|

Getting your Trinity Audio player ready...

|

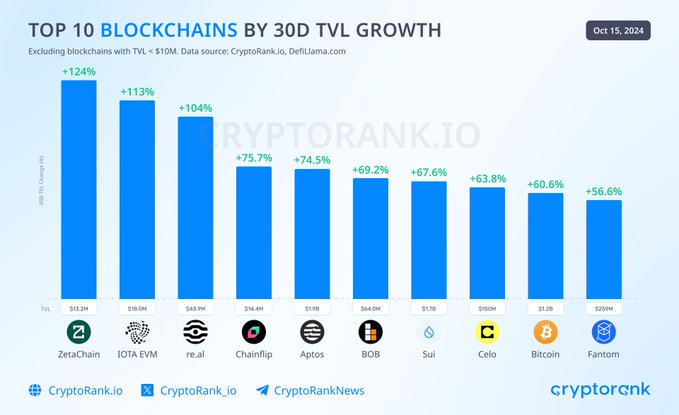

IOTA EVM has emerged as a DeFi powerhouse, experiencing a staggering 113% growth in Total Value Locked (TVL) within the last 30 days, according to CryptoRank.

This impressive feat places IOTA EVM as the second-highest performer among the top ten DeFi platforms, narrowly trailing ZetaChain’s 124% growth.

IOTA EVM’s meteoric rise is further highlighted by its rapid TVL increase, jumping from $5 million on September 4th to $18 million within just ten days. This organic growth, achieved without marketing campaigns, underscores the burgeoning trust in IOTA EVM’s decentralized solutions.

What’s Driving the Growth?

Web3 builder and Venture Fund Nakama Labs attributes IOTA EVM’s success to its expanding use cases and the growing adoption of decentralized solutions on the network. This robust growth is expected to attract a wider pool of developers and users, creating a self-sustaining ecosystem.

IOTA Price Lags Behind

While IOTA EVM enjoys phenomenal TVL growth, its native token, IOTA, has exhibited a muted performance. Despite a broader market mini-rally, IOTA has managed only a meager 0.81% price increase in the past month.

Also Read: Fireblocks Integrates IOTA EVM, Expanding Access to Digital Assets

Development and Innovation

Despite its price stagnation, IOTA remains focused on development. The recently announced IOTA Labs account, functioning as an independent ecosystem arm, aims to translate innovative ideas into tangible solutions. This initiative, backed by a $2 million incentive program, holds the potential to drive long-term growth and ultimately impact IOTA’s price positively.

IOTA EVM’s phenomenal TVL growth signifies its emergence as a major player in the DeFi landscape. With its focus on decentralized solutions and continuous development, IOTA EVM’s future remains bright, even if its token price currently lags behind. However, the potential impact of IOTA Labs and its incentive program on IOTA’s price trajectory remains to be seen.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.