|

Getting your Trinity Audio player ready...

|

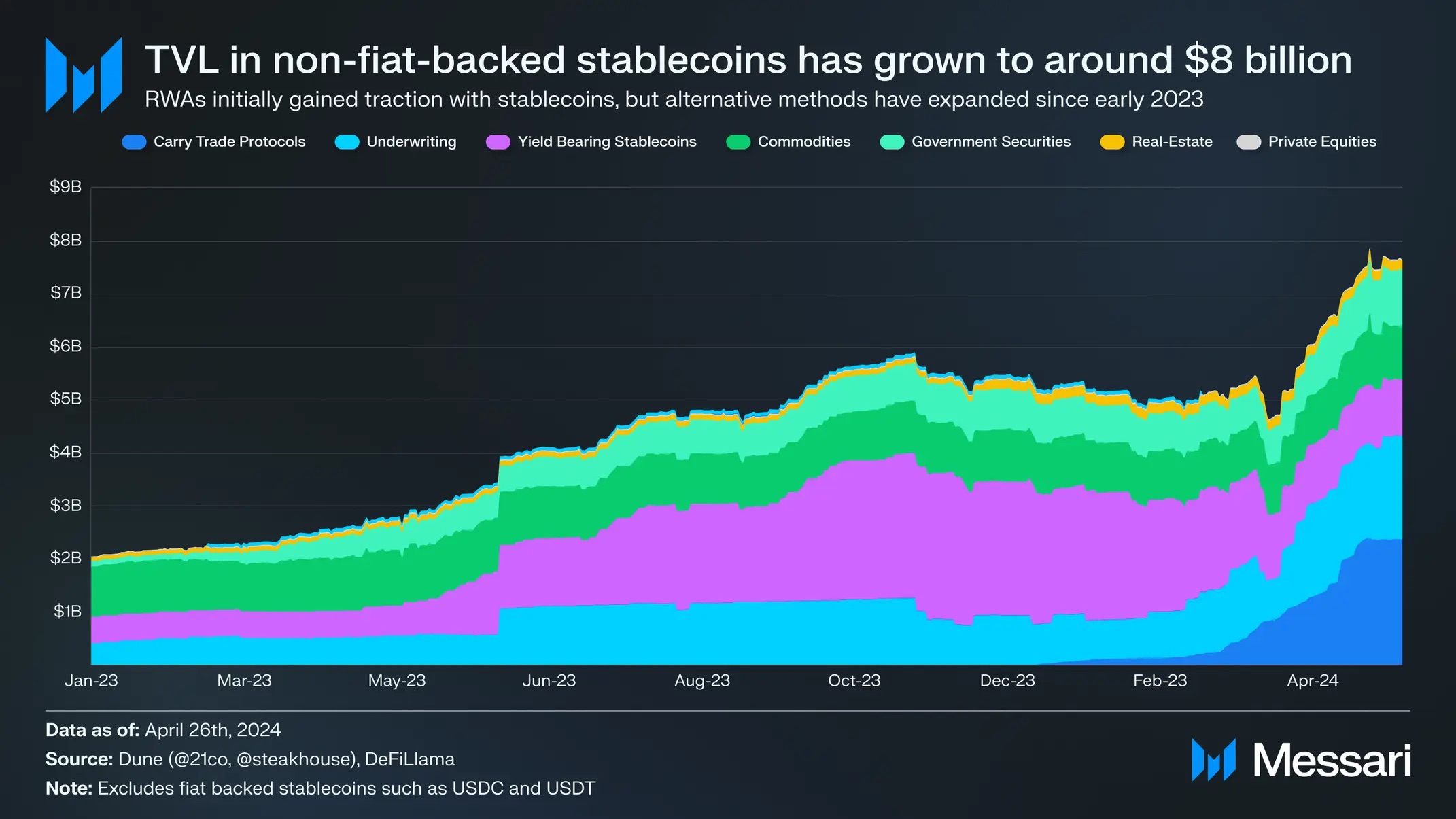

The tokenization of real-world assets (RWA) is experiencing a red-hot surge, with the total value locked (TVL) in the sector reaching near-unprecedented heights. According to blockchain analytics firm Messari, RWA protocols saw their TVL skyrocket to nearly $8 billion as of April 26, marking a significant milestone.

This “remarkable resurgence” over the past year, as Messari describes it, is attributed to a growing investor appetite for “debt-based, high-yield investments.” This figure excludes popular stablecoins like Tether and USDC, and encompasses diverse protocols like carry trade, underwriting, yield-bearing stablecoins, commodities, securities, and real estate tokenization.

Since February alone, the TVL in RWA protocols has witnessed a staggering 60% increase, showcasing the sector’s rapid acceleration. While DeFiLlama presents a slightly lower TVL figure of $6 billion, it still signifies a monumental 700% growth since the beginning of 2023.

Beyond TVL, the number of active users on RWA protocols has also spiked dramatically, indicating growing retail interest. Platforms like Toucan, KlimaDAO, and Propy have been at the forefront of this user surge.

Tokenized treasuries, fueled by high inflation and interest rates, have witnessed remarkable growth as well. The total value locked in tokenized U.S. treasuries and bonds currently stands at a record $1.29 billion, reflecting an 80% surge since the start of 2024. Protocols like Securitize and Ondo have been instrumental in driving this growth.

Also Read: BlackRock’s Tokenized Treasury Fund Claims Top Spot, Disrupting the $1.3 Billion Market

The recent success of BlackRock’s BUIDL fund, now the world’s largest tokenized treasury fund, and the Franklin OnChain U.S. Government Money Fund (FOBXX) further underscores the booming potential of this specific segment within the RWA market.

With such impressive growth metrics and increasing institutional involvement, RWA tokenization appears poised for continued expansion, potentially revolutionizing traditional investment avenues through the power of blockchain technology.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!