|

Getting your Trinity Audio player ready...

|

Polygon (POL), the Ethereum scaling solution, has been a subject of much discussion in recent months. Despite a significant upgrade from MATIC to POL, the token’s price action has been lackluster. However, recent on-chain data and market sentiment suggest a potential turnaround.

A Bullish Outlook Renowned crypto analyst Ali Martinez recently highlighted several key developments that could signal a bullish future for Polygon. Notably, POL’s price surged over 26% in the past week, coinciding with a broader market uptrend.

I have a wild price prediction for #Polygon $POL that many will think this post is sponsored… But it’s not!

— Ali (@ali_charts) November 25, 2024

So, let’s dive in! 👇🧵

A closer look at on-chain metrics reveals even more promising signs. Polygon’s active addresses and transaction volume have been steadily increasing, indicating growing user interest and activity on the network. Additionally, whale activity has surged, with large investors accumulating significant amounts of POL tokens. This suggests strong confidence in the token’s future potential.

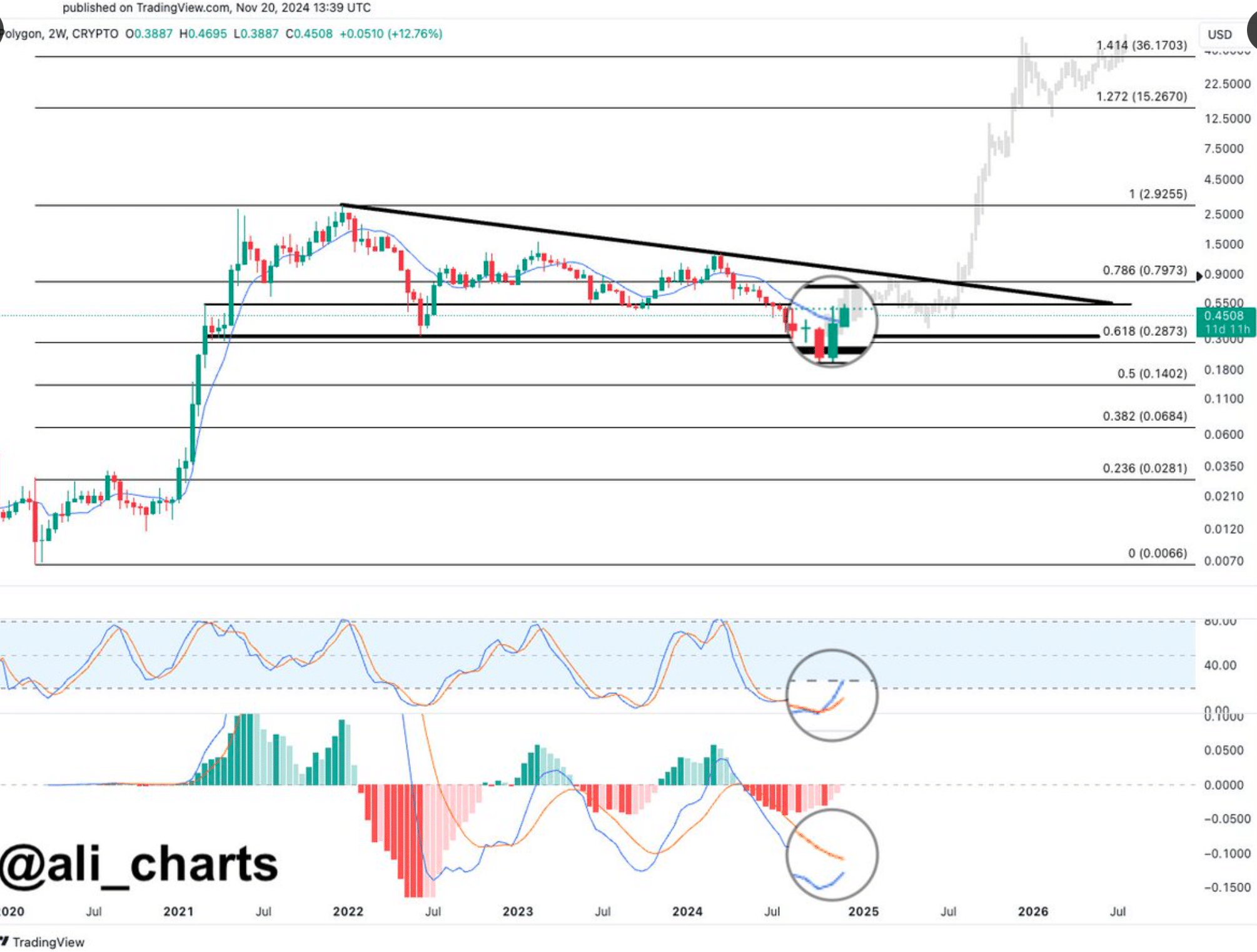

Technical Analysis Points to Upside From a technical perspective, POL’s price has been forming a multi-year bullish pattern. A weekly close above the crucial resistance level of $0.7973 could trigger a substantial rally, potentially reaching targets of $15.27 or even $36.17.

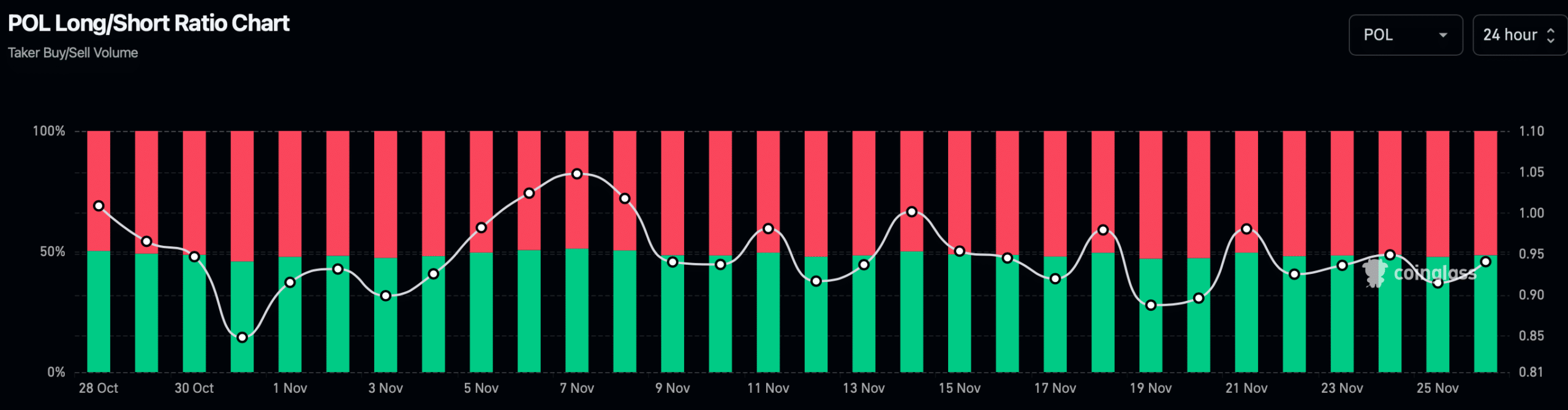

On-Chain Data Corroborates Bullish Sentiment Further supporting the bullish narrative, Polygon’s long/short ratio has seen a slight uptick, indicating a growing number of investors taking long positions on the token. Moreover, the high open interest suggests sustained market interest and a potential continuation of the recent price trend.

