|

Getting your Trinity Audio player ready...

|

Pi Network (PI) has faced a sharp correction over the past two weeks, dropping 22%, with an additional 8% decline in the last 24 hours alone. The cryptocurrency has struggled to regain momentum, and recent technical indicators suggest that sellers remain in control. Here’s a closer look at PI’s current market setup and what might come next.

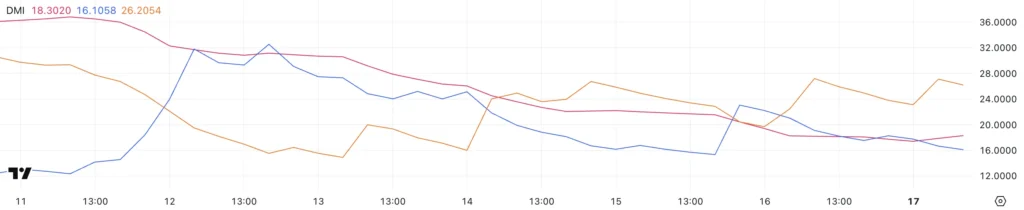

DMI Signals Persistent Selling Pressure

PI’s Directional Movement Index (DMI) reveals a bearish outlook, with the Average Directional Index (ADX) sitting at 18.3. This reading indicates a weak trend, but the widening gap between the +DI and -DI lines suggests increasing selling pressure. The -DI has risen to 26.2 from 19.6, while the +DI has dropped to 16.1 from 23. Unless the ADX climbs above 20 and the +DI begins to recover, PI could remain under bearish pressure in the near term.

CMF Indicates Strong Outflows

Adding to the negative sentiment, PI’s Chaikin Money Flow (CMF) has dropped to -0.14 after peaking at 0.15 just four days ago. This decline signals a shift from accumulation to distribution, confirming that sellers are currently dominating the market. A CMF below zero typically indicates sustained selling pressure, and unless buying volume increases, PI could continue its downward trajectory.

Will PI Fall Below $1?

PI’s recent struggles stem from a major sell-off post-KYC deadline and growing concerns over its .pi domains launch. If the bearish trend persists, PI could test key support at $1.23. A break below this level might push the price under $1.20, a threshold not seen since February 22.

However, a bullish recovery could see PI reclaim resistance at $1.57. A breakout above this level could drive prices toward $1.82 and $1.98, with a potential push past $2 if momentum accelerates.

Also Read: Pi Network Price at Risk? Traders Brace for Drop as Mainnet Deadline Ends

Pi Network’s technical indicators paint a bearish picture, with weak trend strength, growing selling pressure, and negative money flow. While a rebound is possible, PI needs a strong uptick in buying volume to break free from its current downtrend. Investors should watch for key support and resistance levels to gauge the next move in PI’s price action.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.