|

Getting your Trinity Audio player ready...

|

The New York Stock Exchange has unveiled a new — and once unthinkable — addition to its historic facade: a “disappearing” Satoshi Nakamoto statue by Italian artist Valentina Picozzi. The installation makes the NYSE the sixth global location to host one of her sculptures, joining Switzerland, El Salvador, Japan, Vietnam and Miami.

For an institution long viewed as the stronghold of traditional finance, the move marks a dramatic shift from just a few years ago, when crypto was still treated as an unwelcome outsider on Wall Street. In an announcement on X, the NYSE described the artwork as a moment of “shared ground between emerging systems and established institutions.”

The statue was installed by Twenty One Capital, a Bitcoin-focused firm that began trading this week. Picozzi, posting under her Satoshigallery account, said seeing her work placed at such a symbolic venue was “mind-blowing,” calling it an achievement “we wouldn’t think about even in our wildest dream.” It is the sixth of an intended 21 statues — a nod to Bitcoin’s 21 million hard cap.

The timing is fitting: it lands almost exactly on the anniversary of the Bitcoin mailing list, launched by Nakamoto on Dec. 10, 2008, which quietly set the foundation for the decentralized system that would follow.

From Code Experiment to Formal Asset Class

Bitcoin’s first chapter began on Jan. 3, 2009, when Nakamoto mined the genesis block and created the first 50 BTC. A year later, on May 22, 2010, Laszlo Hanyecz conducted the first known commercial Bitcoin transaction, buying two pizzas for 10,000 BTC — now a symbolic milestone that highlights how far the asset has come.

The years in between were marked by skepticism, regulatory pressure, and periods where banks and governments treated the industry as a nuisance at best. Efforts such as the alleged Operation Chokepoint 2.0 signaled a clear divide between crypto and the traditional financial system.

But the narrative has changed. Former skeptics — including BlackRock CEO Larry Fink — have publicly reversed course, calling Bitcoin a legitimate asset with global appeal. Institutional participation through ETFs, custody platforms, and on-balance-sheet holdings has accelerated the shift.

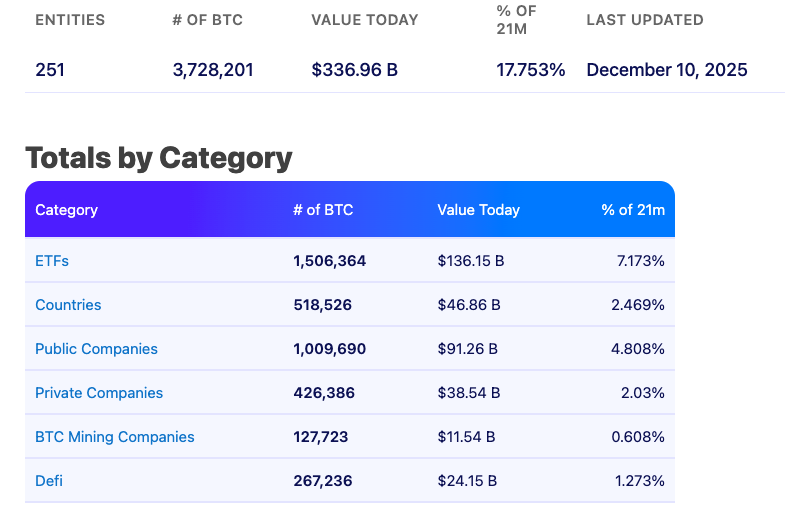

Today, public companies, governments, and ETFs collectively hold more than 3.7 million BTC, worth over $336 billion, according to Bitbo.

A Global Network of ‘Disappearing’ Satoshis

Picozzi’s sculptures are intentionally designed to fade into their surroundings, reflecting the mystery of Bitcoin’s creator. Speaking to Cointelegraph last year, she said the effect symbolizes “the feeling of disappearance,” where Satoshi exists only in the lines of Bitcoin’s code — and not in public life.

The statues portray a hooded hacker seated with a laptop, meant as a tribute not just to Nakamoto, but to the developers and cryptographers who built the Bitcoin ecosystem “fighting for transparency and freedom.”

With five installations already placed around the world and the NYSE now hosting the sixth, Picozzi says her commitment to completing all 21 remains unchanged. Each new location acts as a marker of Bitcoin’s expanding cultural presence — and, increasingly, its acceptance by the very institutions it once sought to disrupt.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!