|

Getting your Trinity Audio player ready...

|

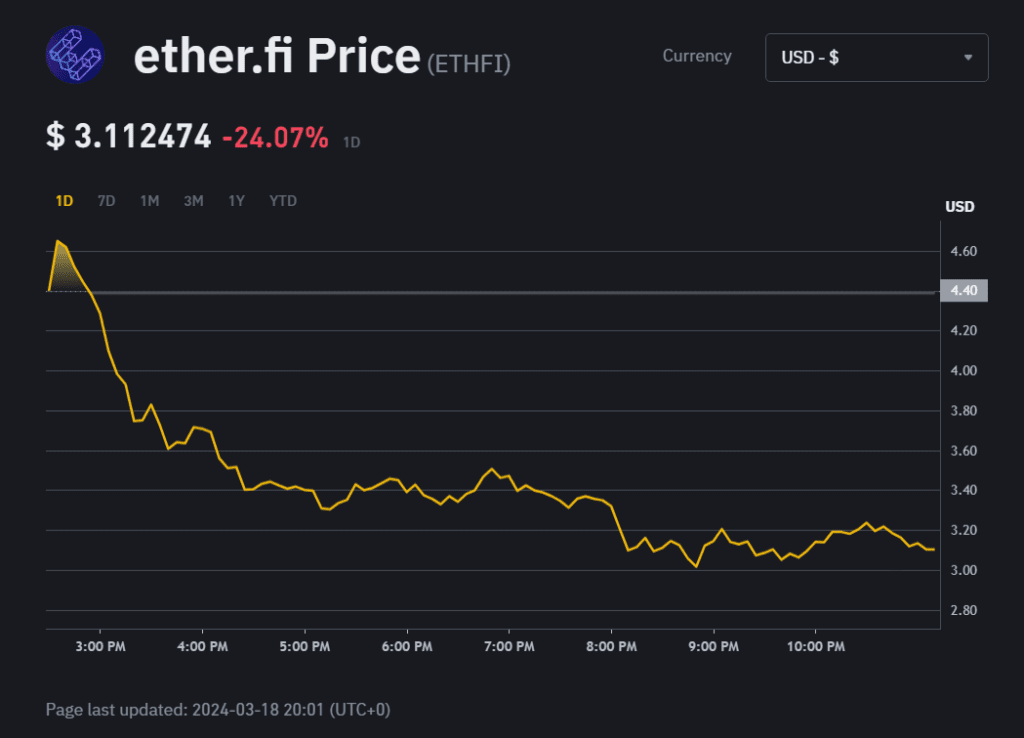

ETHFI, the governance token of the leading liquid restaking protocol Ether.Fi, has experienced a price drop following its highly anticipated launch on Binance Launchpad. Despite initial excitement, the token’s price has slumped by more than 20% since its debut at $4.13.

At the time of writing, ETHFI is hovering around $3.60 on Binance, with a significant trading volume exceeding $118 million recorded within the first 45 minutes.

However, this early burst of activity hasn’t translated into sustained price growth. This price drop follows a trend of recent Binance Launchpad listings, with tokens like ARKM and PORTAL experiencing similar post-launch dips.

Understanding the Tokenomics

ETHFI boasts a fully diluted value (FDV) of $3.6 billion, representing the market capitalization if the entire one billion token supply were in circulation. Notably, only a portion of the supply is currently circulating, with 20 million tokens allocated to the Binance Launchpad sale and another 60 million distributed through an airdrop. An additional 50 million tokens are slated for a “season two” airdrop, further increasing supply over time.

Also Read: BOOK OF MEME (BOME) Coin Takes the Crypto World by Storm: 2700% Surge Fueled by Binance Listing

Vesting Schedule and Distribution

Investors and core contributors will receive their ETHFI holdings through a vesting schedule. Investors will gradually acquire 32.5% of the total supply over two years, while core contributors receive 23.26% over a three-year period. This initial limited circulating supply of 115.2 million tokens might have contributed to the early trading surge, but with more tokens entering the market through vesting and airdrops, downward pressure on the price becomes more likely.

Ether.Fi’s Underlying Strength

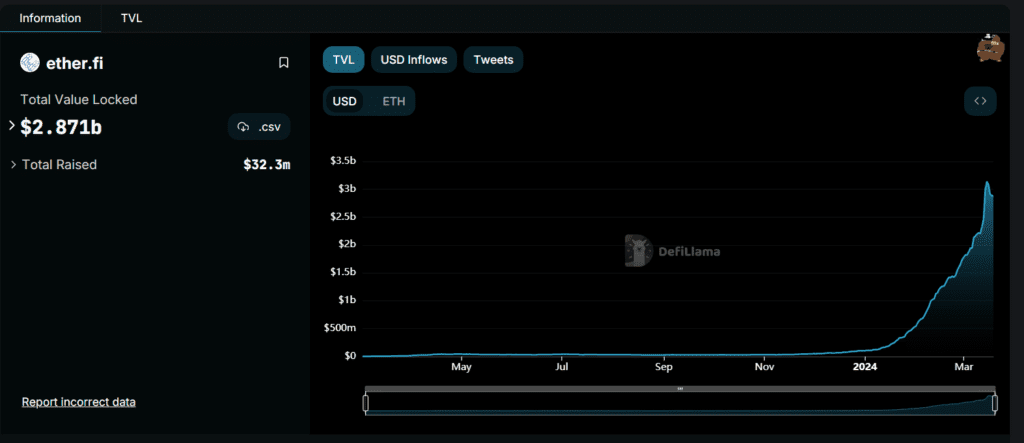

Despite the ETHFI price drop, Ether.Fi itself appears to be on solid ground. The platform’s total value locked (TVL) has surged a staggering 117% in the past month, reaching nearly $3 billion according to DeFiLlama. This growth highlights the increasing demand for liquid staking solutions like those offered by Ether.Fi.

The future of ETHFI remains uncertain. While the initial price drop is concerning, the robust fundamentals of Ether.Fi offer a glimmer of hope. The long-term success of ETHFI will likely hinge on its ability to capture a significant share of the liquid staking market and deliver value to its token holders.

The latest Crypto News on Blockchain, Crypto, NFTs, Bitcoin, DOGE, XRP, Cardano IOTA, SHIB, ETH, DeFi, and the Metaverse.