|

Getting your Trinity Audio player ready...

|

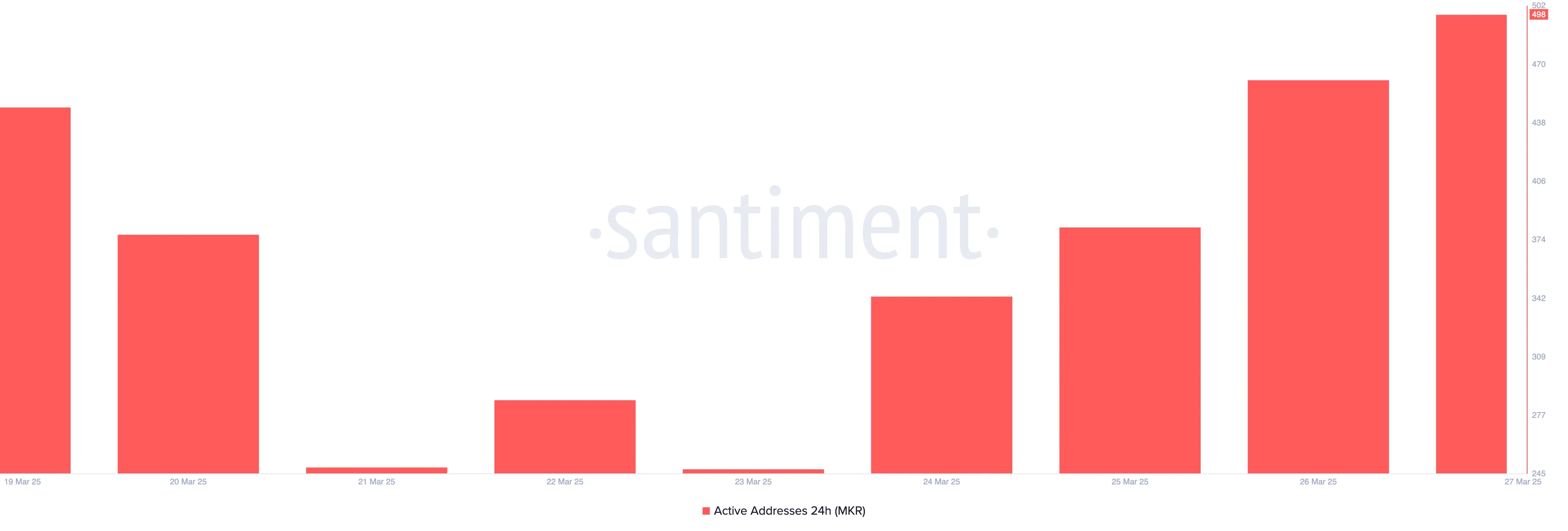

Maker (MKR) is witnessing a resurgence in bullish momentum as on-chain data indicates a spike in investor activity. Recent data from Santiment reveals that MKR’s active address count has surged to a seven-day high of 498, marking an 8% increase in just 24 hours. This uptick signals growing demand for the token, as more traders and investors engage with the asset.

Investor Interest Strengthens MKR’s Market Presence

A rise in active addresses is often a bullish indicator, showcasing heightened participation and liquidity. With increasing engagement, MKR’s bullish trend appears to be gaining traction, reinforcing its potential for sustained growth.

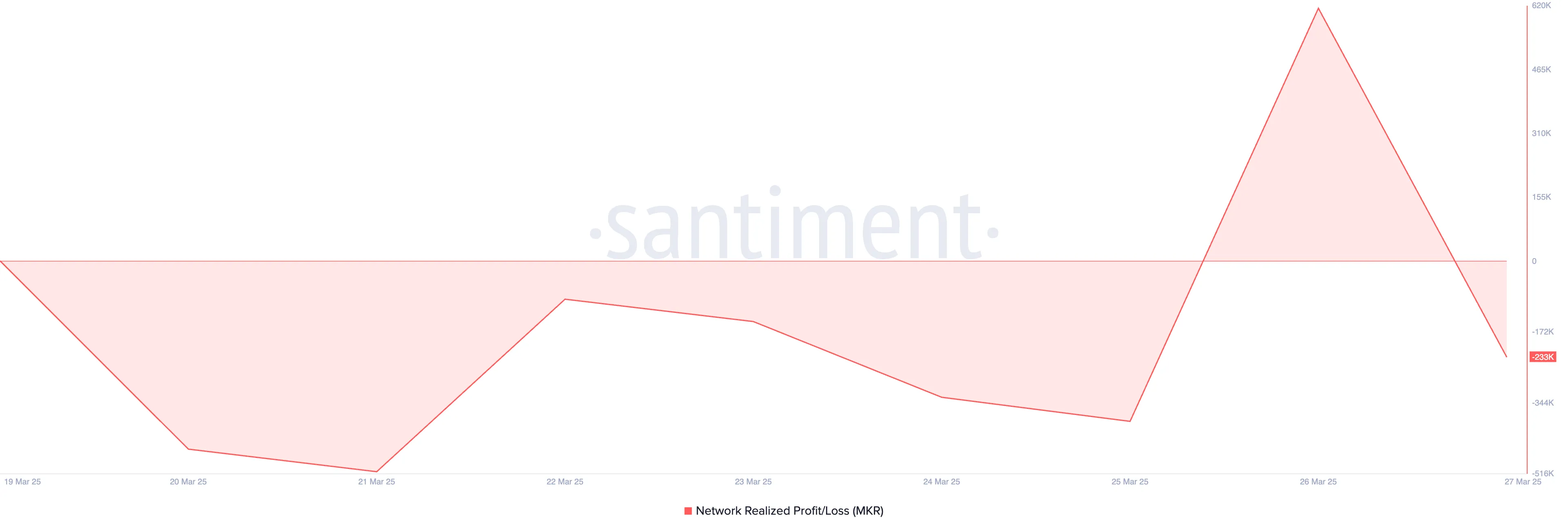

Furthermore, MKR’s Network Realized Profit/Loss (NPL) has turned negative, currently standing at -233,000. This metric suggests that a significant number of holders are unwilling to sell at a loss, reducing selling pressure. When investors hesitate to offload their assets at lower prices, it often creates favorable conditions for an extended price rally.

MKR Flips Resistance Into Support—Can It Reach $1,780?

The altcoin has successfully turned the key resistance level of $1,464 into a new support floor. If the buying pressure continues to mount, bulls could consolidate their position and prevent MKR from dipping below this critical threshold. A sustained uptrend may push MKR toward $1,780, a price level last seen in late February.

However, the bullish outlook is contingent on maintaining current demand levels. A shift in market sentiment or increased selling pressure could see MKR fall below $1,466, potentially leading to a further drop toward $1,109.

What’s Next for MKR?

With rising active addresses and declining selling pressure, MKR appears poised for a potential breakout. If investor sentiment remains positive and demand continues to strengthen, the token could sustain its upward momentum. Traders should watch key support and resistance levels closely as MKR navigates its next major move.

Also Read: Maker (MKR) Price Analysis: Key Levels to Watch as Bulls Target $1500 Breakout

As the crypto market remains volatile, MKR’s ability to maintain this bullish trajectory will depend on broader market conditions and continued investor confidence.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.