|

Getting your Trinity Audio player ready...

|

Pi Network has announced that its transition to the Open Network phase of its Mainnet will begin on February 20, 2025, a significant milestone for the platform. Following this, major cryptocurrency exchanges have confirmed their plans to list Pi, signaling the token’s move into mainstream crypto markets.

Exchanges like OKX, Bitget, and MEXC have already confirmed their plans to list the Pi token. Bitget introduced the PI/USDT trading pair, while MEXC followed suit with its own listing. These moves suggest growing confidence in Pi’s potential and a commitment to supporting its integration into the broader cryptocurrency ecosystem. However, some exchanges are taking a more cautious approach. HTX (formerly Huobi) announced the expiration of its Pi IOU (I Owe You) trading, delisting Pi on February 13, 2025. The exchange halted Pi trading and set the conversion rate for affected users to Tether (USDT) at 1:61.28.

🚨#MEXC Initial New Listing Alert!

— MEXC_Listings (@MEXC_Listings) February 14, 2025

📈 $PI/USDT will be listed in the Innovation Zone on 2025-02-20 08:00 (UTC).@PiCoreTeam is a social cryptocurrency, developer platform, and ecosystem designed for widespread accessibility and real-world utility.

Details:… pic.twitter.com/DDGUMfZMyl

As the Pi mainnet launch draws closer, some industry figures have raised concerns. Bybit’s CEO, Ben Zhou, expressed skepticism about Pi Network, citing risks involved with its user base, which consists mostly of less experienced investors. Critics have pointed to the platform’s pyramid-like structure and multi-level marketing strategies, raising legal questions and concerns over the long-term sustainability of the project.

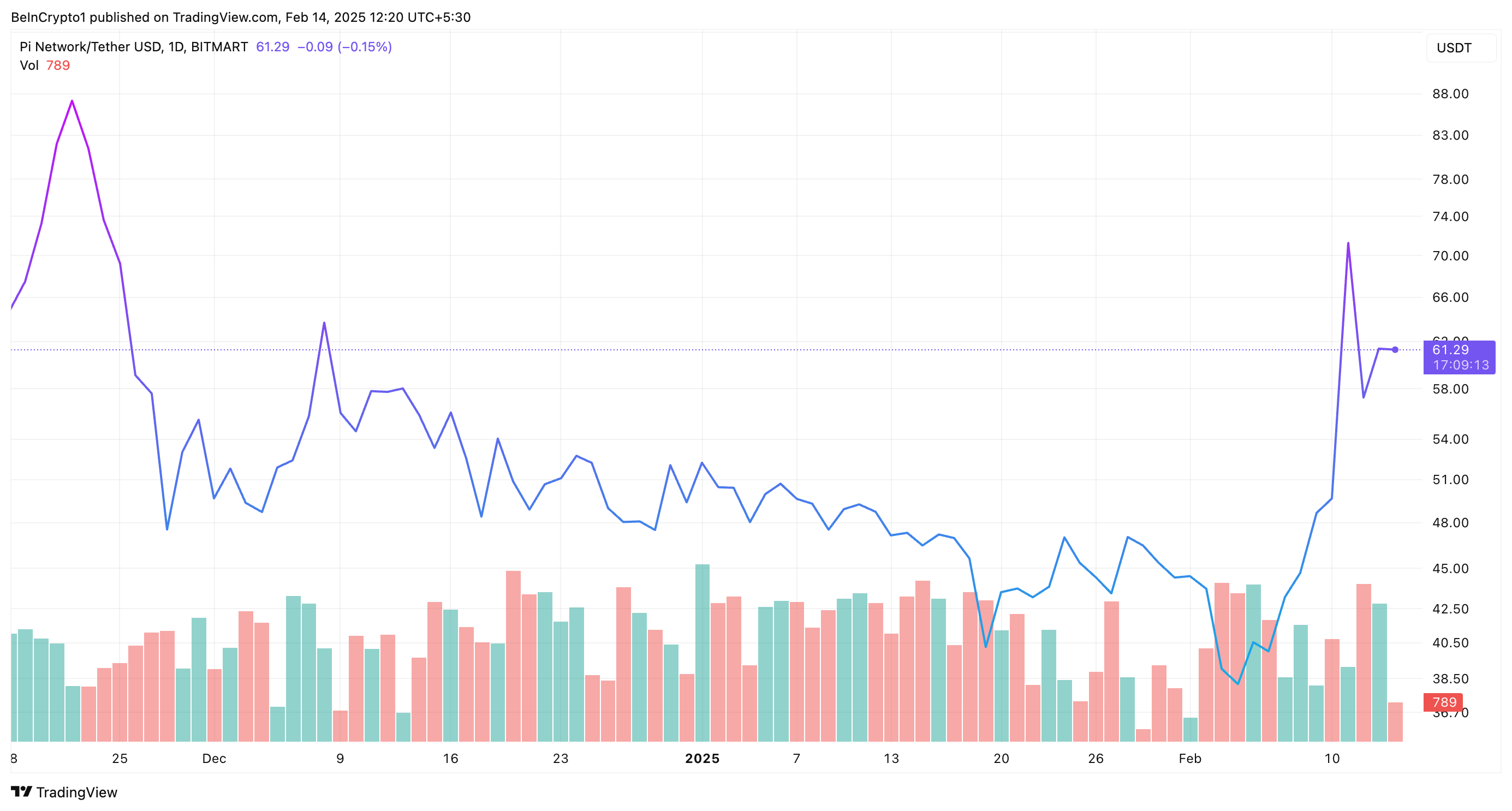

Despite these concerns, the market has shown initial bullish signs. Following Pi’s announcement, its IOU price skyrocketed to a high of $71.2, though momentum has since slowed. Currently trading at $61.2, analysts predict that Pi’s price during the mainnet launch will range between $40.8 and $68.7, according to BeInCrypto’s analysis.

As Pi Network prepares for its mainnet transition, all eyes will be on how the token performs once it is fully integrated into the market. Will Pi live up to expectations, or will the volatility surrounding its listing cause unforeseen challenges? Only time will tell.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

Also Read: Pi Network: What to Expect as Pi Price Surges Ahead of February 2025 Launch

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!