|

Getting your Trinity Audio player ready...

|

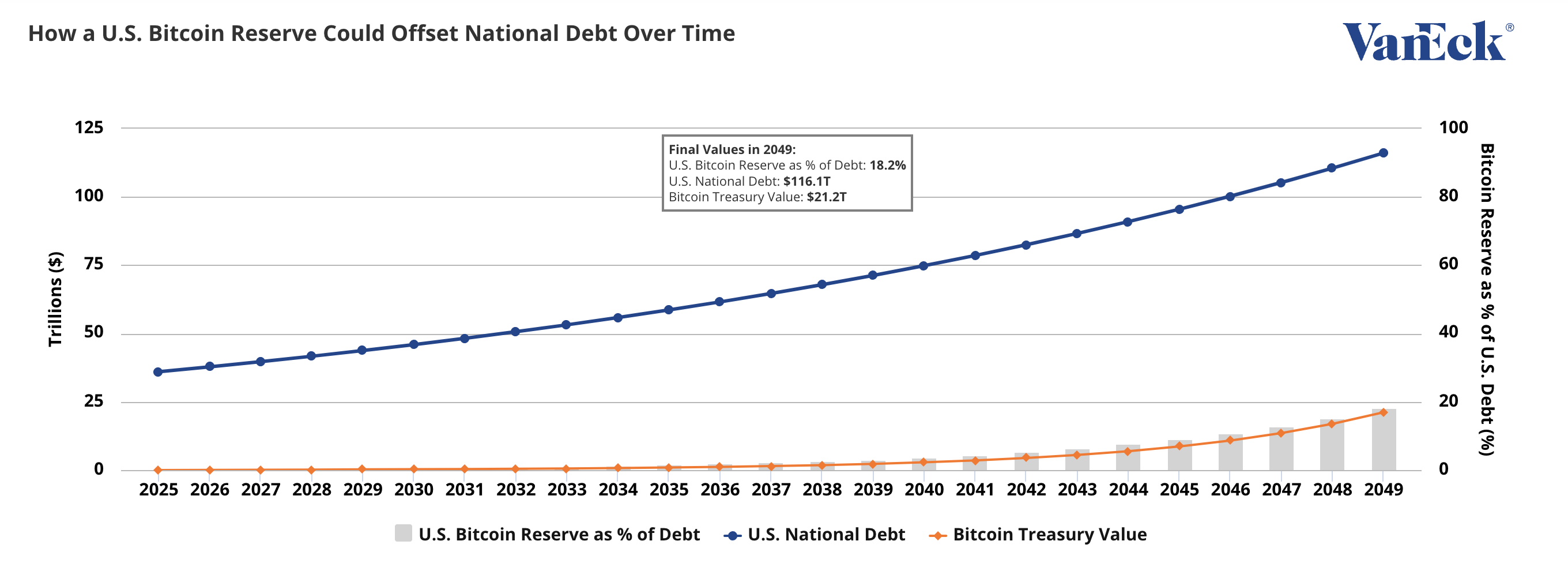

The concept of a Strategic Bitcoin Reserve is gaining traction following the introduction of the BITCOIN Act by Senator Cynthia Lummis. This proposed legislation suggests that the U.S. government could acquire up to 1 millin Bitcoins (BTC) over five years, with a maximum annual purchase of 200,000 BTC. The acquired Bitcoin would then be held in reserve for at least 20 years, with the potential to mitigate the national debt crisis.

VanEck’s Interactive Bitcoin Debt Calculator

To assess the feasibility of this plan, VanEck has developed an interactive tool that allows users to explore different economic scenarios based on Bitcoin’s growth and debt projections. The calculator takes into account key variables such as:

- Annual debt growth rate (estimated at 5%)

- Bitcoin price appreciation (projected at a compounded 25% annually)

- Purchase price of Bitcoin (starting at $100,000 per BTC in 2025)

According to VanEck’s model, if Bitcoin follows its predicted trajectory, it could reach $21 million per BTC by 2049, significantly offsetting U.S. debt, which is projected to hit $116 trillion by that time.

Growing Interest at the State Level

While the federal government deliberates over this strategy, individual states are also exploring digital asset reserves. Reports indicate that at least 20 U.S. states have proposed legislation aimed at accumulating Bitcoin as part of their treasury holdings. Matthew Sigel, Head of Digital Assets Research at VanEck, suggests that state-level initiatives could generate as much as $23 billion in Bitcoin purchases.

Trump’s Pro-Crypto Stance

Amid the growing interest in Bitcoin reserves, President Donald Trump has reaffirmed his commitment to making the U.S. a global leader in cryptocurrency. At the Future Investment Initiative Institute summit in Miami, Trump stated:

“Bitcoin has set multiple all-time record highs because everyone knows that I’m committed to making America the crypto capital.”

Also Read: Bitcoin Funding Rate Signals Potential Bottom: Is a Short Squeeze Incoming?

Since his return to office, Trump has signed an executive order establishing a national digital asset stockpile and appointed pro-crypto regulators. However, it remains uncertain whether the Strategic Bitcoin Reserve will become a reality.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.