|

Getting your Trinity Audio player ready...

|

Shiba Inu (SHIB), the second-largest memecoin by market capitalization, has been grappling with weak buying activity, despite a recent uptrend. The token, which traded at $0.0000268 at press time, has seen a 1.9% decline in the past 24 hours.

Technical Analysis Hints at Consolidation

A technical analysis of SHIB’s one-day chart reveals a right-angled ascending broadening wedge pattern, typically signaling a bullish continuation upon a breakout above the upper trendline. However, the waning volume histogram bars and the weak Money Flow Index (MFI) suggest a lack of buying momentum. Additionally, the downward-sloping MFI indicates increasing selling pressure.

Conversely, the positive Chaikin Money Flow (CMF) suggests that buying pressure still marginally outweighs selling pressure. As a result, SHIB might consolidate within the channel, caught between bullish and bearish forces.

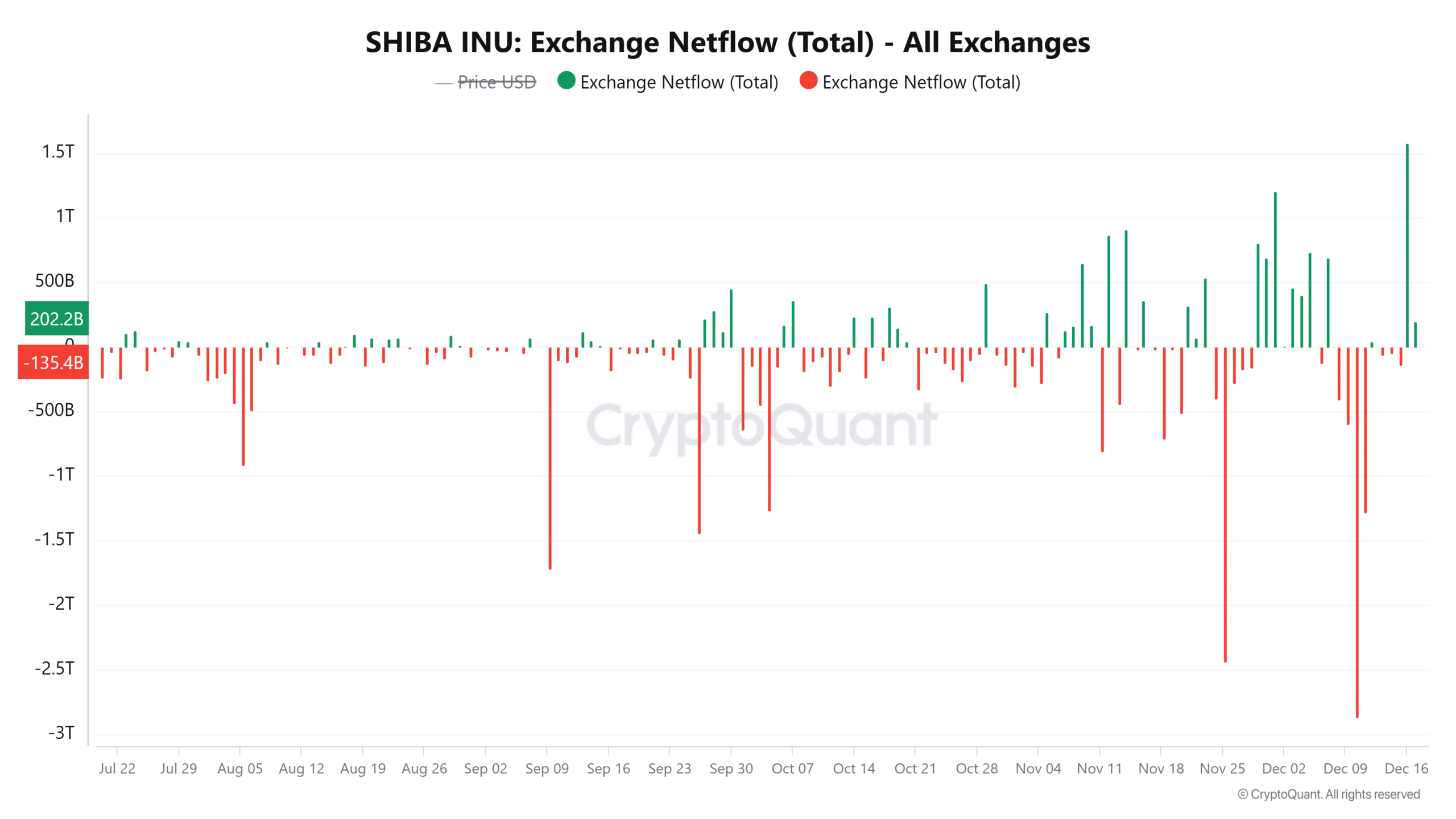

Rising Exchange Inflows Raise Concerns

Data from CryptoQuant highlights a significant surge in SHIB inflows to exchanges on December 16th, reaching a five-month high. Over 1.78 trillion SHIB tokens have been moved to exchanges in the past two days. This influx of tokens to exchanges, coupled with inadequate demand, could potentially exert downward pressure on the memecoin’s price.

