|

Getting your Trinity Audio player ready...

|

The cryptocurrency market witnessed a downturn in the last 24 hours, with many major coins experiencing price corrections. Polkadot (DOT) took a particularly hard hit, becoming the most affected crypto among the top 20 by market capitalization. AMBCrypto dives into the factors behind this drop and explores the possibility of a near-term recovery for DOT.

DOT Price Plunges, Social Sentiment Plummets

While other cryptos saw minor pullbacks, DOT’s value plunged nearly 10% within a single day. At the time of writing, it trades at $9.49 with a market cap exceeding $14.44 billion, ranking 15th largest.

Adding fuel to the fire, DOT’s trading volume surged by 15% over the past 24 hours, seemingly fueling the price decline. This downward trend spilled over to social media, with Santiment data revealing a sharp drop in DOT’s social dominance, indicating a declining interest in the token. Additionally, Polkadot’s Weighted Sentiment entered negative territory, reflecting rising bearish sentiment in the market.

Selling Pressure Mounts, Short Positions Gain Ground

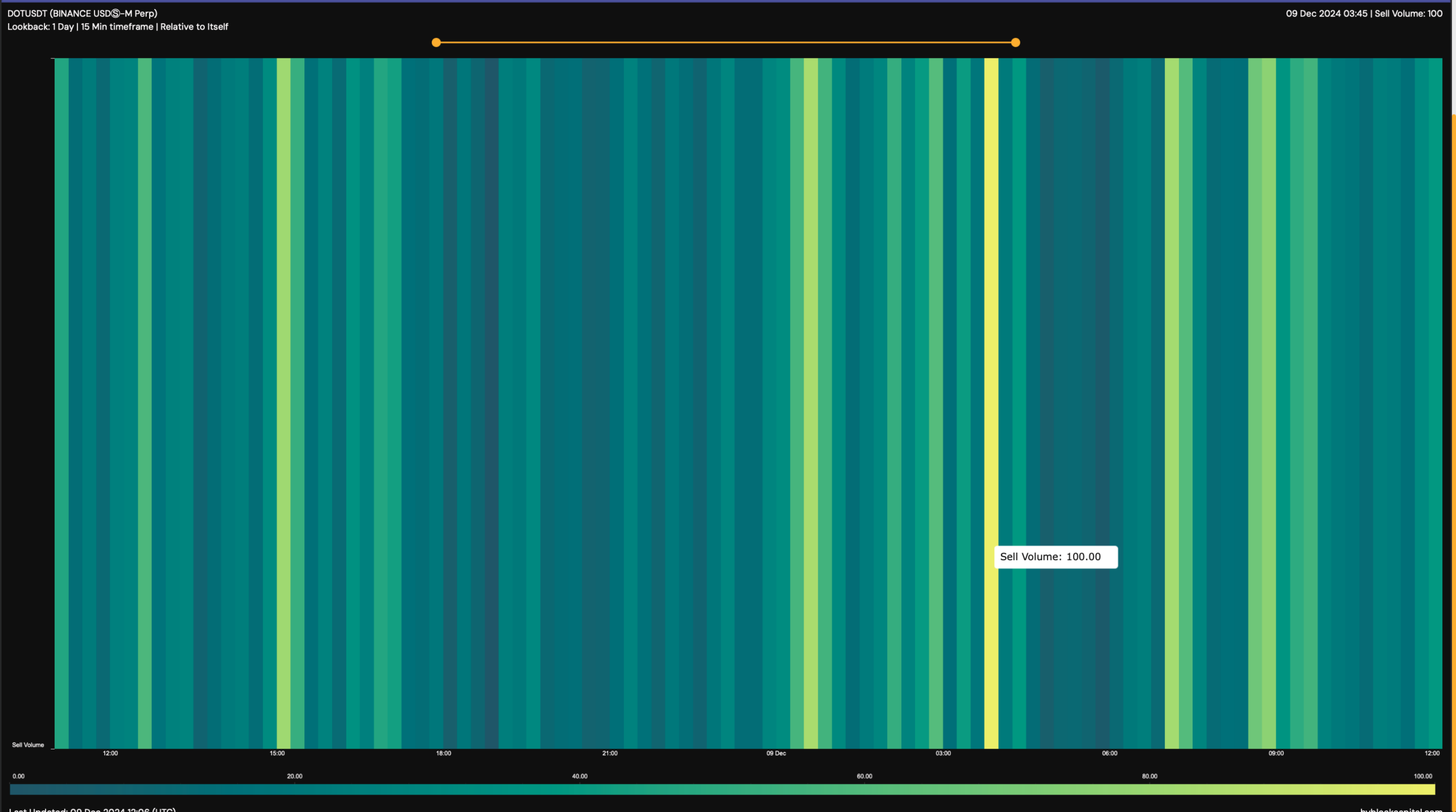

AMBCrypto further investigated other data sources to gauge potential signs of recovery from this bearish trend. The analysis revealed a significant increase in investor selling activity coinciding with DOT’s price drop. Hyblock Capital’s data showed spikes in DOT’s sell volume over the past 24 hours, even reaching a peak of 100 (a number closer to 100 signifies high selling activity).

