|

Getting your Trinity Audio player ready...

|

Despite the broader cryptocurrency market’s recent bearish sentiment, Solana’s [SOL] blockchain continues to exhibit robust network activity. The blockchain has maintained strong performance metrics, signaling long-term optimism and sustained user engagement.

Solana Hits 2024 TVL High Amid Elevated Transaction Volume

Solana’s Total Value Locked (TVL) reached a new 2024 high of 55.37 million SOL. Notably, using SOL as the metric rather than dollar value provides a clearer picture of network health amid fluctuating prices. Positive TVL growth typically aligns with long-term confidence in a blockchain’s ecosystem.

Additionally, Solana’s daily on-chain volume has averaged over $3 billion in the past two days, underlining its resilience. The network also recorded 67.77 million transactions in the last 24 hours, marking an 11-month high in transaction count.

Bearish Price Trends Persist for SOL

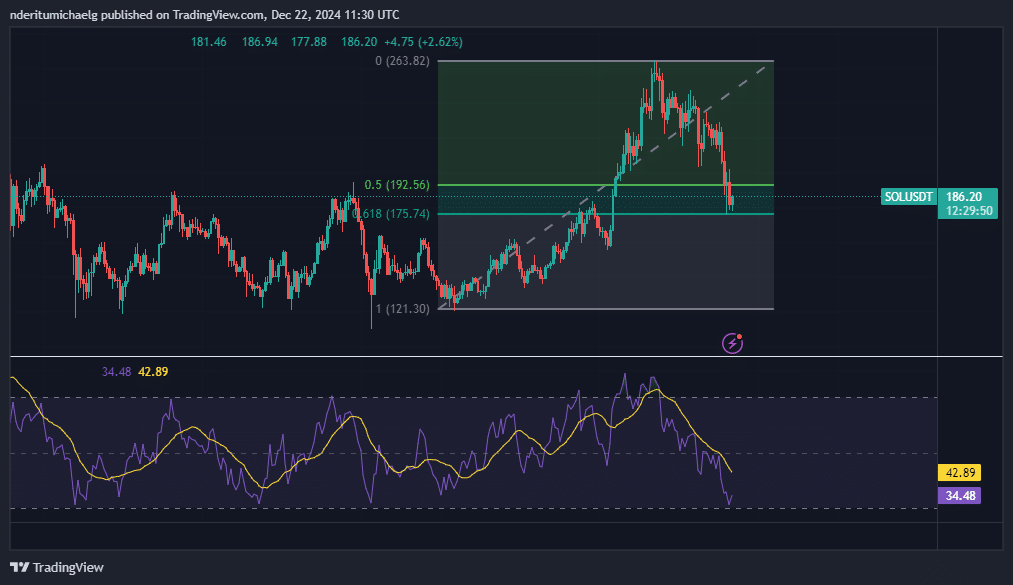

Despite the promising network activity, Solana’s native cryptocurrency, SOL, has not been immune to market downturns. The token experienced a 23% decline last week, retesting key levels within the 0.5 and 0.618 Fibonacci retracement zones.

The Relative Strength Index (RSI) nearly dipped into oversold territory, signaling potential for further downside. However, bearish momentum has begun to show signs of exhaustion, with price stabilization observed at the time of writing.

Potential Signs of Recovery for SOL

Spot market data reveals declining outflows over the past four days, which could pave the way for a recovery. Nonetheless, the derivatives market tells a cautious tale, with Open Interest-weighted funding rates turning negative for the first time in six weeks.

Encouragingly, funding rates have started to shift back into positive territory over the last 24 hours, hinting at renewed bullish sentiment.

While Solana’s robust network activity and declining bearish intensity suggest the potential for recovery, the broader market environment and derivatives trends indicate caution. Traders should monitor funding rates and spot flows closely for clearer signals of a bullish resurgence in the coming days.

Also Read: Solana Price Prediction: Could Spot SOL ETF Approval Propel It to $1,000?

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!