|

Getting your Trinity Audio player ready...

|

SEI has struggled throughout 2025, with its price plummeting by 65% year-to-date (YTD), positioning it among the worst-performing altcoins this year. Despite this dramatic drop, SEI’s oversold status typically signals a potential bullish reversal. However, several technical indicators suggest that such a recovery may not be on the horizon just yet.

The cryptocurrency market’s overall instability, combined with rising macroeconomic tension, has driven a sharp decline in SEI’s value. The lack of demand, coupled with bearish market conditions, has left the asset in a precarious position. As SEI’s price remains trapped within a descending channel, the asset has faced increased pressure after failing to hold critical support levels at $0.21 and $0.18.

A key technical indicator, the Relative Strength Index (RSI), currently reads 26.96, confirming that SEI is indeed oversold. RSI readings below 30 indicate an asset is oversold, suggesting the potential for a price correction. However, this oversold condition alone is not enough to guarantee a recovery, especially given SEI’s broader bearish trend.

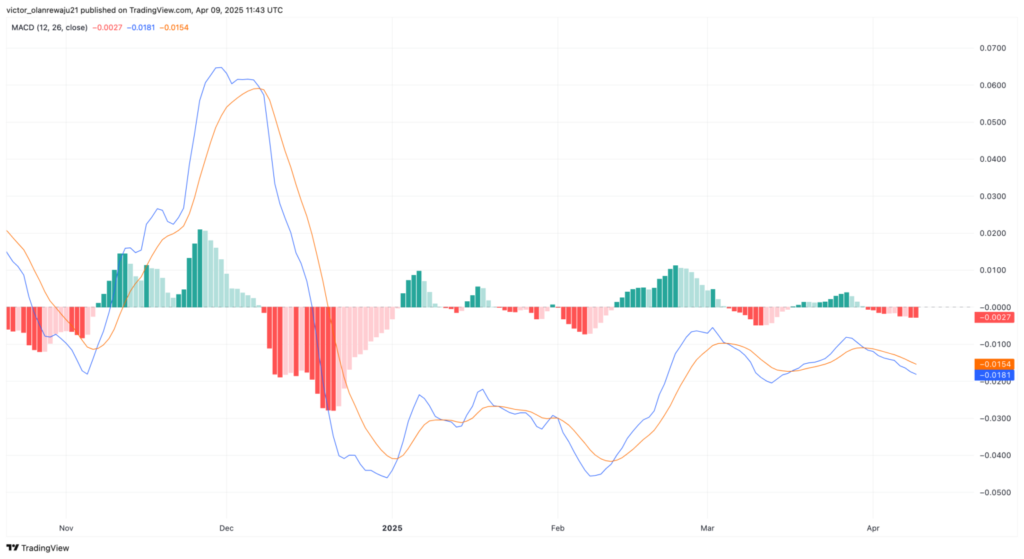

The Moving Average Convergence Divergence (MACD) indicator, another crucial momentum tool, also paints a grim picture for SEI’s short-term prospects. The MACD shows that the 26-period Exponential Moving Average (EMA) has crossed over the 12-period EMA, confirming that the current trend is bearish. This crossover typically signals a lack of upward momentum, further complicating the possibility of a quick recovery.

Additionally, SEI’s price remains below the Ichimoku Cloud, which acts as resistance rather than support. This position further indicates that any potential price rebound is unlikely in the short term. If the cryptocurrency fails to break above the resistance levels, it may continue its downward trajectory, potentially testing the $0.10 level.

However, should SEI manage to break out of its descending channel, there is a chance for a reversal, with possible price targets at $0.27 or even $0.36. Until then, investors should remain cautious as SEI‘s bearish momentum shows little sign of easing.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

Also Read: Trump’s World Liberty Financial Buys 541,242 SEI Tokens, Pushing Price Up 7.5%

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!