|

Getting your Trinity Audio player ready...

|

Ripple (XRP) is on the cusp of a potential breakout, with its price rapidly approaching the crucial resistance level of $0.6533. This level has historically proven to be a significant hurdle for XRP, but recent developments suggest that the cryptocurrency may finally be ready to overcome it.

Technical Indicators Point to Bullish Momentum

Several technical indicators support the bullish outlook for XRP. The Average True Range (ATR) has increased, signaling heightened market volatility and increased trading activity. This suggests that a significant price move is imminent.

Additionally, the Moving Average Convergence Divergence (MACD) has crossed above the signal line, forming a bullish crossover. This indicates a potential shift in momentum from bearish to bullish.

On-Chain Metrics Signal Growing Interest

On-chain metrics also point to a positive outlook for XRP. The number of daily active addresses has increased, indicating growing interest and activity on the network. This suggests that more and more investors are becoming involved with XRP, which could fuel further price appreciation.

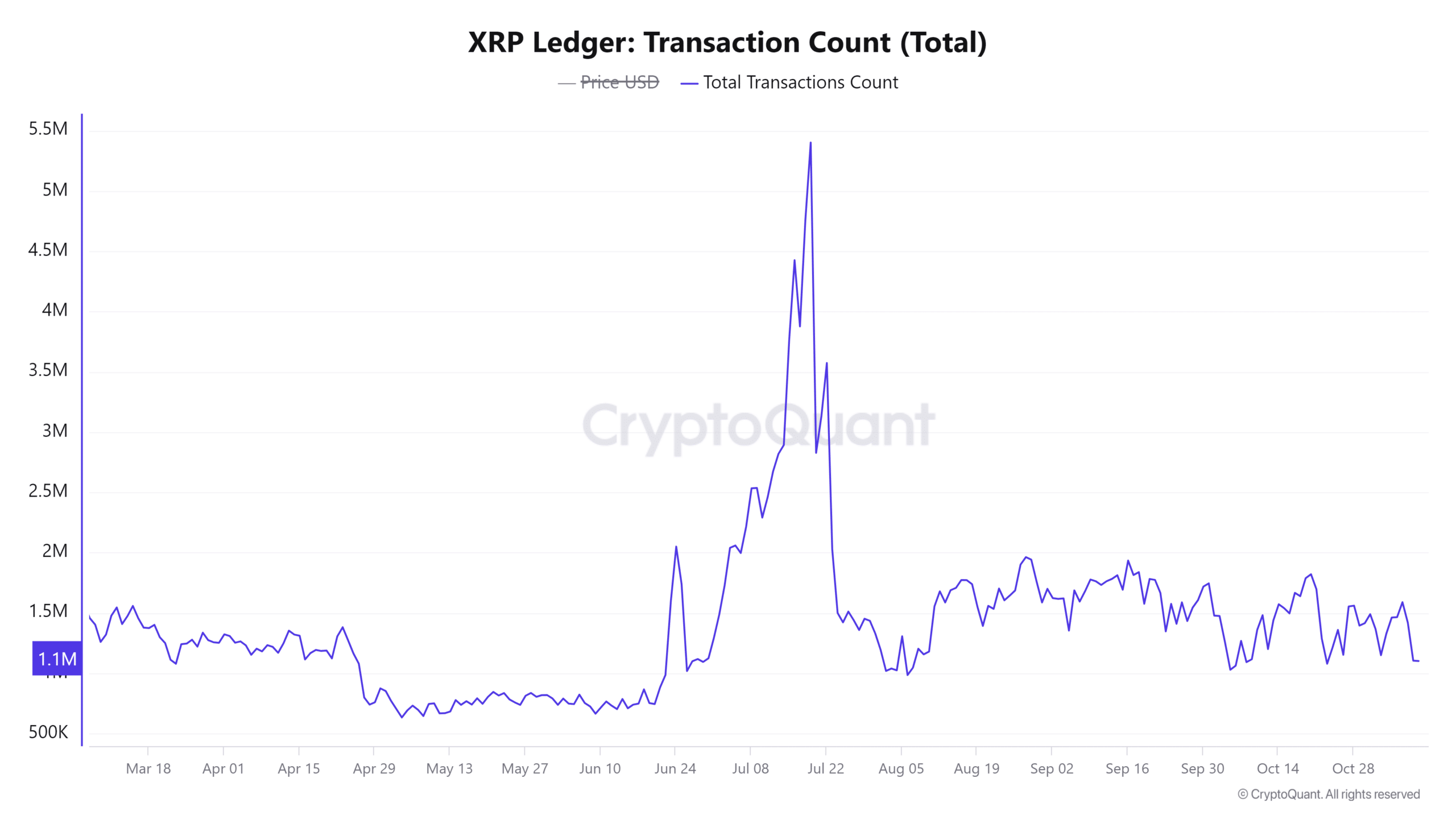

The total transaction count has also risen, reflecting increased demand for XRP. This sustained activity is a positive sign for the cryptocurrency’s future.

Market Sentiment: A Balanced Outlook

While the market sentiment is currently balanced, with long and short positions nearly equal, a successful breakout could shift the balance in favor of the bulls. This could lead to a significant price surge as more investors pile into XRP.

The Road Ahead for XRP

If XRP can successfully break through the $0.6533 resistance level, it could pave the way for a move towards the next target of $0.7463. However, it is important to note that the cryptocurrency market is highly volatile, and prices can fluctuate rapidly.

Investors should conduct thorough research and consider consulting with a financial advisor before making any investment decisions.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.