|

Getting your Trinity Audio player ready...

|

Memecoin PEPE is currently trading in a holding pattern as market sentiment remains indecisive. After a recent 3% price surge, the token is consolidating within a down channel, sparking speculation about a potential breakout or breakdown.

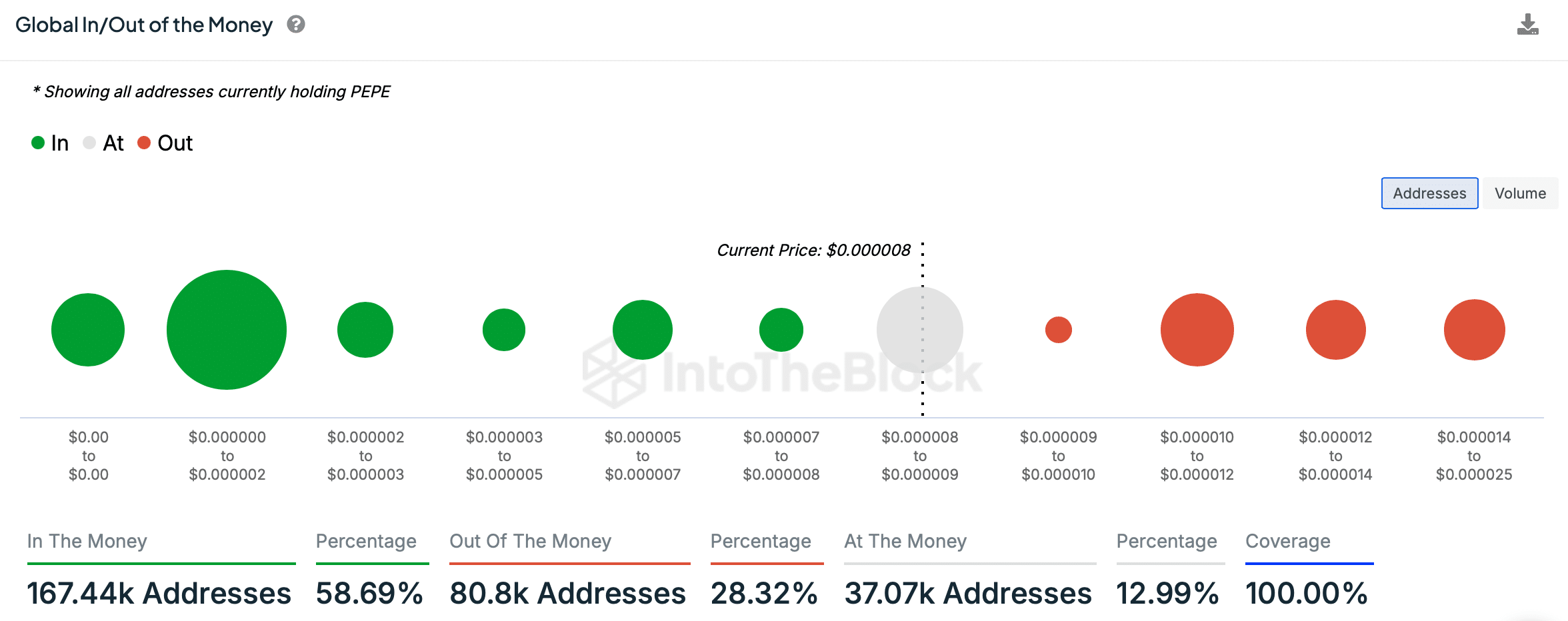

While the price increase has ignited hopes for a bullish rally, the underlying market dynamics paint a more complex picture. The number of profitable PEPE addresses has increased, but it still accounts for less than 60% of total addresses, indicating a cautious investor sentiment.

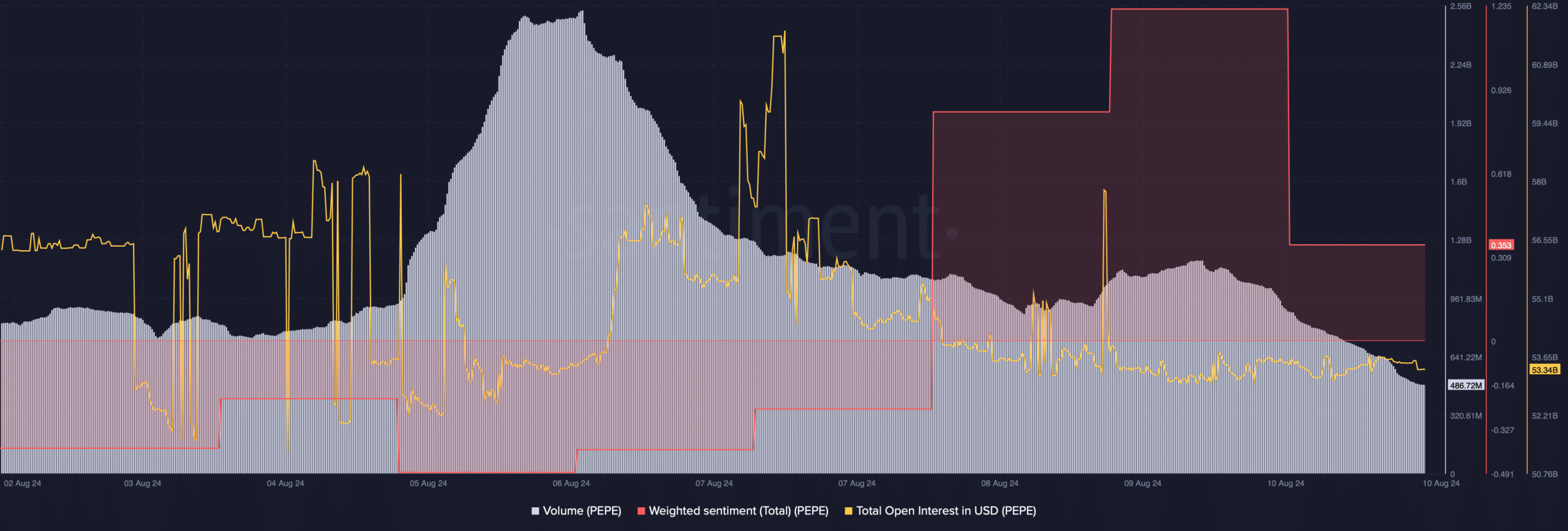

Technical analysis offers conflicting signals. On one hand, a breakout from the down channel could propel PEPE towards its previous highs. However, on-chain metrics such as declining trading volume, dropping weighted sentiment, and a decreasing open interest suggest a potential bearish reversal.

Moreover, the long/short ratio has tilted in favor of short positions, indicating growing bearish sentiment. Traditional indicators like the Chaikin Money Flow and Relative Strength Index are also displaying neutral to bearish signals, suggesting a period of consolidation.

Despite these headwinds, a bullish crossover in the Moving Average Convergence Divergence (MACD) indicator hints at the possibility of continued price appreciation.

Also Read: PEPE Coin: Up 100% or Down 50%? Technical Analysis Reveals Shocking Truth

As PEPE navigates this period of uncertainty, investors are closely watching for signs of a decisive breakout or breakdown. A sustained move above the down channel’s resistance could ignite a bullish rally, while a breakdown below support could trigger a more significant price decline.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!