|

Getting your Trinity Audio player ready...

|

Shiba Inu (SHIB) has broken below the ascending trendline that supported its price action since the August 5 crash. This technical breakdown suggests that the second-largest meme coin could be poised for further declines, potentially revisiting its Q1 2024 lows.

The trendline, which had been holding SHIB’s price between $0.00001095 and $0.00003315, recently dipped to the press-time level of $0.00001160. With the previous low of $0.00000837 from Q1 2024 now within reach, bearish sentiment is gaining traction in the market.

Technical Indicators Signal Further Decline

The Moving Average Convergence Divergence (MACD) indicator currently reinforces the bearish outlook. At press time, the MACD line stands at -0.00000110, the signal line at -0.00000102, and the histogram at -0.00000008. The MACD line remaining below the signal line confirms the ongoing downtrend.

If the MACD line further drops to -0.00000200 and the histogram shifts deeper into negative territory at -0.00000015, it could indicate sustained selling pressure. However, a reversal might be possible if the MACD line crosses above the signal line and heads toward +0.00000100, with the histogram moving into positive territory.

Key Price Levels to Watch

Should SHIB fall to its Q1 2024 low of $0.00000837, panic selling may accelerate, potentially leading to further declines. Conversely, a rebound from this level could see SHIB attempting to retest the broken trendline at $0.00002100, provided buying interest resurfaces.

