|

Getting your Trinity Audio player ready...

|

Pepe Coin price is signaling a potential bullish reversal after showing signs of bottoming. The token recently hit a low of $0.000005740 on Wednesday, slightly above its year-to-date low of $0.000005238. This article examines why Pepe’s price could experience a strong comeback in the coming days.

Pepe Coin Price Technical Analysis

The daily chart reveals that Pepe is trading near a crucial support level at $0.000005853, which has proven resilient since August of last year. The price has failed to drop below this level multiple times, suggesting that bearish traders are hesitant to short the coin further.

A key technical pattern emerging is the triple-bottom formation, a well-known bullish reversal signal in technical analysis. The neckline for this pattern is positioned at $0.00002835, indicating a potential surge if this support holds. Additionally, Pepe has formed an inverse head-and-shoulders pattern, further indicating a possible bullish shift. This pattern follows a falling wedge formation with converging trendlines, suggesting that the price may soon break upward.

Indicators like the MACD and RSI are also pointing toward bullish divergence, reinforcing the possibility of a price rebound. If this bullish momentum continues, the first key resistance level to watch is $0.000017, which represents the 50% Fibonacci retracement. This target is roughly 150% above current levels and aligns with a pivot reversal on the Murrey Math Lines tool.

However, this bullish outlook will be invalidated if the price falls below the critical support at $0.000005853, signaling potential further declines in the longer term.

Top Catalysts for a Pepe Price Surge

Several catalysts could drive Pepe’s price upward. First, the easing of trade tensions, with Donald Trump pausing most tariffs, has improved market sentiment. This alleviates recession fears in the U.S. and could provide a favorable environment for risk assets like Pepe.

Second, the potential Federal Reserve interest rate cut could boost Pepe’s price. Analysts expect a drop in the Consumer Price Index (CPI), signaling lower inflation, which could prompt the Fed to reduce interest rates.

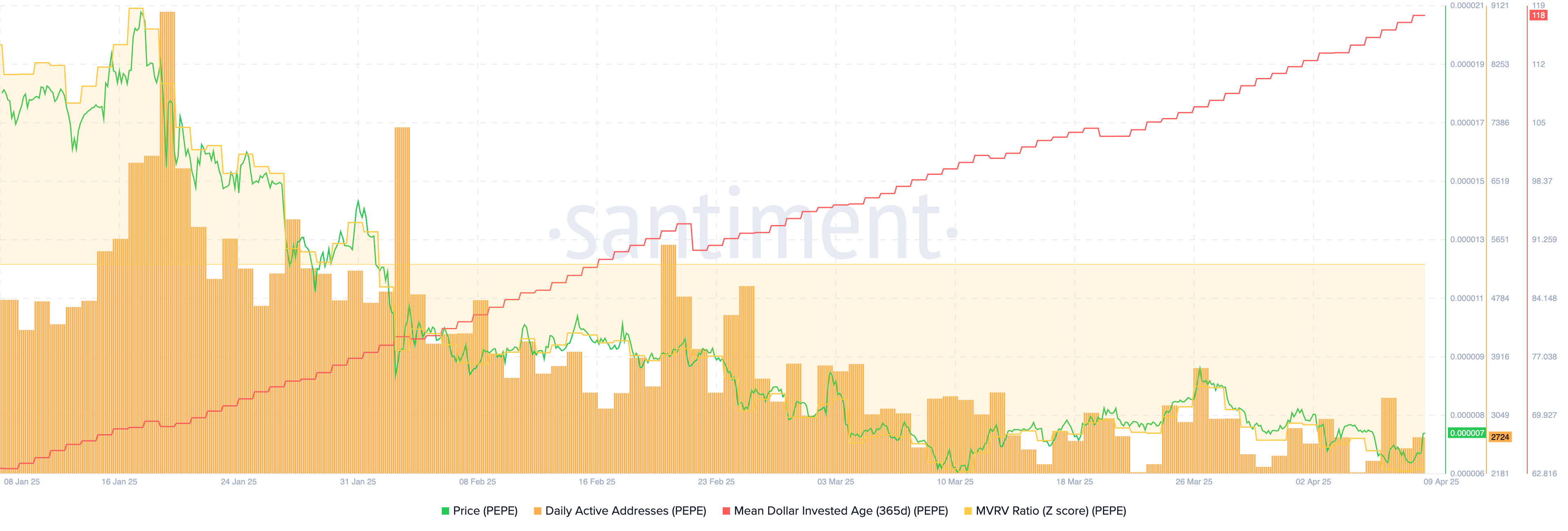

Finally, on-chain metrics are supporting a bullish outlook. Pepe’s Mean Dollar Invested Age (MDIA) has hit a record high, indicating strong investor conviction. Additionally, the MVRV ratio is at its lowest level in over a year, suggesting that Pepe may be undervalued, creating an opportunity for investors to buy the dip.

In conclusion, Pepe Coin appears poised for a potential breakout, with both technical and fundamental factors supporting a price surge. Traders should monitor key support and resistance levels for signals of continued upward movement.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

Also Read: Pepe Coin (PEPE) Whales Trigger Sell-Off: 1 Trillion Tokens Offloaded as Price Slides 14% Weekly

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!