|

Getting your Trinity Audio player ready...

|

- Polygon (POL) Reaches Historic Lows: Is It Time to Buy the Dip?

Polygon’s native token, POL, has extended its downward trend to unprecedented lows, trading at $0.285 — a record low since its inception. While major cryptocurrencies are aiming for new peaks, POL’s ongoing slump has many investors wondering if this is the right time to buy back at what could be an “extreme discount.”

Despite POL’s underperformance, Polygon’s ecosystem has shown signs of strength, suggesting that the token might still have potential. Here’s a closer look at what’s happening with POL and the Polygon network to determine if now is the right time to invest.

POL Hits Oversold Levels: A Potential Buy Signal?

POL’s latest plunge places it in heavily oversold territory, according to the Relative Strength Index (RSI). This oversold condition often indicates a potential buy opportunity, as prices could be due for a bounce back. However, caution is warranted; the lack of demand for POL this year shows that investor confidence remains low.

The downtrend may also signal POL’s current lack of market attractiveness, leaving it outpaced by other assets that have managed to hold ground or rally. Yet, this steep price drop could mean significant upside potential if the token stages a recovery.

Strengthening Polygon Metrics Point to Long-Term Potential

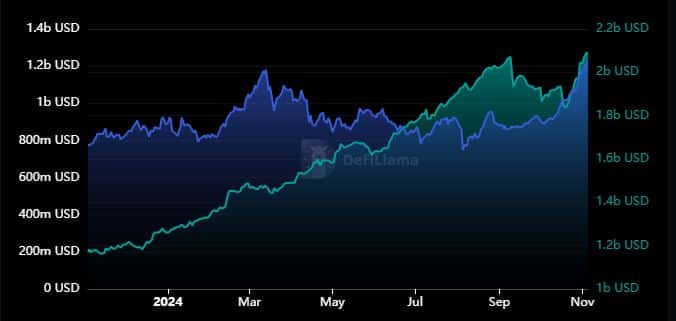

Despite POL’s price struggles, the broader Polygon ecosystem has seen significant growth, particularly in its stablecoin market cap and total value locked (TVL) in decentralized finance (DeFi) applications. Polygon’s stablecoin market cap has surged from $1.17 billion in November 2023 to $2.08 billion a year later, reflecting increased trust in Polygon as a DeFi platform.

Similarly, the network’s TVL has risen from $772.4 million to $1.237 billion, underscoring growing DeFi usage. This steady growth in stablecoin demand and TVL shows that Polygon is enhancing its value proposition for DeFi users, which could eventually boost POL demand as the native asset for the network.

Network Growth Shows Positive Trends but Low Impact on Price

Polygon’s transaction volume hit a high of over 17 million transactions in November 2023, though it has since normalized to around 3 million monthly transactions. This healthy transaction volume suggests consistent network use, though it hasn’t necessarily correlated with POL’s price action.

Address growth, on the other hand, has remained robust, with the network climbing from 379 million unique addresses in November 2023 to 470.9 million by November 2024. This indicates a steady user base, showing that the Polygon network continues to attract interest. However, the growing user base hasn’t yet translated into POL’s price recovery, as broader market sentiment remains tepid.

Is POL Worth the Risk for a Potential 400% Gain?

At its current price level, POL offers a compelling opportunity for high-risk, high-reward investors. A return to its previous all-time highs would yield gains exceeding 400%, making it attractive for those who believe in Polygon’s long-term prospects. However, the path to recovery could be slow and uncertain, given POL’s current lack of momentum and market interest.

In summary, POL’s low price presents an intriguing opportunity for investors who are optimistic about Polygon’s expanding DeFi capabilities and robust network metrics. However, for risk-averse investors, it might be prudent to wait for a confirmed reversal in trend before committing to POL.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.