Key Levels to Watch

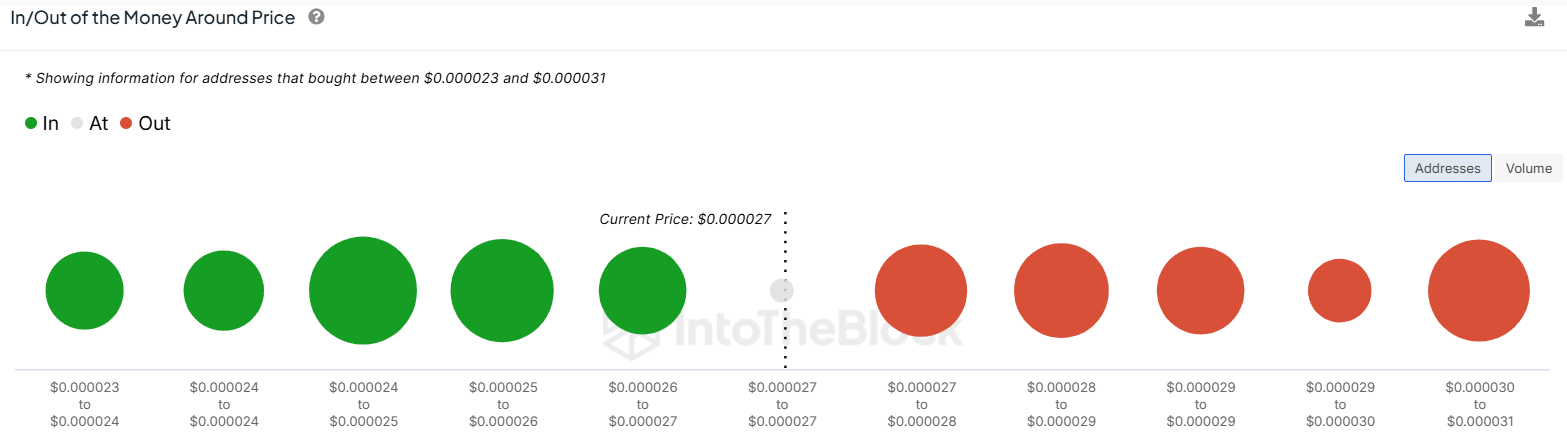

The In/Out of the Money Around Price (IOMAP) metric identifies a strong support level at $0.000024 to $0.000025, where 43,080 addresses have accumulated SHIB. This zone could attract buyers looking for potential entry points.

Conversely, a supply zone exists between $0.000030 and $0.000031, where over 3 trillion SHIB tokens were purchased by 37,230 addresses. As SHIB approaches this zone, it may encounter resistance from traders who purchased at a loss and might seek to minimize their losses.

Bearish Sentiment Prevails

Shiba Inu’s Long/Short Ratio indicates a bearish bias, with short sellers outnumbering long positions. This trend has persisted since December 7th, suggesting that most traders anticipate further downward movement in SHIB‘s price.

Also Read: Shiba Inu Price Prediction: Analyst Forecasts 189% Surge as Ecosystem Expands

As SHIB navigates this complex market dynamic, investors should closely monitor these key levels and the overall market sentiment to make informed decisions.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!