|

Getting your Trinity Audio player ready...

|

Amid rising market uncertainty, Shiba Inu (SHIB) is flashing bearish signals as investor interest wanes and technical indicators suggest continued downward pressure.

According to Coinglass, traders remain largely bearish, with SHIB’s Long/Short Ratio at 0.69—indicating a significant lean towards short positions. Nearly 59.17% of top traders are shorting SHIB, while only 40.83% maintain long positions, reflecting cautious sentiment among seasoned investors.

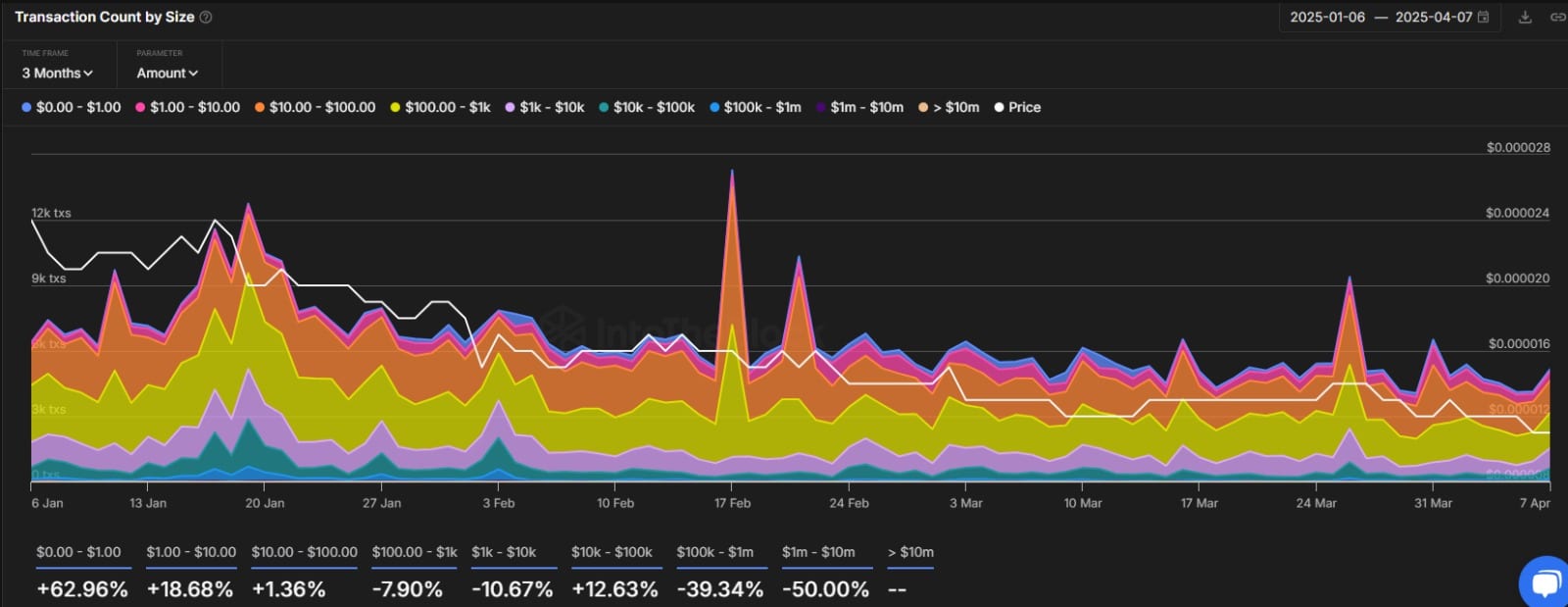

Adding to the pressure, whale activity has notably declined. Data from IntoTheBlock shows a dramatic 50% drop in $1M–$10M SHIB transactions over the past three months, signaling reduced interest from institutional players. At the same time, exchanges recorded a $1.70 million inflow of SHIB tokens within the last 24 hours—often a precursor to increased selling activity.

Despite these bearish indicators, SHIB saw a brief 2.30% uptick in the last 24 hours, trading around $0.00000119. Trading volume also climbed 15%, suggesting renewed market participation. However, technical analysis by AMBCrypto shows SHIB trading within a descending channel since early 2025. The memecoin now hovers near the channel’s upper resistance, a critical level that could determine its next move.

A successful breakout from this resistance could drive SHIB up by 20% to $0.00000152. Conversely, failure to sustain bullish momentum may lead to a 14% drop toward $0.00000109.

Also Read: Shiba Inu Whale Activity Surges 173% as SHIB Faces Key Price Test at $0.000012

Despite bearish short-term signals, some experts remain optimistic about SHIB’s long-term potential. In a recent Finder report, Bitget CEO Gracy Chen predicted SHIB could reach $0.0000600 by the end of 2025, citing its strong community and potential ecosystem developments.

As SHIB sits at a technical crossroads, the next few days could be decisive. Whether bulls manage to overpower bearish sentiment or capitulate under increasing sell pressure remains to be seen. Investors should closely monitor volume, whale activity, and key resistance levels to navigate SHIB’s volatile journey ahead.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!