|

Getting your Trinity Audio player ready...

|

Shiba Inu (SHIB), the popular meme coin, is facing a critical juncture. After losing a key support level in the past 24 hours, the price action has sparked concerns about a potential extended decline. However, there’s a chance for a bullish reversal if certain conditions are met.

Technical Indicators Flash Warning Signs

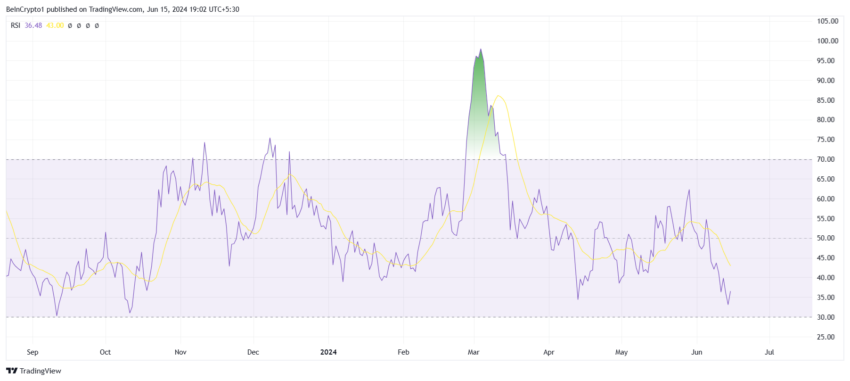

The Relative Strength Index (RSI), a technical indicator used to gauge momentum, is currently painting a bearish picture for SHIB. This indicator typically ranges from 0 to 100, with readings above 70 signaling overbought conditions and readings below 30 indicating oversold conditions.

Currently, SHIB’s RSI sits firmly below the neutral mark of 50.0, with ongoing bearish pressure dragging it down. This reading mirrors levels last seen in October 2023, marking an eight-month low for the indicator.

Shiba Inu Price Prediction: A Balancing Act

For nearly two months, SHIB had been consolidating between $0.00002835 and $0.00002093. While investors anticipated a breakout from this zone, the price disappointingly fell below it. SHIB is currently trading at $0.00002084.

Based on technical analysis, a further decline seems likely. Analysts predict SHIB could plunge to lows of $0.00001600 or even $0.00001473.

A Glimmer of Hope: Consolidation or Capitulation?

However, there’s a potential silver lining. If SHIB manages to reclaim $0.00002093 as support, consolidation could resume. This would offer investors a chance to recoup their losses and potentially invalidate the bearish predictions.

The Takeaway: Patience is Key

Shiba Inu’s price action is a reminder of the inherent volatility in the cryptocurrency market. While a potential price drop looms, it’s crucial to remember that technical indicators are not absolute.

Investors should closely monitor SHIB’s price movement in relation to the $0.00002093 level. If consolidation resumes, a bullish reversal remains a possibility. However, if the price breaks decisively below this support, further losses could be imminent.

Also Read: Ethereum ETF Hype! SHIB, LINK, ETH Exchange Supply Drain – Get Ready For Liftoff?

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!