|

Getting your Trinity Audio player ready...

|

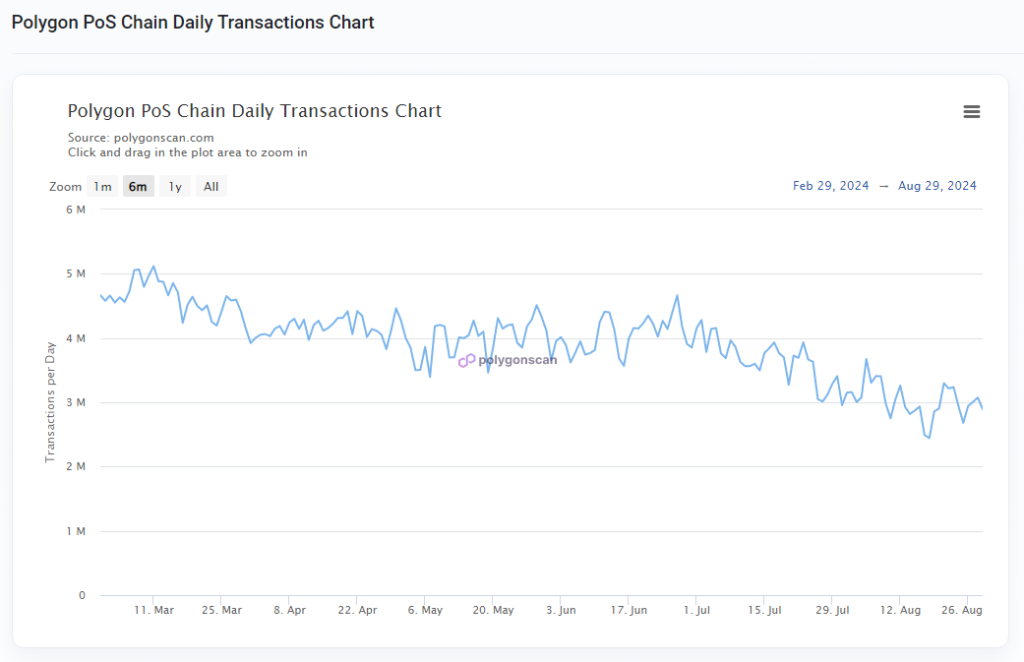

Polygon (MATIC), the Ethereum scaling solution, has experienced a decline in network activity since the broader cryptocurrency market began its correction in March. However, recent data suggests a potential reversal could be brewing.

Blockchain analytics platform Santiment reported a significant spike in on-chain activity on the Polygon network. Data shared on August 28 revealed a substantial surge in active addresses and dormant token movements this week. This surge coincides with the second-highest number of Polygon addresses interacting with the network this year, indicating increased user engagement and potential bullish sentiment.

Diverging from the Downtrend

While the overall trend in Polygon network activity has been downward, the recent surge diverges from this pattern. According to data from Polygonscan, address activity has seen a decline since late July, plummeting from 1.6 million to 700,000 by the end of August. Similarly, daily transactions have dropped significantly, from over five million in March to approximately three million in late August.

MATIC Price Retreats Despite Activity Surge

Despite the recent surge in activity reported by Santiment, MATIC remains firmly within a bear market territory. The token experienced a short-lived rally on August 25th, reaching a two-month high of approximately $0.58. However, this momentum couldn’t be sustained, and the price quickly retreated.

As of August 29th, it had plummeted by 24% from its recent peak, reaching a 10-day low of $0.437. This marked a further 5% decline over the past 24 hours. MATIC remains a staggering 85% down from its all-time high of $2.92, recorded in December 2021, according to data from CoinGecko.

Broader Market Downturn Impacts MATIC

The decline in MATIC’s value mirrors a broader downturn in the cryptocurrency market. The market leaders, Bitcoin and Ethereum, have also suffered price corrections, contributing to the overall bearish sentiment.

However, the recent surge in on-chain activity could be a sign of a potential price reversal for MATIC. Santiment’s Age Consumed metric, which measures the movement of long-held tokens, has exhibited a significant uptick. This suggests that dormant MATIC tokens are being reactivated, a historical indicator of impending price fluctuations.

Furthermore, the Polygon network is undergoing a significant upgrade, and Binance has announced its support for the migration from MATIC to POL tokens. This upgrade is expected to improve the Polygon token’s functionality and could positively impact its price.

While the short-term price outlook remains uncertain, the recent on-chain activity suggests a potential shift in sentiment for MATIC. The upcoming network upgrade and exchange support could further fuel a price recovery, but broader market conditions will also play a crucial role.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!