|

Getting your Trinity Audio player ready...

|

- Kiyosaki sold $2.25M BTC but remains bullish on Bitcoin.

- Proceeds reinvested into businesses generating $27,500/month cash flow.

- Strategy highlights converting crypto gains into passive income and diversification.

The crypto market experienced a sharp downturn this week as Bitcoin prices plummeted to $80,000, erasing nearly $2 billion in value within hours. Analysts now consider $74,000 as the crucial support level, warning that a breach could trigger further declines across major cryptocurrencies. The sudden volatility has left traders cautious, prompting both fear and strategic moves in the investment community.

PRACTICING WHAT I TEACH:

— Robert Kiyosaki (@theRealKiyosaki) November 21, 2025

I sold $2.25 million in Bitcoin for approximately $90,000.

I purchased the Bitcoin for $6,000

a coin years ago.

With the cash from Bitcoin I am purchasing two surgery centers and investing in a Bill Board business.

I estimate my $2.25 million…

Kiyosaki Cashes Out Bitcoin Profits

Amid the market turbulence, Robert Kiyosaki, author of Rich Dad Poor Dad, disclosed that he sold $2.25 million worth of Bitcoin at nearly $90,000 per coin. Having purchased the coins for $6,000 each, Kiyosaki secured substantial profits. Despite selling, he clarified that he remains bullish on Bitcoin. His plan is to redirect the funds into two surgery centers and a billboard business, generating an estimated $27,500 per month in tax-free cash flow starting early next year.

Kiyosaki emphasized that this move aligns with his long-term strategy: converting asset gains into reliable income streams. “I am still very bullish and optimistic on Bitcoin and will begin acquiring more with my positive cash flow,” he stated, highlighting a cycle of profit-taking and reinvestment into income-generating ventures.

Community Reactions and Investment Debate

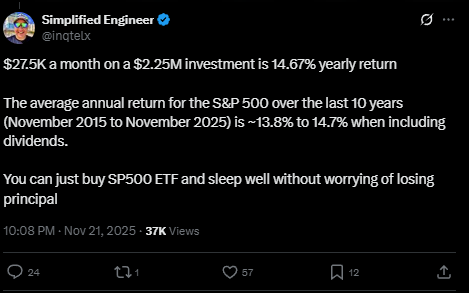

Kiyosaki’s approach sparked widespread discussion online. Some commentators pointed out that the 14.67% annualized return from his investments is comparable to the 10-year S&P 500 average return, suggesting that simpler index investing could yield similar results with less operational risk. Others defended his strategy, noting that cash-flowing businesses offer tax advantages, depreciation benefits, and steady capital for dollar-cost averaging into Bitcoin, benefits that traditional ETFs cannot provide.

Strategic Diversification in Volatile Markets

Kiyosaki’s decision highlights the growing trend of converting crypto profits into diversified, income-generating assets. By leveraging market gains into ventures that produce recurring revenue, investors can mitigate risk while maintaining exposure to crypto upside. As Bitcoin navigates its latest correction, strategies like Kiyosaki’s underscore the importance of balancing volatility with predictable cash flow.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

Also Read: Robert Kiyosaki Warns of Bitcoin August Crash, Sees It as Prime Buying Opportunity

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.