|

Getting your Trinity Audio player ready...

|

Litecoin (LTC) is facing a challenging market environment, with several signs pointing to a potential continuation of its downtrend. Recent on-chain data and technical indicators suggest that the altcoin may be at risk of further losses in the short term.

Declining User Demand Signals Weakening Interest

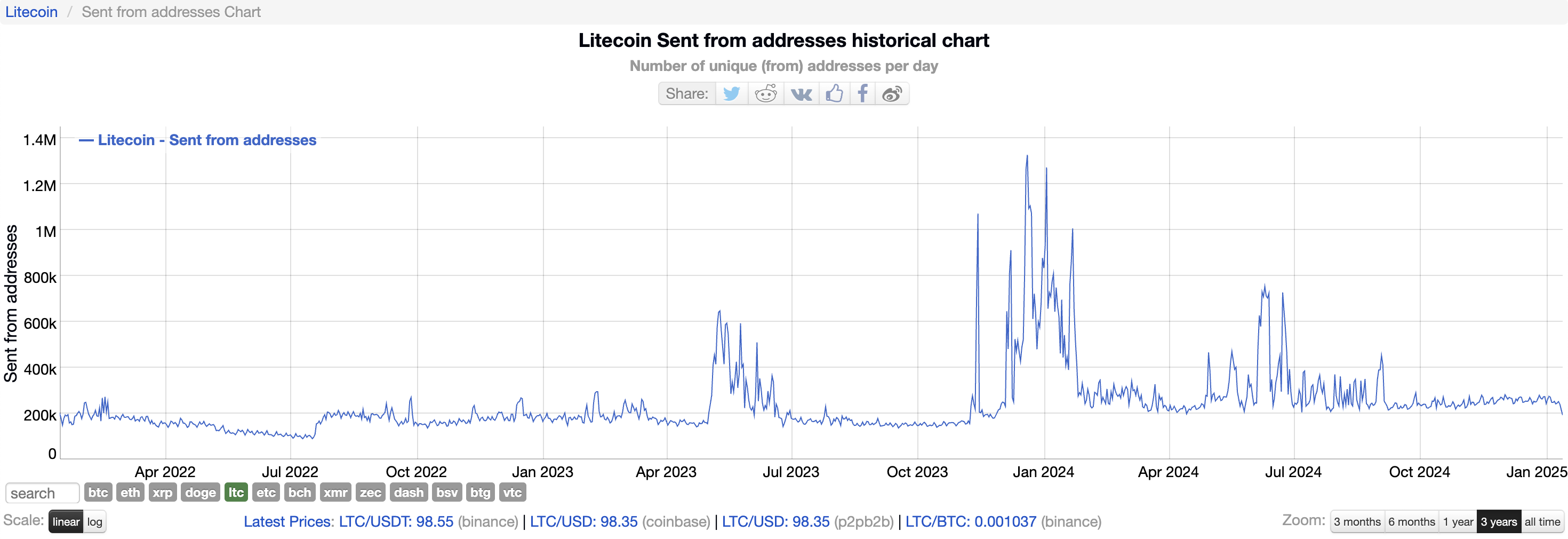

Litecoin’s user activity has seen a noticeable decline, with the number of unique addresses engaging with the network dropping to its lowest levels since November 2023. According to BitInfoCharts, only 193,477 unique addresses completed transactions on the Litecoin network on Monday—marking a significant drop in user engagement.

A decrease in daily active addresses often signals a decline in network usage, which could lead to lower demand for the token. This downturn in user activity has translated into a 13% loss for Litecoin over the past week, with the altcoin currently trading at $98.63, below the critical $100 mark.

Negative Sentiment Exacerbates Price Decline

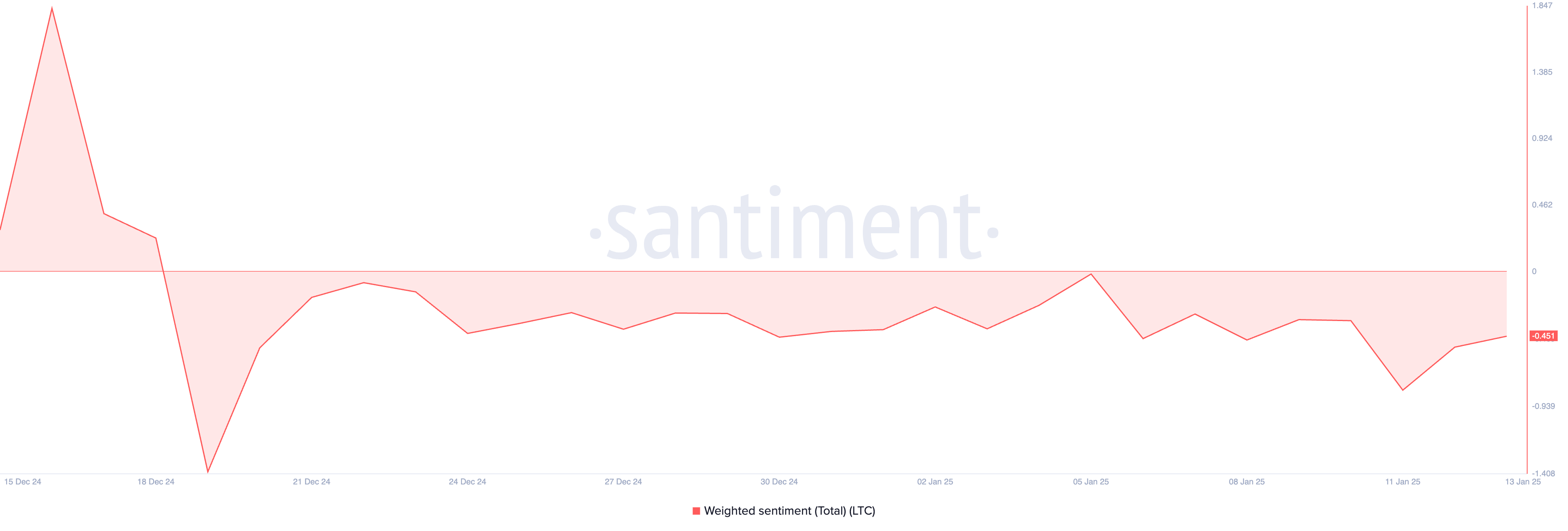

In addition to weakening user demand, Litecoin is also grappling with negative sentiment. As of now, the token’s weighted sentiment stands at -0.45, indicating a predominantly bearish outlook. Weighted sentiment takes into account both the volume of social media mentions and the sentiment expressed within those discussions. A negative reading suggests investor skepticism, further dampening interest in LTC and contributing to downward pressure on its price.

LTC Price Prediction: Bearish Trend Persists

Technical analysis on Litecoin’s one-day chart shows a descending triangle pattern, characterized by lower highs and a consistent downward trend. This pattern reflects a market sentiment that is largely bearish, with selling pressure outweighing buying activity.

If the downward trend continues and buying interest fails to pick up, LTC could see its price drop toward key support at $86.64. However, should buying activity resume and push the price above the descending trendline, the bearish outlook could be invalidated, and LTC could rise to $109.81.

For now, Litecoin’s prospects remain uncertain as it faces diminishing user demand and negative sentiment, putting its future performance in question.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

Also Read: Litecoin (LTC) Eyes Bullish Momentum in 2025: Can Whale Activity Sustain Its Recovery?

Crypto and blockchain enthusiast.