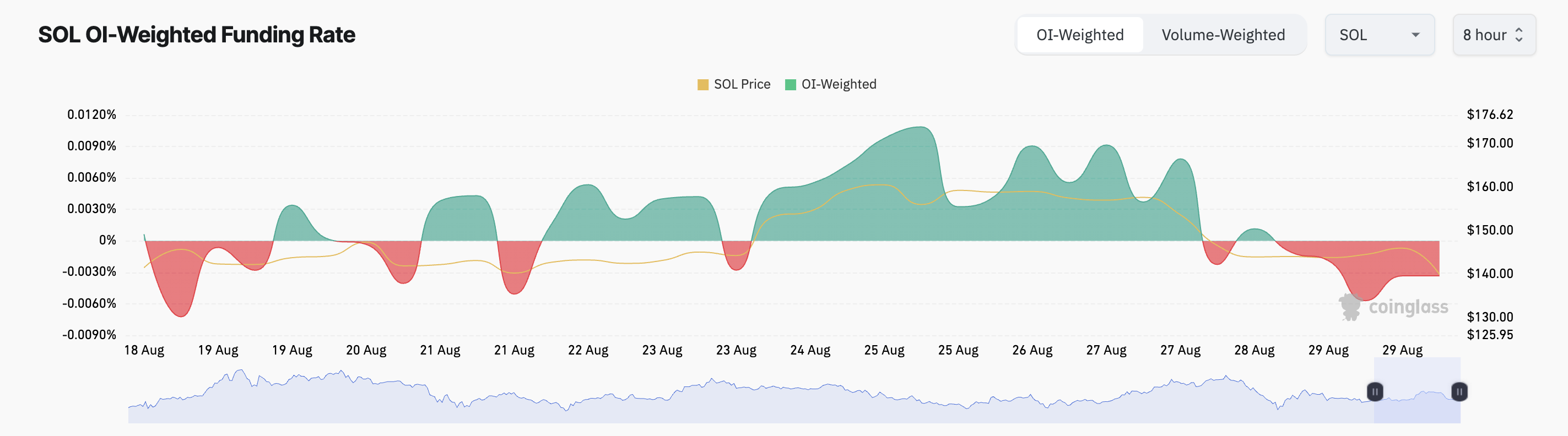

Additionally, the sentiment in Solana’s futures market mirrors the bearish outlook in its spot market. Traders are increasingly taking short positions, indicating a belief that the price will continue to decline. Solana’s funding rate has remained negative since August 28th, further confirming this bearish sentiment.

SOL Price Prediction: Potential for Further Decline

If the current downtrend continues, Solana’s price could fall to $133.64. Should the negative sentiment persist, the next target could be $110. However, if there is a resurgence in demand, Solana’s price might recover and climb to $148.27.

Also Read: Solana Faces Severe Downturn – Analyst Alan Santana Predicts 62% Plunge To $55 Amid Bearish Trends

Overall, Solana’s bearish outlook is reinforced by the decline in price, the inability to break above key moving averages, the negative RSI, and the bearish sentiment in the futures market. While a recovery is possible, the current trend suggests that Solana may face further downward pressure in the near term.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!