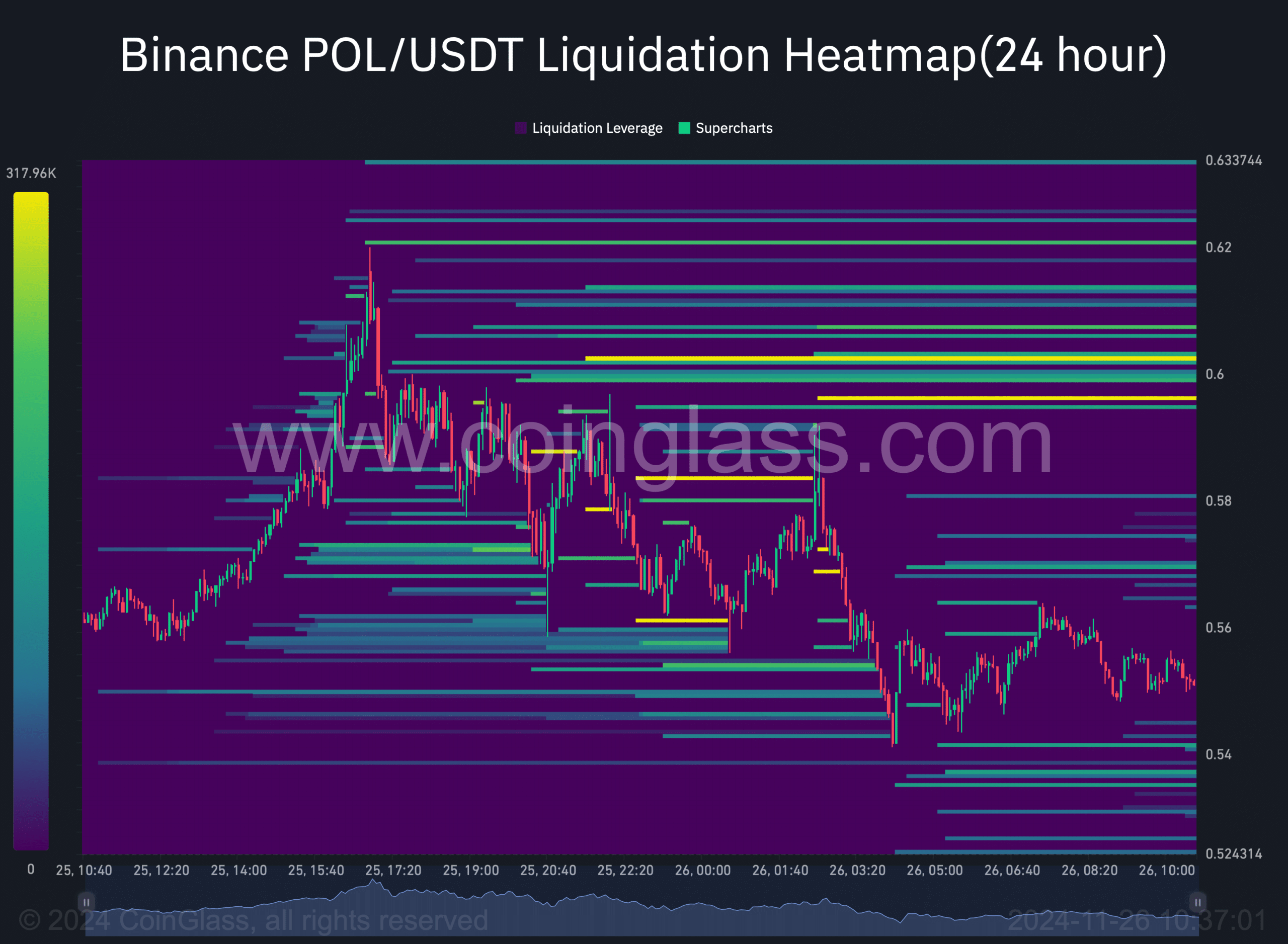

Challenges Ahead While the outlook for Polygon appears promising, there are still hurdles to overcome. The $0.6 resistance level could pose a significant challenge, as it coincides with a high liquidation zone. A sharp increase in liquidations could lead to a price correction, potentially hindering POL’s upward momentum.

Despite past underperformance, Polygon’s recent price action and on-chain metrics suggest a potential revival. The influx of new users, increased whale activity, and a favorable technical outlook all point to a bullish future for the Ethereum scaling solution. However, investors should remain cautious and monitor market developments closely.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

A lifelong learner with a thirst for knowledge, I am constantly seeking to understand the intricacies of the crypto world. Through my writing, I aim to share my insights and perspectives on the latest developments in the industry. I believe that crypto has the potential to create a more inclusive and equitable financial system, and I am committed to using my writing to promote its positive impact on the world.