|

Getting your Trinity Audio player ready...

|

The meme coin market has seen its fair share of volatility, and PEPE is no exception. After reaching a meteoric high in 2024, the meme coin’s price and open interest have experienced a significant decline. While this might initially seem concerning, it could actually be a bullish sign for PEPE’s future.

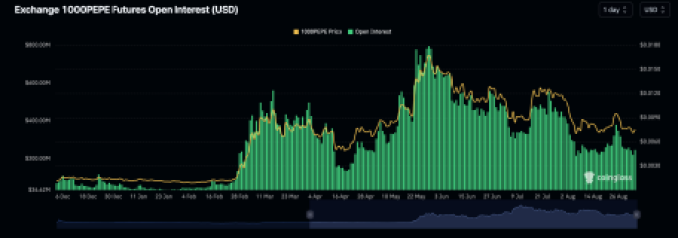

In the middle of 2024, PEPE’s price surged to a new all-time high, accompanied by a surge in open interest. This indicated growing investor confidence and bullish sentiment. However, as the broader crypto market began to consolidate, PEPE’s price and open interest started to decline.

By August, PEPE’s open interest had dropped by a staggering 72% from its peak. This decline suggests a shift in investor sentiment, with more traders leaning bearish on the meme coin. However, such periods of extreme bearishness can often set the stage for a reversal.

When investors are most pessimistic, the odds of a surprise price surge increase. The sharp decline in PEPE’s open interest could be a precursor to a short squeeze, where short sellers are forced to cover their positions, driving the price higher.

If a short squeeze occurs, PEPE’s price could experience a rapid recovery. As open interest starts to rise again, a positive correlation between price and open interest could further fuel the rally.

Also Read: Pepe (PEPE) On The Verge? Whale Activity Surges Amid Bullish Flag Formation – What The Stats Reveal

While the decline in open interest is a notable development, it’s important to consider other factors that could influence PEPE’s price. The overall market sentiment, developments within the meme coin ecosystem, and news related to the broader crypto industry will all play a role.

Ultimately, the future of PEPE remains uncertain. However, the current decline in open interest could be a bullish signal, suggesting that a potential price reversal may be on the horizon. Investors should closely monitor market developments and make informed decisions based on their risk tolerance and investment goals.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.