|

Getting your Trinity Audio player ready...

|

The Solana (SOL) ecosystem is buzzing with discussions following a proposal to slash the network’s annual inflation rate to 1.5%. The idea, spearheaded by Tushar Jain, Managing Partner at Multicoin Capital, aims to address inefficiencies in the current inflation model. Jain criticized the existing system, arguing it emits “more than necessary” SOL tokens to secure the network, which could be detrimental to long-term value.

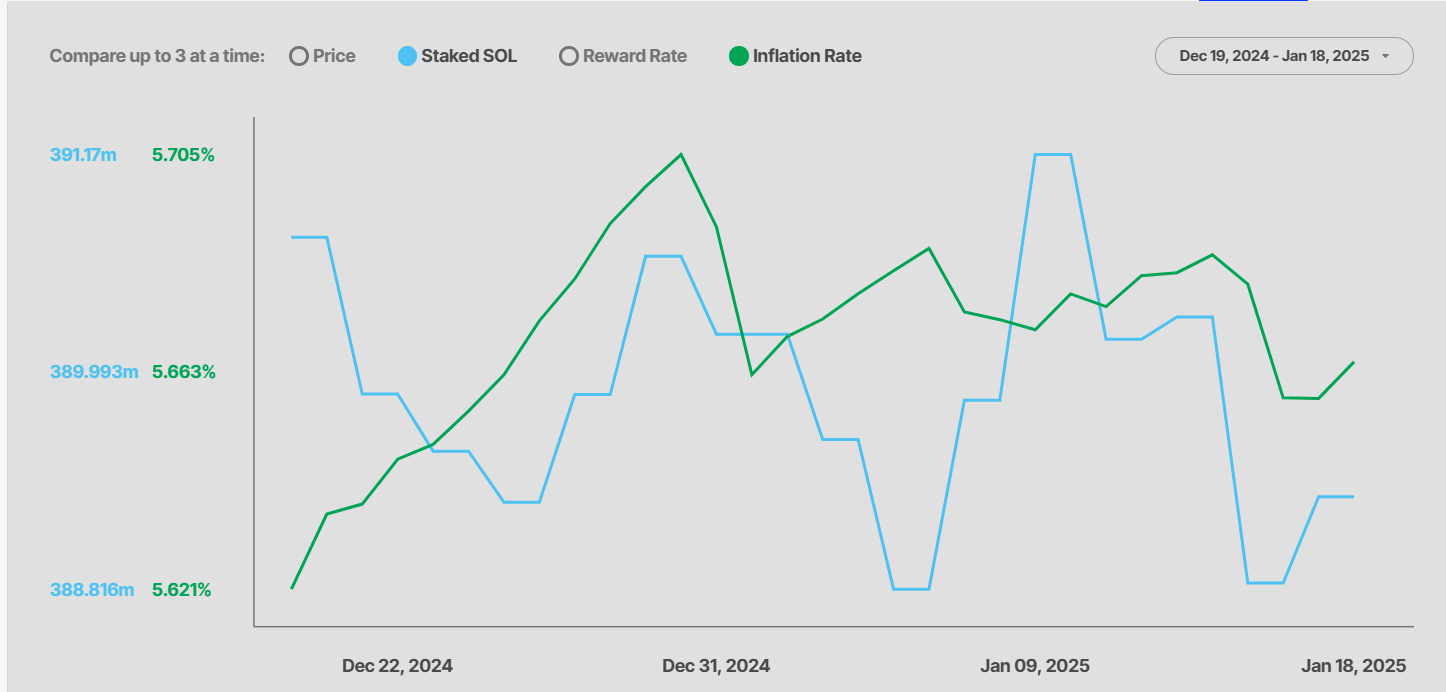

In a recent episode of the Lightspeed podcast, Jain elaborated on the proposal, emphasizing that the current inflation pressure largely stems from validator staking. Validators lock up SOL to secure the network, earning rewards in SOL tokens, which increases the token supply. Jain highlighted that since 2021, approximately 100 million SOL tokens have been added to circulation, raising concerns about over-inflation.

With 66% of the total 592.4 million SOL tokens currently staked, Jain argued that anything beyond 67% provides no added security. He explained, “Beyond 67%, incremental staked SOL does not add any incremental security guarantees because a supermajority of all SOL has voted on any given block, making a long-range attack impossible.” However, staking levels below 33% could compromise the network’s security.

If implemented, the proposal would not only improve market efficiency but also reduce selling pressure. Validators often sell their rewards to cover operational costs, including taxes. Lower inflation could alleviate this trend, bolstering SOL’s market perception and reducing fears of token devaluation.

The proposal has sparked mixed reactions within the community. While proponents view it as a step toward enhancing Solana’s ecosystem, critics, such as pseudonymous DeFi analyst Ignas, expressed concerns about reduced staking rewards. Ignas remarked, “I don’t want the $SOL Inflation Reduction Act to pass… I was really happy with my 20% to 30% APY.”

Also Read: Top Solana Rivals to Buy for 100x Gains Ahead of SOL ETF Approval

Multicoin Capital believes the changes could also encourage DeFi activity, benefiting both stakers and non-stakers. By reducing inflation, the proposal seeks to ensure a healthier balance between network security, market stability, and token value preservation. Whether the community will rally behind the initiative remains to be seen.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!