|

Getting your Trinity Audio player ready...

|

Dogecoin (DOGE) is flashing bullish signals as multiple technical indicators align, suggesting a potential uptrend. At the time of writing, DOGE has successfully retested key technical levels, including the 0.5 Fibonacci retracement, macro trend lines, and the 200-week SMA and EMA. These developments coincide with the 3-day RSI sitting at historically low levels, indicating oversold conditions.

1. Back test macro 0.5 FIB

— Kevin (@Kev_Capital_TA) March 12, 2025

2. Back test of macro trend lines

3. Back test of 200 week SMA and EMA

4. 3 Day RSI at Historical lows

If #BTC holds up and Macro Economic Data and Monetary policy adjust then you just got your last opportunity to buy #Dogecoin relatively cheap. A… pic.twitter.com/BVhT6RVbmd

DOGE’s Risk-Reward Setup Favors Bulls

Historically, Bitcoin’s consolidation phase has created favorable conditions for memecoins, as investors seek high-risk, high-reward opportunities. With BTC currently ranging between $80,000 and $85,000, the total memecoin market cap has surged 3.6% in the last 24 hours, reaching $46.19 billion. This suggests increased capital rotation into speculative assets, including Dogecoin.

At press time, DOGE was retesting the crucial $0.15 support level after retracing to pre-election levels. On-chain data highlights that this zone is becoming a high-demand area, a signal often associated with trend reversals. If sustained, this demand could fuel a strong recovery, reinforcing the strategic case for accumulation.

Key Technical Indicators Support a Bullish DOGE Case

DOGE’s 3-day RSI remains at historic lows, further validating oversold conditions. This setup recently enabled a 10% price rebound, pushing DOGE back to $0.17. Additionally, the 0.5 Fibonacci retracement confirmed a potential local bottom, while the 200-week SMA and EMA reclaiming further strengthens the outlook for a sustained uptrend.

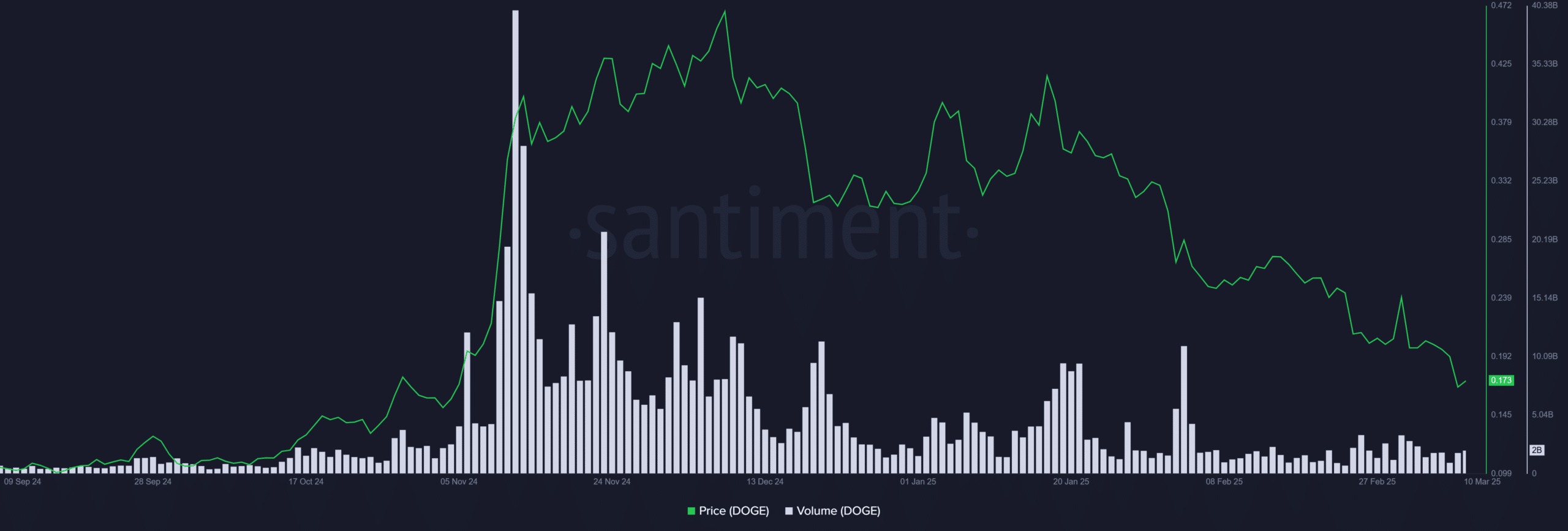

Volume metrics are also aligning with this bullish narrative. Dogecoin’s trading volume recently surged past 2 billion, replicating its October 2023 setup—right before the “Trump pump” propelled it beyond $0.40.

Will DOGE Maintain Its Momentum?

For now, Dogecoin remains in an accumulation phase, with its price closely tied to Bitcoin’s performance. Until BTC clears the $85,000 resistance level, DOGE is likely to consolidate. Historically, such consolidations have preceded explosive breakouts.

Also Read: Dogecoin’s Path to $20: Analyst Predicts 11,811% Surge—Will DOGE Break Out?

If DOGE breaks above $0.20, it could trigger the next leg of its rally, reinforcing the bullish structure. However, while technical indicators and historical patterns point to a favorable risk-reward setup, external market risks remain a key factor to monitor.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!