Furthermore, Coinglass’ data indicated a slight decline in Polkadot’s Funding Rate. In the cryptocurrency market, a decline in Funding Rates suggests an increase in dominant short positions, which can be a sign of bearish sentiment.

Technical Indicators Paint a Bearish Picture

The Relative Strength Index (RSI) complemented the sell volume indicator, showcasing a sharp decline. This decline implies rising selling pressure. If the downtrend continues, the Bollinger Bands suggest DOT might first find support at its 20-day SMA. This could provide a potential springboard for a recovery and a bull rally.

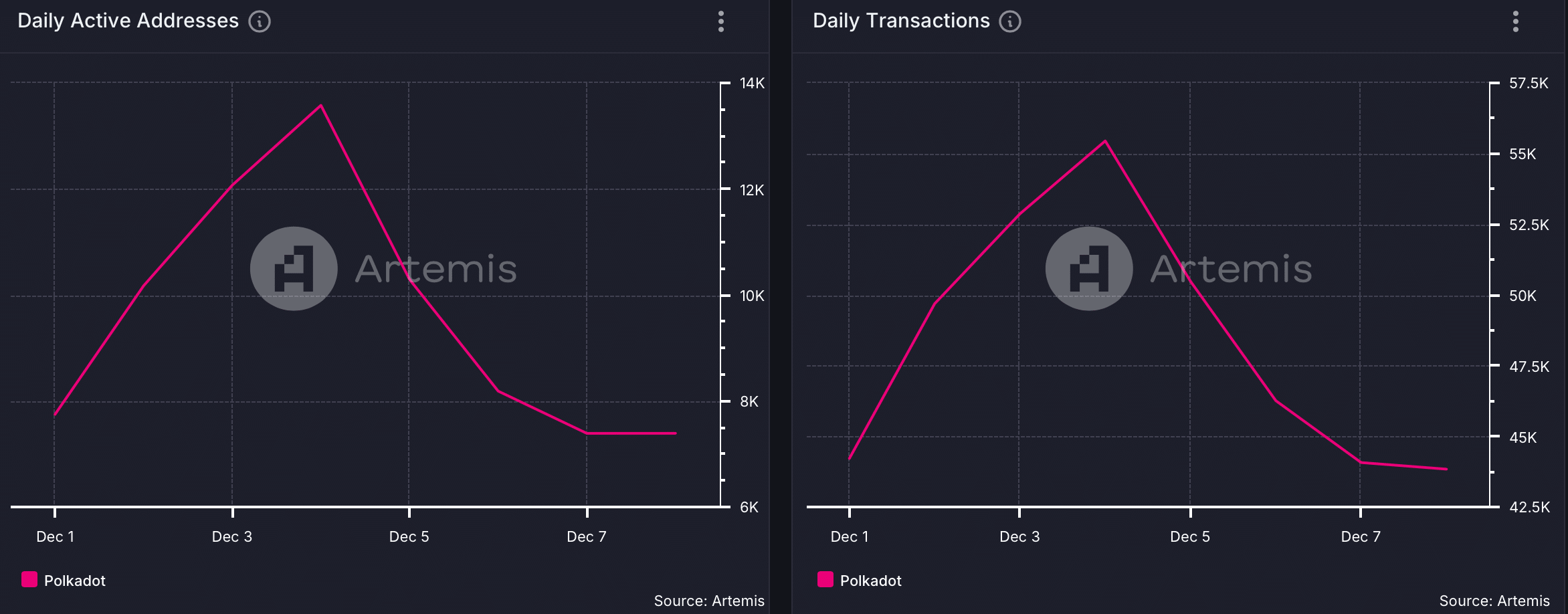

Network Activity Takes a Hit

The negative trend extended beyond DOT’s price, impacting network activity as well. AMBCrypto’s analysis of Artemis’ data revealed a significant decrease in both DOT’s daily active addresses and transactions over the past few days. This implies a reduced user engagement on the Polkadot blockchain, potentially posing further challenges for DOT’s recovery.

Polkadot (DOT) has been hit hard by the recent market correction, experiencing a significant price drop and a decline in social sentiment and user activity. While some technical indicators suggest potential support levels, the rise in selling pressure and short positions paint a bearish picture. It remains to be seen if DOT can reverse this downtrend and recover in the near future.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

Also Read: Polkadot (DOT) Bulls Eye $16.35, But Short-Term Bearish Divergence Signals Possible Pullback to $8.4

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.