|

Getting your Trinity Audio player ready...

|

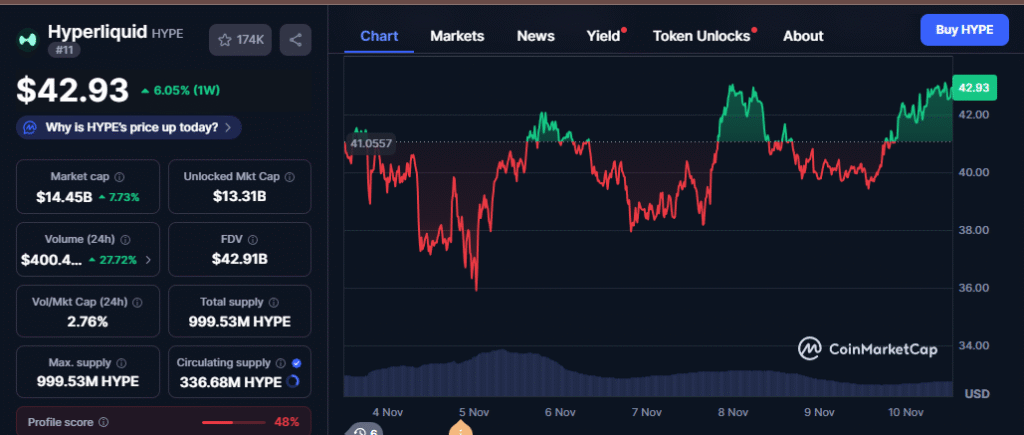

- HYPE rose 7% in 24 hours to $42.81, boosted by the BLP Testnet launch.

- Bulls aim for a breakout above $43.68, eyeing targets at $46 and $49.95.

- Support zones at $41.74 and $40.79 could limit downside risk.

The Hyperliquid (HYPE) market is heating up again, drawing traders’ attention with sharp price swings and resilient support levels. As of today, HYPE trades at $42.81, marking a 6.99% gain in 24 hours and a nearly 4% weekly rise.

The latest rally follows the BLP Testnet launch, which boosted investor confidence and renewed interest in DeFi lending and borrowing utilities. The move has sparked optimism that Hyperliquid could set a new benchmark in decentralized finance, even as whale activity adds both excitement and short-term volatility.

Technical Picture: Bulls Hold Firm Above Key Support

From a technical standpoint, HYPE remains comfortably above its 50-day simple moving average (SMA) at $40.79, a sign that bulls still control the near-term trend. The token is now testing resistance at $43.68, corresponding to the 38.2% Fibonacci retracement level.

A clear breakout and close above this level could quickly push prices toward $46.07, with the next target at $49.95. However, the 14-day RSI at 59.8 shows that momentum remains neutral, while a slightly bearish MACD divergence warns of possible short-term hesitation.

Support Zones to Watch

If buyers lose momentum, HYPE has several strong support layers. The $41.74 zone aligns with the 50% Fibonacci mark, while deeper support at $40.79 serves as the SMA buffer. A decisive move below $39.05, however, would flip sentiment bearish and open the door for a correction.

Outlook: Bulls Need a Strong Close Above $43.68

For now, the short-term battle is finely balanced. Bulls are favored if HYPE manages to hold above $43.68, potentially setting up a run toward $46–$50 within the week. But if resistance holds and momentum fades, traders should be ready for a retest of lower support zones before the next breakout attempt.

Hyperliquid’s latest rally shows clear bullish intent supported by technical strength and renewed ecosystem interest. Still, volatility remains part of the game — and this week’s close will determine whether the bulls can finally claim control.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

Also Read: Hyperliquid [HYPE] Nears All-Time High After $25M Inflows

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!