|

Getting your Trinity Audio player ready...

|

Solana (SOL) is currently grappling with a critical test of its $153.95 support level, following a sharp 6% decline. The cryptocurrency market is on edge as investors closely monitor whether this support will hold or if Solana is poised for a deeper downturn.

Technical indicators are offering mixed signals. The stochastic RSI is edging towards the neutral zone from overbought territory, suggesting potential bullish momentum. However, the looming threat of liquidations casts a shadow over Solana’s immediate outlook.

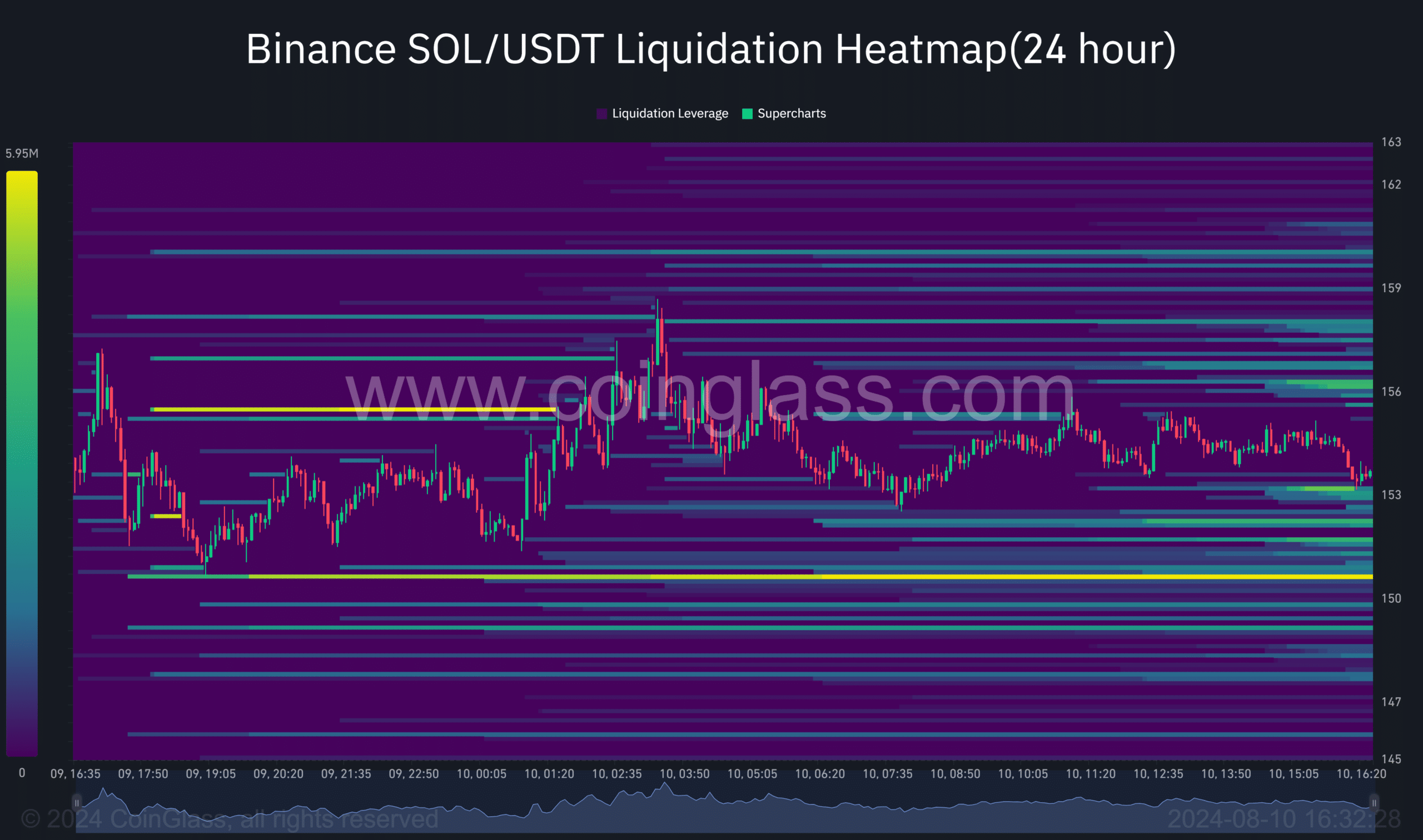

According to Coinglass data, a substantial Solana liquidation pool worth $5.96 million is clustered around the $150 price level, just below the crucial $153.95 support. This concentration of liquidations increases the likelihood of a breakdown, as forced selling could intensify downward pressure on the price.

While the bearish scenario is a real possibility, it’s essential to note that there are also liquidation pools above the $153.95 level. If Solana bulls manage to defend the support, these upper liquidation pools could act as a catalyst for a potential upward surge.

The battle between Solana’s bulls and bears is evident in the short-to-long ratio. Although currently tilted in favor of bears, the ratio has shown signs of resilience. Recent oscillations suggest that buying pressure is gradually increasing. A sustained uptick in buying could potentially reverse the bearish trend.

Also Read: Solana Narrowly Avoids Catastrophe – Silent Patch Prevents Major Network Outage

The coming days will be crucial for Solana. A breach of the $153.95 support could trigger a sharp decline towards the $150 level. Conversely, a successful defense of this level could ignite a rally and retest of higher resistance zones.

Ultimately, the interplay between liquidation pools and the evolving sentiment among traders will determine Solana’s next move. Investors should remain vigilant and closely monitor these factors to make informed decisions.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.