Declining On-Chain Activity and Market Implications

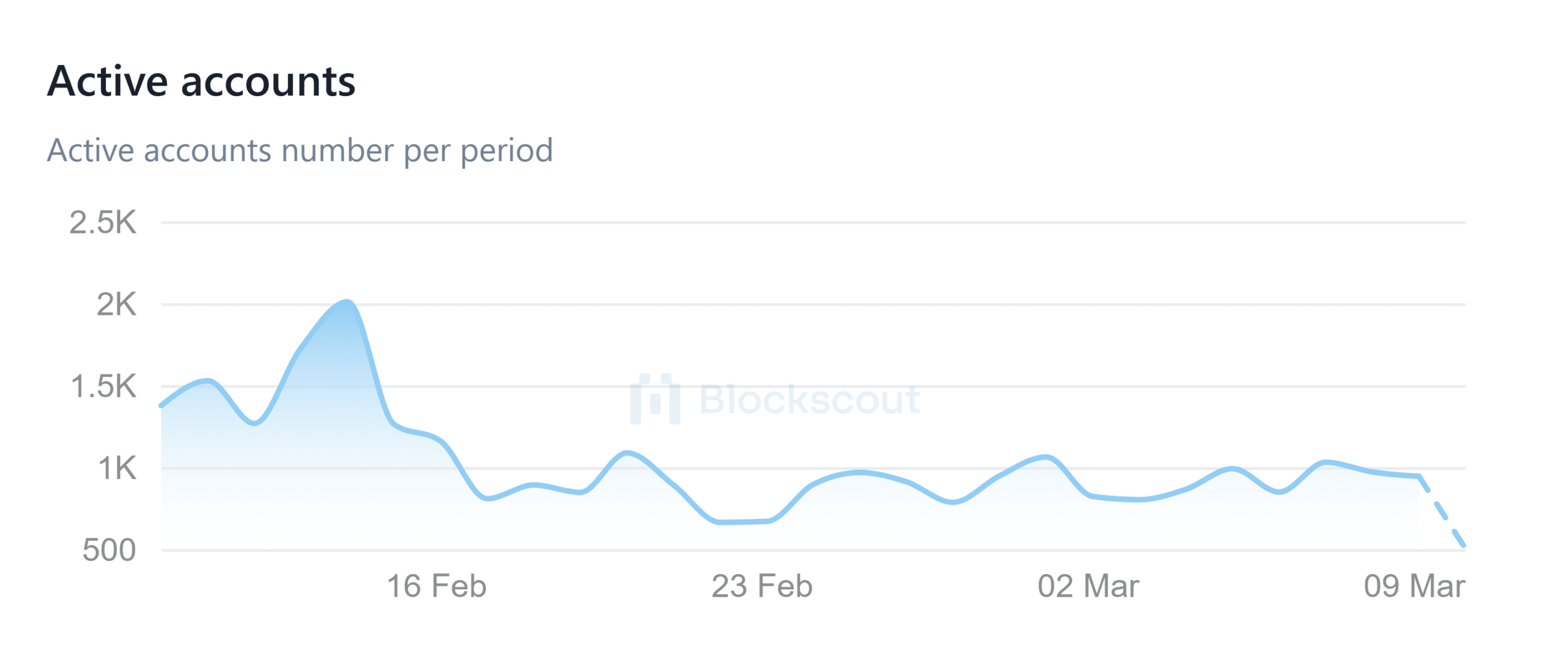

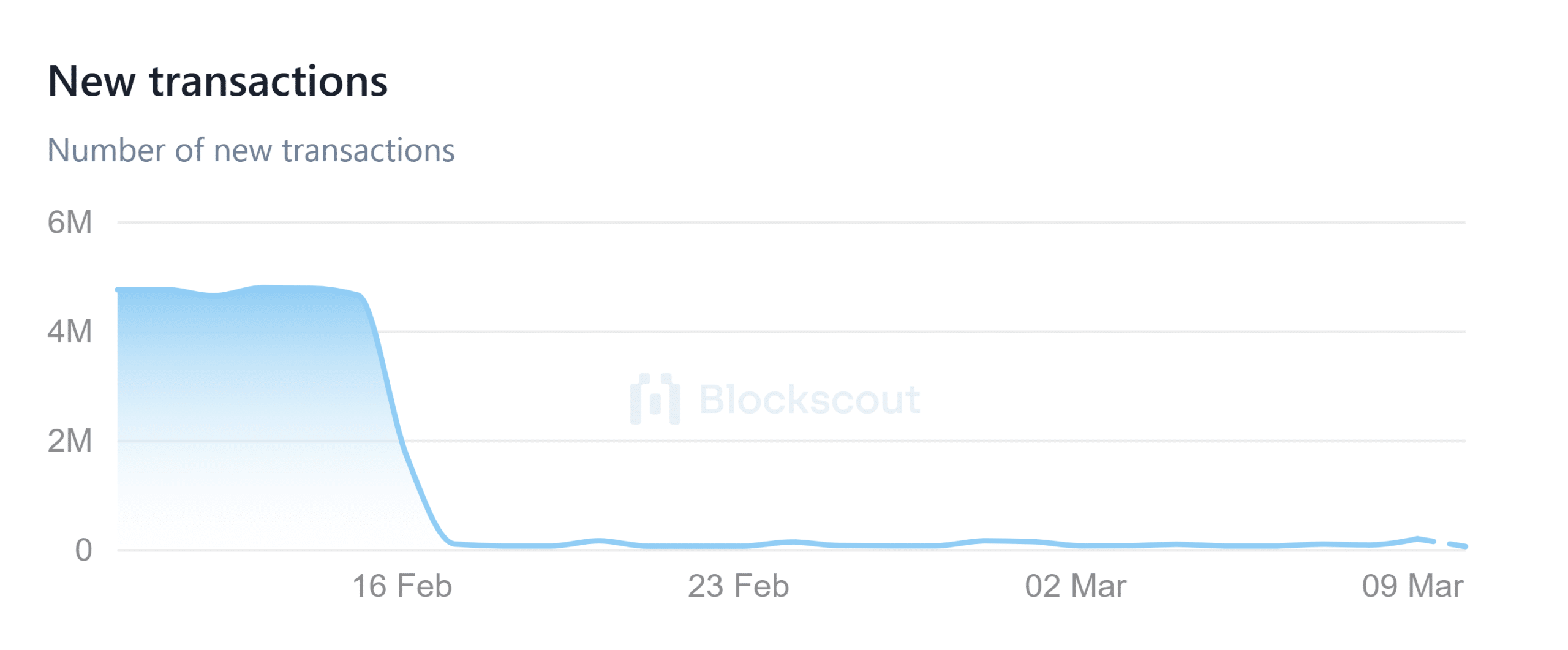

SHIB’s on-chain activity is also signaling trouble. Active addresses per period have dropped significantly, from over 2,000 in mid-February to just 501—a historic low. Additionally, new transactions have plummeted from 4.6 million to just 44,913, indicating a sharp decline in network engagement.

As trading volumes stagnate, investor demand has weakened, reducing liquidity and increasing susceptibility to sell-offs. If SHIB fails to regain bullish momentum or attract new network activity, its price could continue to slide.

Also Read: Shiba Inu (SHIB) Faces Bearish Pressure: Key Support, Resistance Levels, and Market Outlook

For now, traders should watch these key support levels closely while assessing broader market sentiment for potential recovery signals.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!