|

Getting your Trinity Audio player ready...

|

Polygon [POL] is capturing market attention after surpassing Tron in key transaction metrics, reinforcing its potential as a leading Ethereum Layer-2 solution. Coupled with major leadership changes and strong technical indicators, this performance spike has sparked speculation about a possible price breakout.

Polygon Outperforms Tron in Real-World Transactions

In May 2025, Polygon processed over 81 million transactions on its PoS chain—outpacing Tron’s 67 million. The total value settled on Polygon hit $141 billion, a significant milestone that positions it ahead in the DeFi space.

More impressively, Polygon is now testing transaction speeds exceeding 100,000 TPS, aimed at supporting real-world assets and payments. This push toward becoming a “GigaGAS” chain—backed by data from Amazon Web Services—signals a strong focus on scalability and mass adoption.

With Web3 payments growing by 30% this year, Polygon’s improved throughput could attract greater developer and investor interest, providing a bullish foundation for POL’s price.

Nailwal Returns as CEO Amid Strategic Restructuring

Polygon’s renewed momentum is also fueled by internal restructuring. Co-founder Sandeep Nailwal has stepped back into leadership as CEO of the Polygon Foundation, following the exit of Mihailo Bjelic in May 2025.

May was another huge month for @0xPolygon POS chain for payments

— Sandeep | CEO, Polygon Foundation (※,※) (@sandeepnailwal) June 12, 2025

All the numbers broke previous monthly records

81m transfers – compared to Tron's 67mn or so

141B – total volume settled vs Tron's

The question isn’t IF, it’s how big. https://t.co/NwXDA7MTlY

Nailwal, who holds the largest share of POL tokens, has emphasized a roadmap focused on scalability, growth, and product spin-offs such as Polygon zkEVM and ZK projects. Jordi Baylina will oversee ZK developments, while Polygon Labs, under Marc Boiron, will continue as a separate entity but remain aligned with the foundation.

Also Read: Polygon (POL) Flashes Bullish Divergence as Analysts Target $1.15 Breakout

The proposed AggLayer upgrade could further enhance liquidity across chains and incentivize POL stakers through airdrops—adding to investor excitement.

POL Price Eyes Breakout From Falling Wedge Pattern

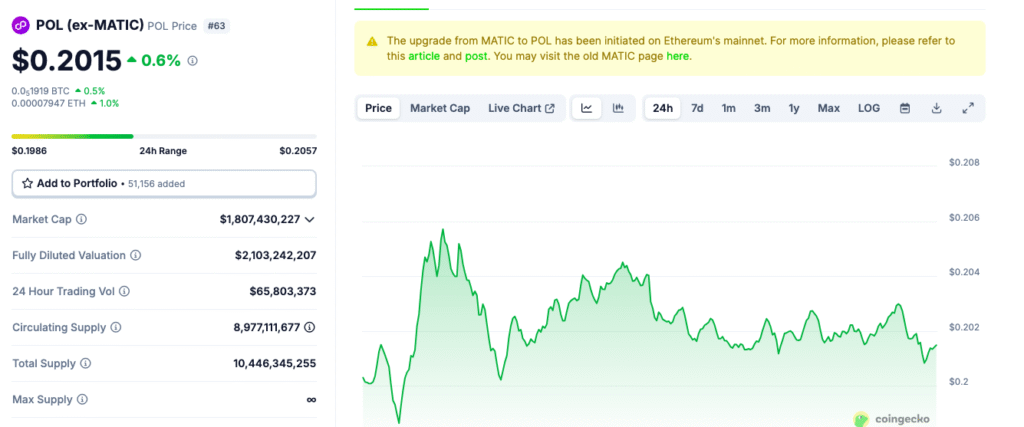

POL is currently trading at $0.2015. However, technical analysis suggests the token is forming a falling wedge pattern—a structure often preceding breakouts.

Experts believe POL could hit $0.233 by mid-July, with long-term projections aiming as high as $3, assuming positive momentum continues. Rising investor interest and increased network usage may soon propel POL past critical resistance levels.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!