|

Getting your Trinity Audio player ready...

|

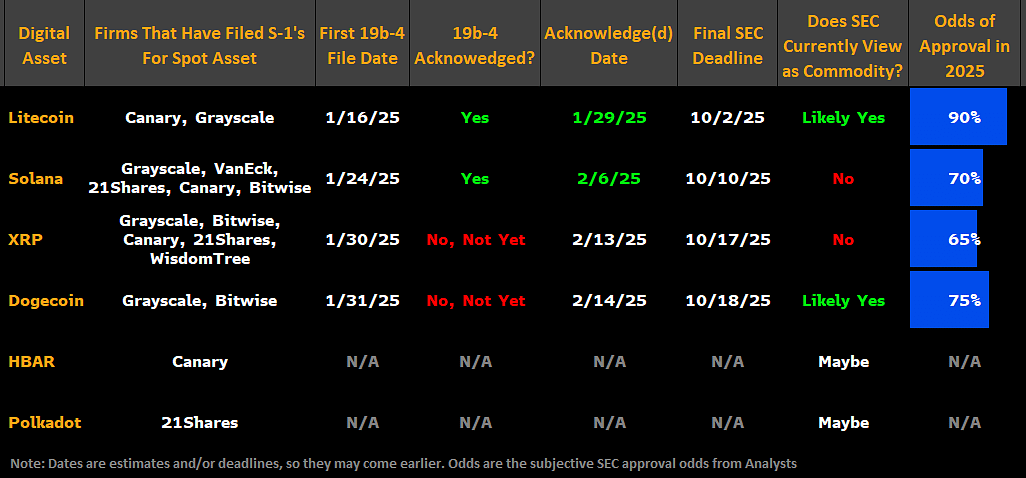

Litecoin (LTC) has experienced a significant surge in price, rising over 20% in just two days to top $132. This spike is largely attributed to renewed speculation surrounding the approval of a Litecoin Exchange-Traded Fund (ETF) in the United States. According to Bloomberg ETF analysts, James Seyffart and Eric Balchunas, LTC has the highest odds of ETF approval among altcoins, with a 90% chance of receiving approval in 2025. However, the final deadline for the U.S. Securities and Exchange Commission (SEC) to make a decision is October 2025.

Despite the optimistic outlook, questions remain about whether LTC can sustain this rally. Litecoin has been testing its range highs, with the $95-$140 price range acting as a key level since last November. On the daily chart, LTC remains bullish but is yet to enter overbought territory, as indicated by the Relative Strength Index (RSI). This suggests there may still be room for further growth, but unless Bitcoin (BTC) breaks $100K, LTC could face selling pressure near its range-high of $135.

A potential sell-off could come from swing traders who capitalized on last week’s de-leveraging event, with some sitting on 30% profits. Long-term holders may also impact the market, as data from IntoTheBlock reveals that 73% of LTC holders are currently in profit. Historically, LTC’s rallies have often stalled when profitability levels have been this high, as seen in December and March when profits peaked at 84% and 72%, respectively.

Also Read: Altcoin ETFs Near Approval: Litecoin, Dogecoin, Solana, and XRP Poised for SEC Green Light

Looking ahead, the next major resistance for LTC on the weekly chart could be $180, a key level from 2021 when the coin experienced a significant price surge. With the ongoing ETF speculation, LTC has created trading opportunities for both short-term speculators and long-term holders. However, for the uptrend to continue, LTC’s sustained rally could be capped if profit-taking becomes widespread among holders.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!