|

Getting your Trinity Audio player ready...

|

The long-awaited arrival of Spot Ethereum ETFs in the U.S. has ignited excitement in the cryptocurrency market, with potential ramifications extending beyond Ethereum itself. Memecoins like PEPE, known for their wild price swings and close ties to major altcoins, could be poised for significant growth.

Following the approval of Spot Bitcoin ETFs, Bitcoin experienced a dramatic surge, reaching its then all-time high. This upward trend wasn’t limited to Bitcoin alone – altcoins, including memecoins like PEPE, benefitted from the positive market sentiment. In just one week after the Bitcoin ETF launch, PEPE skyrocketed by a staggering 86.56%.

Technicals Signal Bullish Continuation for PEPE

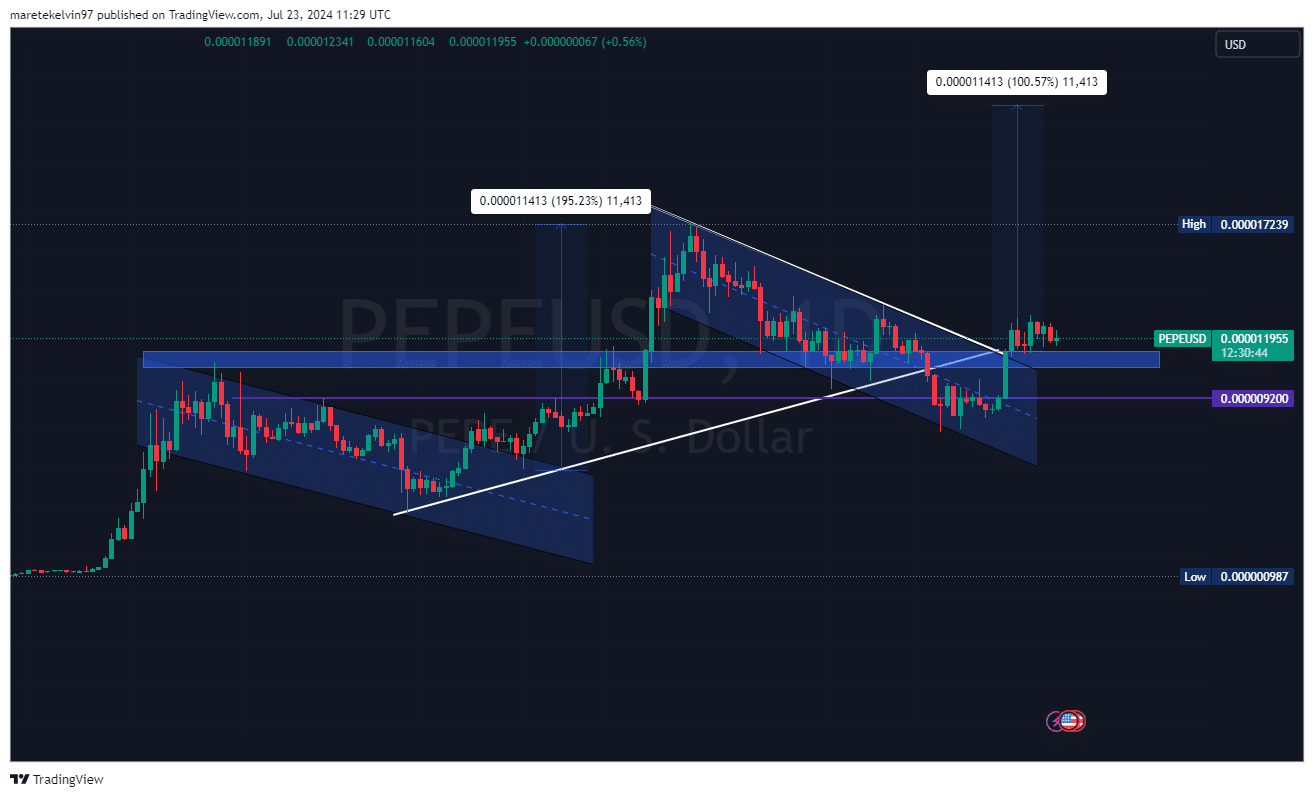

Technical indicators for PEPE are painting a bullish picture. The cryptocurrency recently emerged from a bullish flag pattern on the charts, which often signals a period of consolidation before a further price increase. Importantly, $0.0000015 is acting as a strong support level, indicating investor confidence and potentially setting the stage for a rally.

Seasonal Trends: PEPE’s Time to Shine?

PEPE appears to exhibit a seasonal trend, characterized by consolidation periods followed by explosive breakouts and price rallies. Considering the recent breakout from a bullish flag, there’s a chance that a significant price surge is on the horizon for PEPE.

Whales Take a Breather, Sentiment Remains Positive

While the number of large PEPE transactions has dipped recently, this could be a prelude to significant price movement. Additionally, the market appears balanced, with a slight bullish bias. This suggests investors are anticipating a price increase for PEPE in the near future, further strengthening the bullish outlook.

Also Read: Catnip for Crypto? MEW Coin Soars 85% in a Week, But Paid Shill Allegations Cloud Future

Spot ETH ETFs: A Catalyst for Memecoin Mania?

The combined factors of Spot Ethereum ETFs, PEPE’s technical indicators, seasonal trends, and positive investor sentiment create a potentially explosive scenario for the memecoin. While the duration of the rally remains uncertain, PEPE and other altcoins correlated to Ethereum are strong candidates to benefit from the increased market activity surrounding Spot ETH ETFs.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!