In a cryptocurrency market marked by uncertainty, Pepe (PEPE), the world’s third-largest memecoin by market cap, is flashing signs of potential upside. While established players like Bitcoin (BTC), Ethereum (ETH), and Ripple (XRP) experience mixed results, PEPE is attracting significant attention from investors and whales.

Bullish On-Chain Metrics and Investor Confidence

On-chain analytics from Coinglass reveal a significant outflow of PEPE tokens from exchanges over the past two days, totaling $15 million. This “outflow” often indicates long-term holders and whales moving their assets to wallets, suggesting a potential buying opportunity and bullish sentiment.

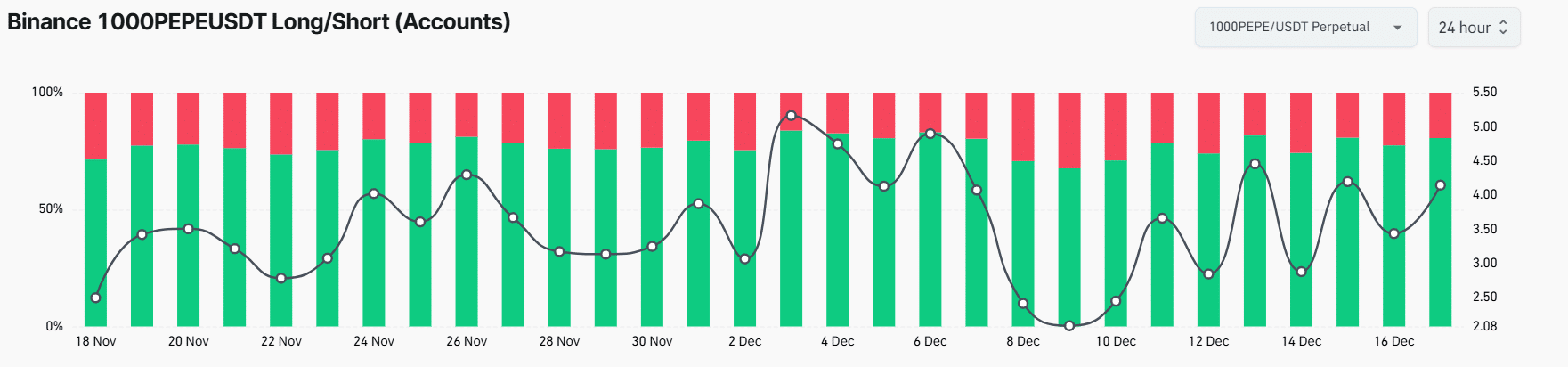

Further supporting this notion, Binance, a leading cryptocurrency exchange, shows a strong long bias for PEPE. The PEPEUSDT Long/Short Ratio currently sits at 4.15, with 80.57% of top traders holding long positions. This data paints a clear picture of investor confidence in PEPE’s future.

Technical Analysis Hints at Breakout

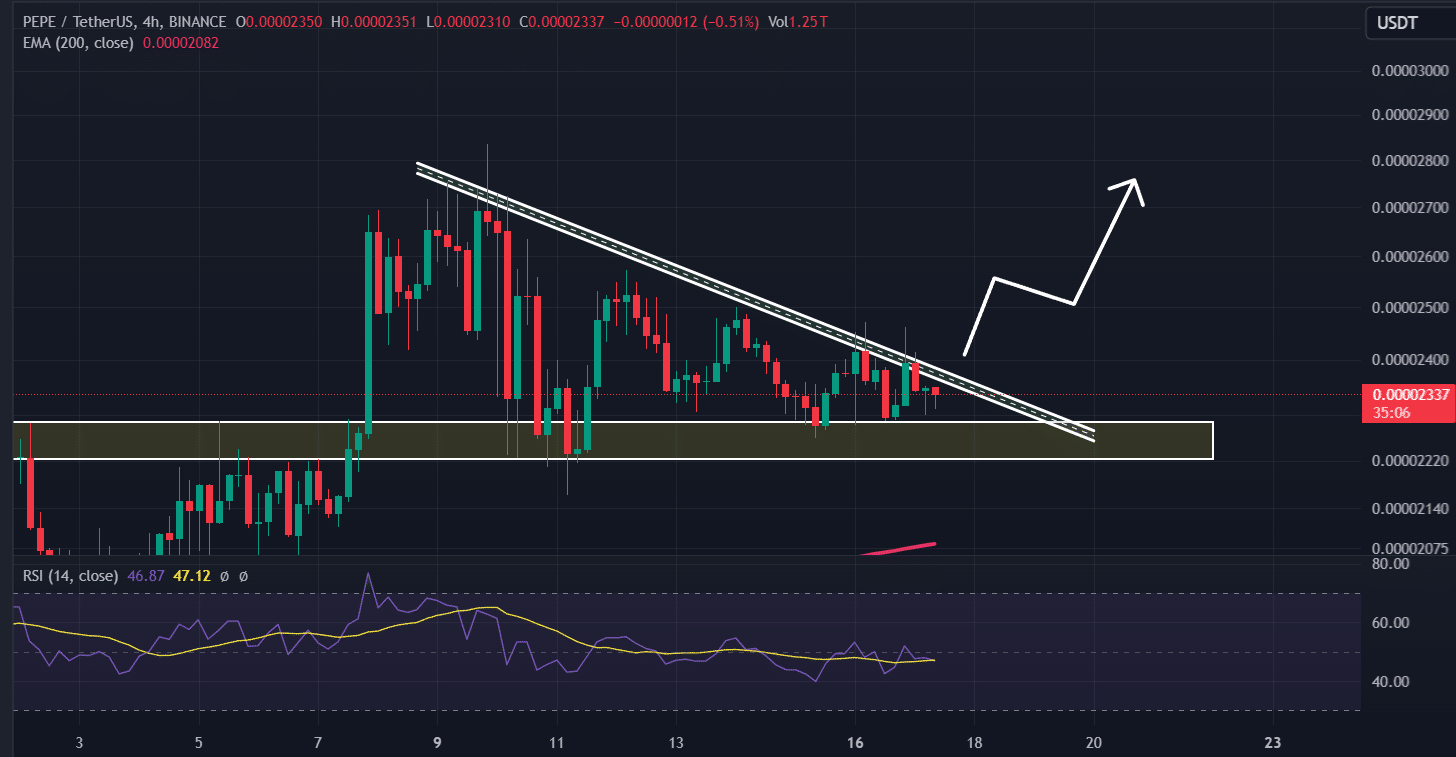

Technical analysis adds another layer to the bullish narrative. According to AMBCrypto, PEPE has formed a descending triangle pattern on the four-hour timeframe, potentially signaling a breakout. A confirmed breakout with a closing price above $0.0000243 could propel PEPE by 17%, reaching $0.000028.

Encouragingly, PEPE’s Relative Strength Index (RSI) remains below the overbought territory, suggesting room for further growth. Combining on-chain metrics and technical analysis, it appears both long-term holders and traders are currently bullish on coin. This confluence of factors could trigger a breakout from the pattern and a potential 17% surge in the coming days.

Also Read: Dormant PEPE Whale Awakens: Turns $27 into $52M After 600 Days Amid Bullish Meme Coin Rally

Current Market Position

At the time of writing, PEPE is trading near $0.0000235, enjoying a 1.5% price increase in the last 24 hours. Notably, trading volume has also jumped by 15%, reflecting heightened interest from investors and traders amidst the positive outlook for PEPE.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.