|

Getting your Trinity Audio player ready...

|

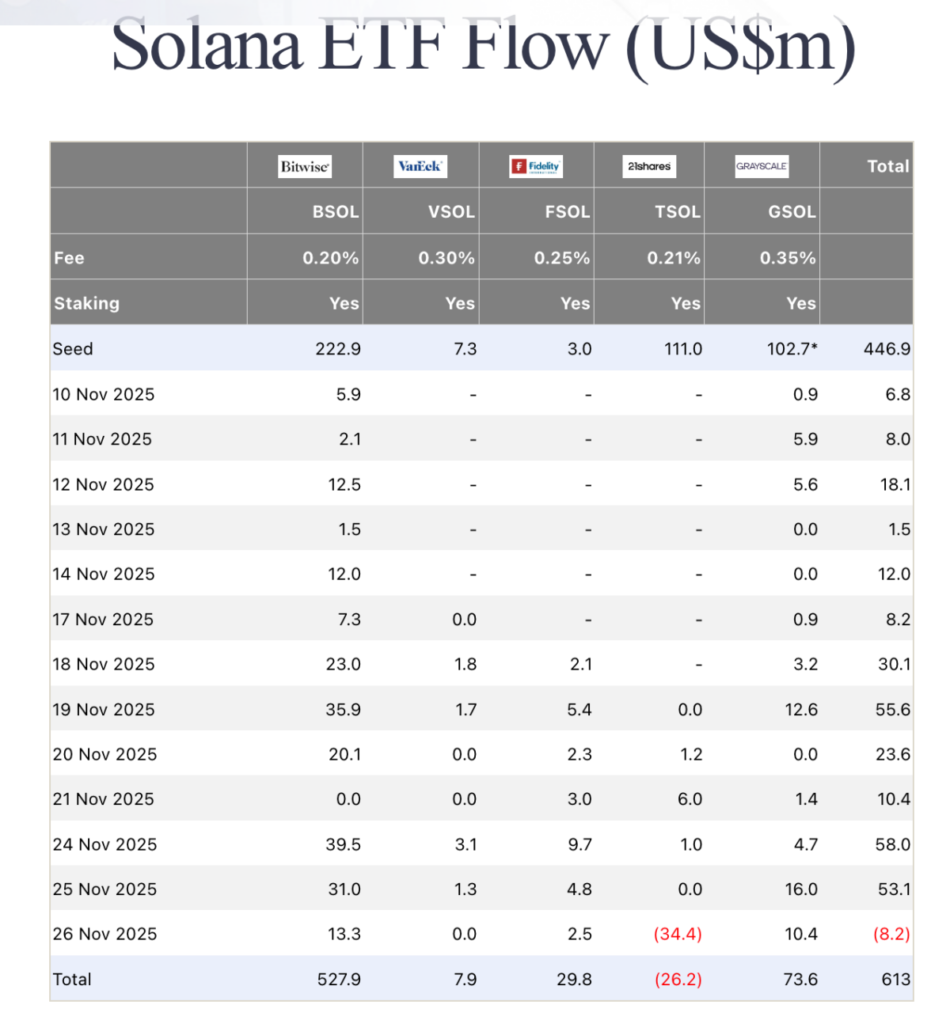

- Solana ETFs experience their first significant outflow, with 21Shares leading the charge.

- Solana’s price is hovering around $140, with technical indicators showing weak momentum.

- ETF holders may delay selling due to staking rewards, but profit-taking could influence price action.

Solana (SOL) made a significant move, reclaiming the $140 mark for the first time in weeks, signaling a brief but notable recovery. This bounce comes amid a pivotal shift in ETF flows, which could have important implications for both Solana’s price and the broader cryptocurrency market. After a prolonged streak of inflows into Solana ETFs, the market saw its first outflow since the SEC’s approval of these ETFs in late October. Here’s what you need to know.

Solana ETFs Record First Major Outflow Since Launch

Solana ETFs, particularly those managed by 21Shares, saw $33.4 million in outflows on November 27, marking the first negative session since their launch. This sharp outflow followed 22 consecutive days of inflows, reflecting a shift in investor sentiment. While 21Shares recorded the largest withdrawal, Bitwise, Fidelity, and Grayscale saw relatively minor positive or neutral movements. The outflow from 21Shares was significant enough to push overall ETF flows negative, which may prompt traders to reassess their positions in Solana.

Interestingly, despite the withdrawals, some investors still opted to hold onto their Solana positions due to the staking rewards associated with these ETFs. This yield-driven incentive has kept many investors from liquidating their holdings, even as market volatility increases.

Will Solana’s Price Sustain Its Recovery?

At the time of writing, Solana (SOL) was trading around $141, with a recent rebound helping it recover from a low of $135 earlier in the month. However, Solana’s price remains below key short-term moving averages, suggesting that the bullish momentum may be fragile. The 7-day simple moving average (SMA) is currently at $142, while the 20-day and 50-day SMAs are at $152 and $168, respectively. Traders are keeping a close eye on these levels, as a break above the 20-day MA could signal a retest of $168. On the other hand, failure to clear this resistance could lead to another dip toward the $135 support zone.

Also Read: Franklin Templeton Files Solana ETF: What It Means for SOL’s Price

What’s Next for Solana Investors?

The latest developments indicate that while the immediate outlook for Solana remains cautious, the recent price rebound offers some hope. However, the broader market conditions and ETF dynamics will continue to play a pivotal role in shaping the price trajectory of SOL. As Solana approaches key technical levels, traders may need to stay alert for any signs of further outflows or market shifts.

The key question for investors is whether Solana can break through these technical barriers or if profit-taking and further outflows will dampen its prospects. As always in crypto, volatility is the only certainty.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.