|

Getting your Trinity Audio player ready...

|

Over the past week, POL has faced significant bearish pressure, with its price dropping 18.90% on the charts. The last 24 hours added to this decline, registering a 1.15% dip and reinforcing market pessimism. Analysts suggest that POL’s downtrend could deepen further, given current market indicators.

POL Trades in a Descending Channel

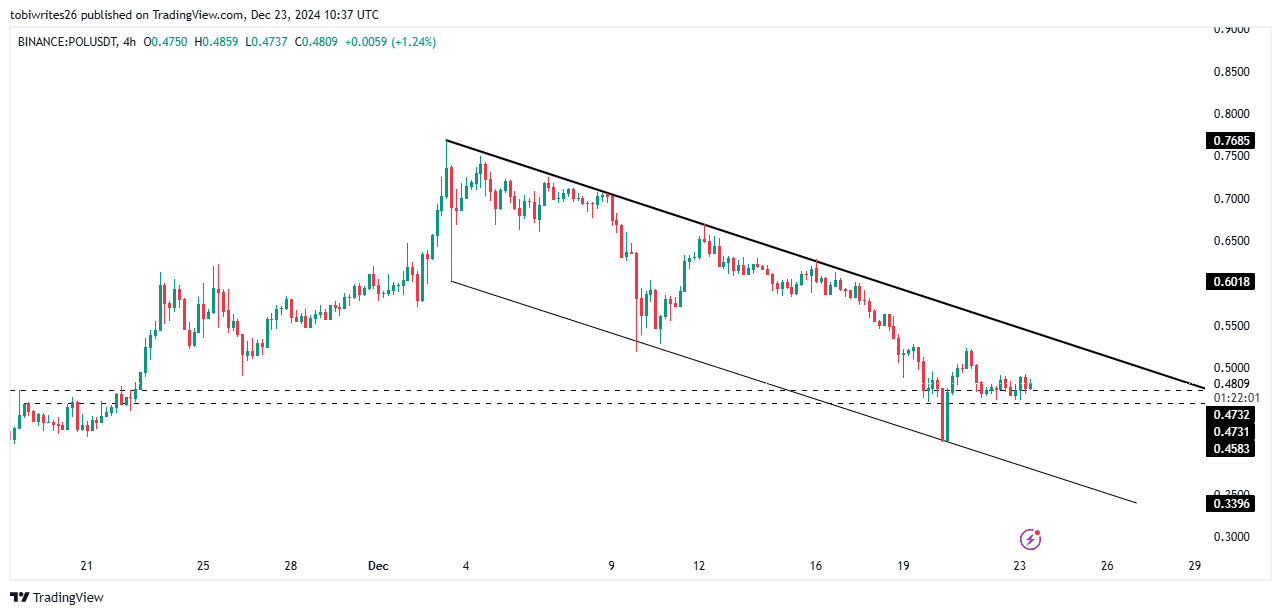

At press time, POL was trading within a descending channel, a pattern often associated with declining prices. Testing a key support level at $0.4731, the asset shows limited signs of a rebound. A lower support level at $0.4583 remains in sight, but the lack of upward momentum casts doubt on a potential recovery.

Although descending channels can sometimes signal an impending bullish reversal, on-chain data paints a more cautious picture. According to Analysts, exchange reserves for POL have surged, undermining the likelihood of a rally.

