|

Getting your Trinity Audio player ready...

|

Justin Sun, the enigmatic founder of Tron, has once again stirred the crypto community with a significant move. His team has been actively transferring substantial amounts of Ethereum (ETH) to centralized exchanges, raising eyebrows and sparking speculation.

The ETH Exodus

Since November, Sun’s team has deposited over 41,630 ETH, valued at approximately $146 million, into various exchanges. The majority of these funds, around 39,000 ETH ($137 million), were sent to HTX, while 2,630 ETH ($8.76 million) found their way to Poloniex. Notably, these transfers were executed at an average ETH price of $3,505, adding intrigue to the timing and rationale behind the move.

Justin Sun (@justinsuntron) deposited another 20,000 $ETH ($76.3M) to #HTX 8 hours ago as the price surged past $3,800!

— Spot On Chain (@spotonchain) December 5, 2024

Since $ETH began rebounding in early November, he has deposited 41,630 $ETH ($145.9M) into CEXs—39,000 $ETH ($137M) to HTX and 2,630 $ETH ($8.76M) to… https://t.co/G3QOPod2L3 pic.twitter.com/8RtZfJg71I

Just recently, Sun’s team made another significant deposit of 20,000 ETH ($76.3 million) to HTX, as Ethereum’s price surged past the $3,800 mark.

The Motive Behind the Move

The scale and timing of these transfers have ignited speculation within the crypto community. Some believe that Sun might be preparing for a substantial trade or seeking to secure liquidity. Others view it as a strategic maneuver, capitalizing on Ethereum’s bullish momentum.

The heavy focus on HTX, where the majority of the funds have been directed, raises further questions. Is this a testament to the exchange’s stability, or is there a deeper, strategic reason behind this choice?

Ethereum’s Bullish Outlook

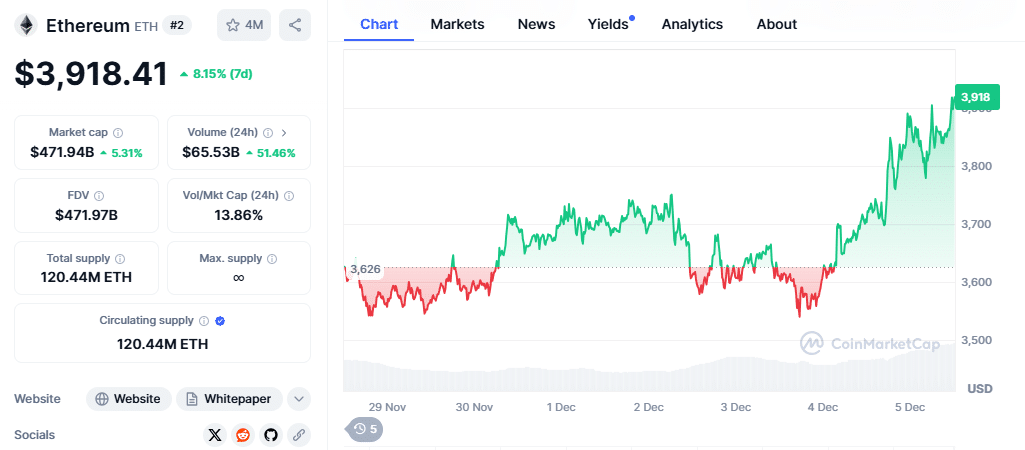

Ethereum has been exhibiting strong upward momentum, steadily climbing from the $3,550 support level. The recent breach of the $3,800 mark, reaching a high near $3,895, has fueled optimism among traders.

Technical analysis suggests that the next crucial resistance levels for ETH lie at $3,920 and $3,950. A successful break above these levels could pave the way for a potential move toward $4,000. Further gains, possibly reaching $4,050 or $4,120, could follow a break above $4,000.

However, if Ethereum fails to surpass $3,920, a potential pullback might occur. In such a scenario, support levels at $3,800 and $3,750 would be crucial. A deeper correction could even take the price back to the $3,600 level.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

A lifelong learner with a thirst for knowledge, I am constantly seeking to understand the intricacies of the crypto world. Through my writing, I aim to share my insights and perspectives on the latest developments in the industry. I believe that crypto has the potential to create a more inclusive and equitable financial system, and I am committed to using my writing to promote its positive impact on the world.