|

Getting your Trinity Audio player ready...

|

In a recent tweet, renowned software engineer and crypto enthusiast Vincent Van Code delved into the intricacies of Ripple’s evolving ecosystem. His analysis highlighted the pivotal role of RLUSD, a regulated stablecoin, in shaping the future of the XRP Ledger (XRPL) and its broader impact on the global financial landscape.

RLUSD: A Catalyst for Institutional Adoption

Van Code emphasized RLUSD’s potential to revolutionize the interface between traditional finance and the Ripple network. As a highly regulated stablecoin, RLUSD is designed to meet the stringent requirements of financial institutions. By enabling banks to hold RLUSD as an asset on their balance sheets, Ripple aims to bridge the gap between traditional finance and blockchain technology. This move could significantly accelerate the adoption of blockchain-based solutions for cross-border payments and other financial transactions.

#RLUSD is a very important component of #Ripple, more than anyone can imagine.

— Vincent Van Code (@vincent_vancode) December 10, 2024

The front end interface to banks and required holdings will now happen in RLUSD, a heavily regulated stablecoin that is compliant enough for banks to hold, show as assets on balance sheet, and of…

XRPL: The Foundation for Global Financial Transformation

Van Code also underscored the importance of the XRPL in Ripple’s long-term vision. The XRPL’s decentralized exchange (DEX) and automated market maker (AMM) functionalities facilitate seamless cross-border payments across over 80 fiat currencies. By leveraging the XRPL, Ripple aims to create a more efficient and transparent global financial system.

However, Ripple’s ambitions extend beyond building a proprietary payments network. The company envisions a future where the XRPL becomes a widely adopted, open-source platform that empowers individuals and institutions to build innovative financial applications.

XRP: A Scarce Asset Driving Value

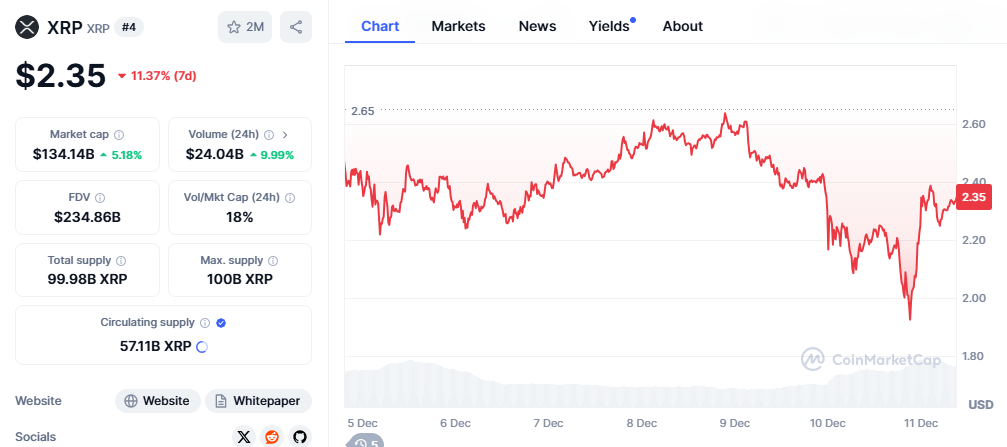

Van Code addressed concerns about XRP’s price dynamics and supply constraints. He explained that the increasing demand for XRP to facilitate transactions on the XRPL, particularly for on-off ramps and AMM pools, could lead to a significant reduction in the circulating supply. As more institutions and individuals adopt XRP, the demand for the asset could outstrip its supply, driving its price higher.

A Bright Future for Ripple

Van Code’s analysis offers a comprehensive view of Ripple’s strategic direction. By combining the stability and regulatory compliance of RLUSD with the flexibility and decentralization of the XRPL, Ripple aims to create a new era of global finance. As the blockchain industry continues to evolve, Ripple’s innovative approach positions it as a key player in shaping the future of financial services.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

Also Read: Ripple’s RLUSD Stablecoin Delay: Why Waiting for NYDFS Approval Could Pay Off

Crypto and blockchain enthusiast.