Rising Exchange Reserves Signal Selling Pressure

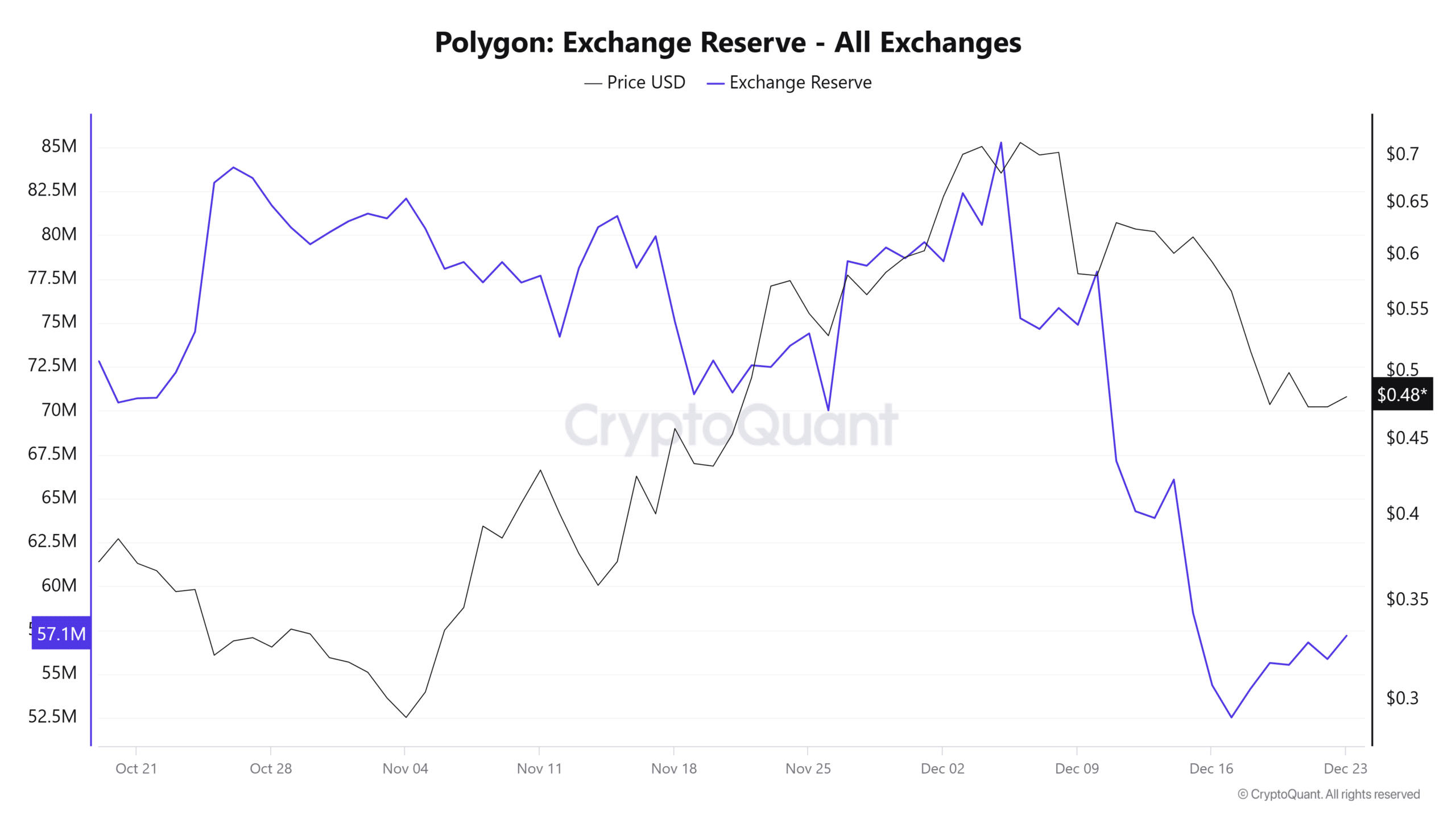

CryptoQuant data reveals that POL’s exchange reserves have climbed to over 57 million, an increase of approximately 2 million within a single day. This surge indicates that traders are transferring POL back to exchanges, a move often associated with upcoming sell-offs.

Adding to the bearish sentiment, the number of active addresses has dropped to 1,231, reflecting a significant decline in investor activity and confidence. IntoTheBlock’s data corroborates this trend, with the average transaction size shrinking dramatically. The 24-hour average plummeted to $4,908.63, its lowest point in a week, signaling reduced market participation.

Declining Open Interest and Liquidations Favor Short Sellers

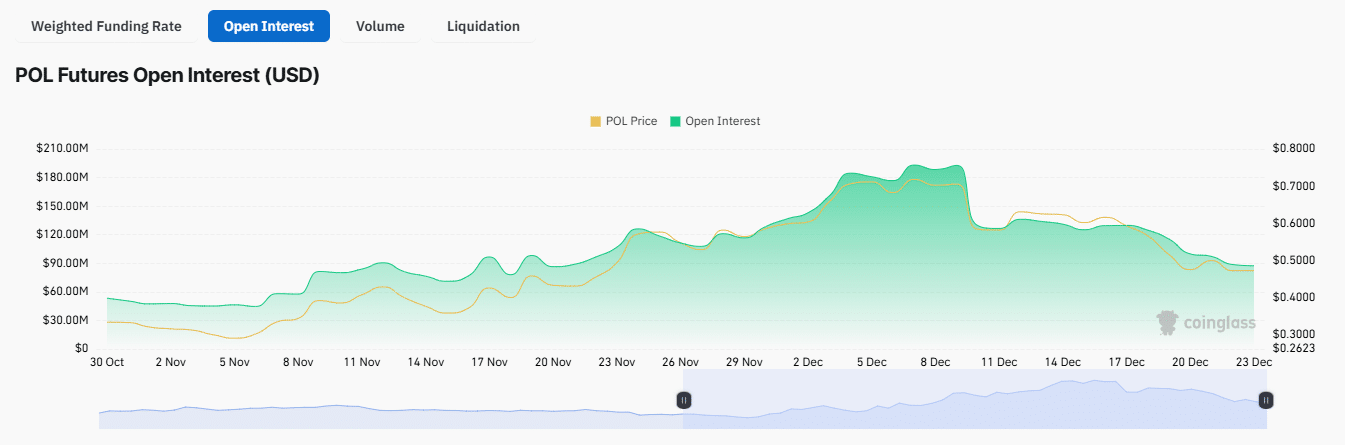

Open Interest in POL fell by 2.60% to $88.30 million, highlighting an increase in closed positions as traders reacted to the downtrend. Liquidation data further confirmed the bearish momentum, with $225,670 worth of long contracts closed in the past 24 hours compared to just $58,380 in short contracts.

With growing exchange reserves, declining active addresses, and bearish liquidation trends, POL faces sustained downward pressure. Without a strong reversal in on-chain metrics or technical indicators, the asset’s struggles may continue in the short term.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!