|

Getting your Trinity Audio player ready...

|

In a recent, headline-grabbing presentation, Michael Saylor, the visionary CEO of MicroStrategy, made a compelling case for Microsoft to allocate a staggering $100 billion annually to Bitcoin. This bold proposal, if adopted, could potentially catapult Microsoft’s market capitalization to unprecedented heights, exceeding $4.9 trillion.

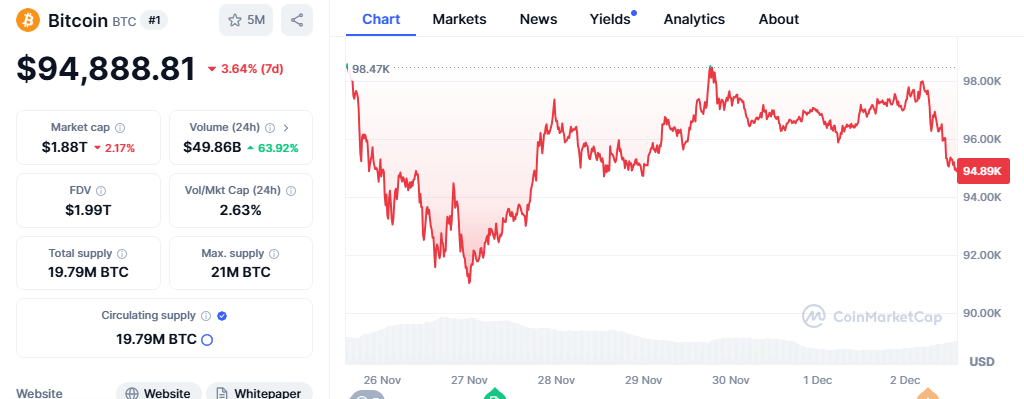

Saylor’s argument is rooted in the explosive growth of Bitcoin, which has surged by nearly 120% this year alone. He asserts that embracing Bitcoin could revolutionize Microsoft’s financial trajectory and solidify its position as a technological pioneer.

A Bitcoin-Fueled Future – Saylor’s Price Predictions

Saylor’s optimistic outlook extends to Bitcoin’s future price. He predicts that the cryptocurrency could reach a staggering $1.7 million by 2034. If Microsoft were to leverage its treasury reserves, debt, and revenue streams to acquire Bitcoin, Saylor estimates that the company’s stock price could soar by $584 per share over the next decade.

This ambitious projection aligns with the broader trend of institutional investors increasingly recognizing the potential of cryptocurrencies. As Bitcoin’s valuation recently surpassed $100,000, Saylor warns that traditional investment strategies may not be sufficient to capitalize on the transformative power of this emerging asset class.

The $100 Billion Question – Can Microsoft Afford to Ignore Bitcoin?

Saylor’s pitch to Microsoft is a timely reminder that the world of finance is rapidly evolving. He argues that holding onto cash reserves is a less rewarding strategy than investing in Bitcoin, which offers the potential for exponential growth. By comparing Bitcoin to a high-growth company trading at a 1x revenue multiple, Saylor emphasizes the compelling investment case for cryptocurrencies over traditional assets like stocks and bonds.

As public and political support for Bitcoin continues to grow, Saylor believes that a “crypto renaissance” is underway. Influential figures, including incoming [Political Leader’s Name], have voiced their support for cryptocurrencies, which could shape regulatory policies and public perception. This favorable environment presents a unique opportunity for companies like Microsoft to embrace the decentralized future and position themselves as leaders in the crypto economy.

Michael Saylor’s audacious proposal to Microsoft marks a significant milestone in the mainstream adoption of cryptocurrencies. By advocating for a $100 billion annual Bitcoin investment, Saylor underscores the immense potential of digital assets to reshape the global financial landscape. As Bitcoin continues to rally, the world awaits Microsoft’s response to this groundbreaking proposition. The decision could have far-reaching implications for the company’s future growth and the broader cryptocurrency market.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

Crypto and blockchain enthusiast.