|

Getting your Trinity Audio player ready...

|

Polygon’s native token, POL, has surged 20% from its all-time low of $0.15, marking a potential trend reversal for the Ethereum layer-2 scaling solution. After months of steady decline, the price of POL has climbed to $0.19, breaking through a key resistance zone. However, on-chain data and technical indicators suggest the rally may be on shaky ground.

POL, formerly known as MATIC, hit a high of $0.53 in January before plunging 60% year-to-date. The recent bounce followed the formation of a falling wedge — a typically bullish chart pattern. POL has since broken above the wedge’s upper trendline, with the $0.18 resistance now turned support.

Despite the breakout, trading volume remains thin. The Chaikin Money Flow (CMF) indicator continues to hover in negative territory, signaling weak capital inflow. At the same time, the Relative Strength Index (RSI) is below the neutral 50 mark, indicating that bullish momentum has yet to gain traction.

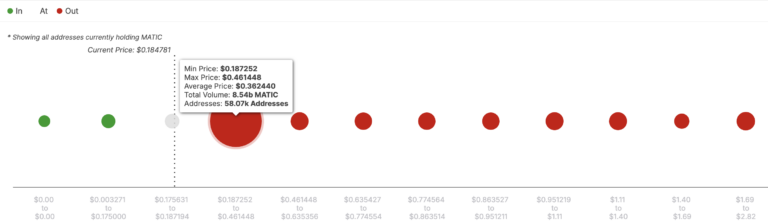

Further challenges emerge from on-chain metrics. According to IntoTheBlock’s Global In/Out of Money (GIOM) analysis, over 58,000 addresses are holding 8.54 billion POL tokens between $0.19 and $0.46 — all in unrealized losses. This creates a strong resistance cluster, as many holders may look to exit positions and break even.

The Supertrend indicator also flags caution. With the red line sitting above POL’s current price near $0.20, it suggests a bearish trend remains intact. As a result, POL may consolidate in a tight range between $0.16 and $0.20 in the near term.

Still, a bullish breakout isn’t off the table. If both CMF and RSI indicators turn positive, POL could rally to $0.30, aligning with the 0.236 Fibonacci retracement level. Conversely, increased sell pressure could drag the token below support, potentially setting a new all-time low.

For now, the market awaits stronger confirmation before POL’s recovery can be declared sustainable.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

Also Read: Why Polygon (POL) Could Be the Best Crypto Investment for 2025 and Beyond

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!