|

Getting your Trinity Audio player ready...

|

Ripple’s native cryptocurrency, XRP, has experienced a remarkable 372% upswing in the past month, skyrocketing its market cap from $29 billion to $138 billion. This surge in value briefly positioned XRP as the third-largest cryptocurrency by market capitalization, overtaking Tether’s USDT. But what is behind this explosive rally, and what factors are fueling the bullish sentiment around XRP?

The rally began after the U.S. Presidential election in November. Once Donald Trump, a pro-crypto figure, was declared the winner, XRP saw an immediate 16% increase in its value. This initial breakout was just the beginning of a broader uptrend for Ripple’s cryptocurrency. By the second week of November, XRP had skyrocketed by nearly 80%, reaching $1.20—its highest point since 2021.

However, the rally didn’t stop there. On November 21, XRP experienced its second leg of the bull run. The catalyst for this push was the announcement that U.S. SEC Chairman Gary Gensler would resign by January 2025. The market interpreted this as a potential turning point for Ripple, which has been embroiled in a four-year lawsuit with the SEC regarding the security status of XRP. This legal battle had kept XRP’s price growth muted for years. In reaction to the news, XRP surged by 35%.

On January 20, 2025 I will be stepping down as @SECGov Chair.

— Gary Gensler (@GaryGensler) November 21, 2024

A thread 🧵⬇️

The bullish sentiment continued into the last week of November, with XRP reaching a new high, briefly crossing the $2 mark for the first time since 2018. This momentum coincided with rumors that the New York regulator might approve Ripple’s stablecoin, RLUSD, by December 4. Ripple had previously announced that RLUSD was undergoing private beta testing on Ethereum and other blockchains, and it would play a crucial role in Ripple’s cross-border payment solutions. The speculation surrounding RLUSD’s potential to drive XRP adoption helped push XRP to $2.49.

Testing, testing…RLUSD! We’re excited to share that Ripple USD (RLUSD) is now in private beta on XRP Ledger and Ethereum mainnet. RLUSD has not yet received regulatory approval and therefore is not available for purchase or trading – please be cautious of scammers who claim they…

— Ripple (@Ripple) August 9, 2024

Ripple’s focus on enhancing its payments ecosystem through RLUSD, combined with the growing adoption of XRP in cross-border transactions, has captured the market’s attention. The company’s escrow accounts, holding $1 billion worth of XRP tokens, further sparked optimism about the cryptocurrency’s long-term potential.

What’s Next for XRP?

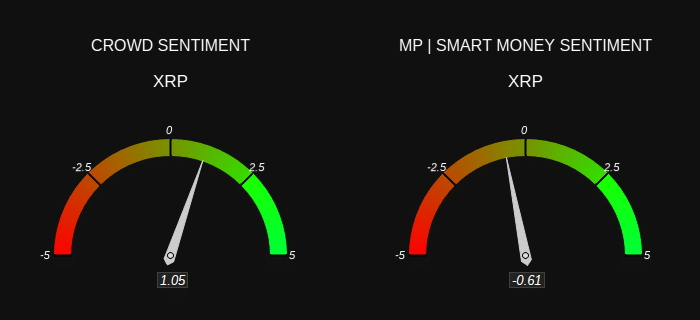

Despite the overwhelming bullish sentiment, signs of a potential correction are emerging. Data from Market Prohit and CryptoQuant suggest that smart money is becoming increasingly bearish, even as retail investors remain overwhelmingly optimistic. Whale-to-exchange transactions have spiked, indicating that large holders of XRP may be taking profits after the altcoin’s recent gains. This suggests that XRP could face a short-term pullback before its next move.

While XRP’s future remains uncertain, it’s clear that recent developments—such as the possible resignation of SEC Chairman Gary Gensler and the launch of RLUSD—have set the stage for further growth in Ripple’s ecosystem. However, investors should remain cautious, as market dynamics and regulatory decisions could greatly influence XRP‘s next phase.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

Crypto and blockchain enthusiast.