|

Getting your Trinity Audio player ready...

|

Helium (HNT), the token powering the decentralized wireless network, has grabbed investor attention with a 10% price increase in the past day. This bullish momentum coincides with a 12% jump in trading volume, signaling a surge in investor interest. As the price approaches a critical resistance level of $9.5, analysts are gauging the strength of the current rally.

Helium Defies Market Trends with Upward Trajectory

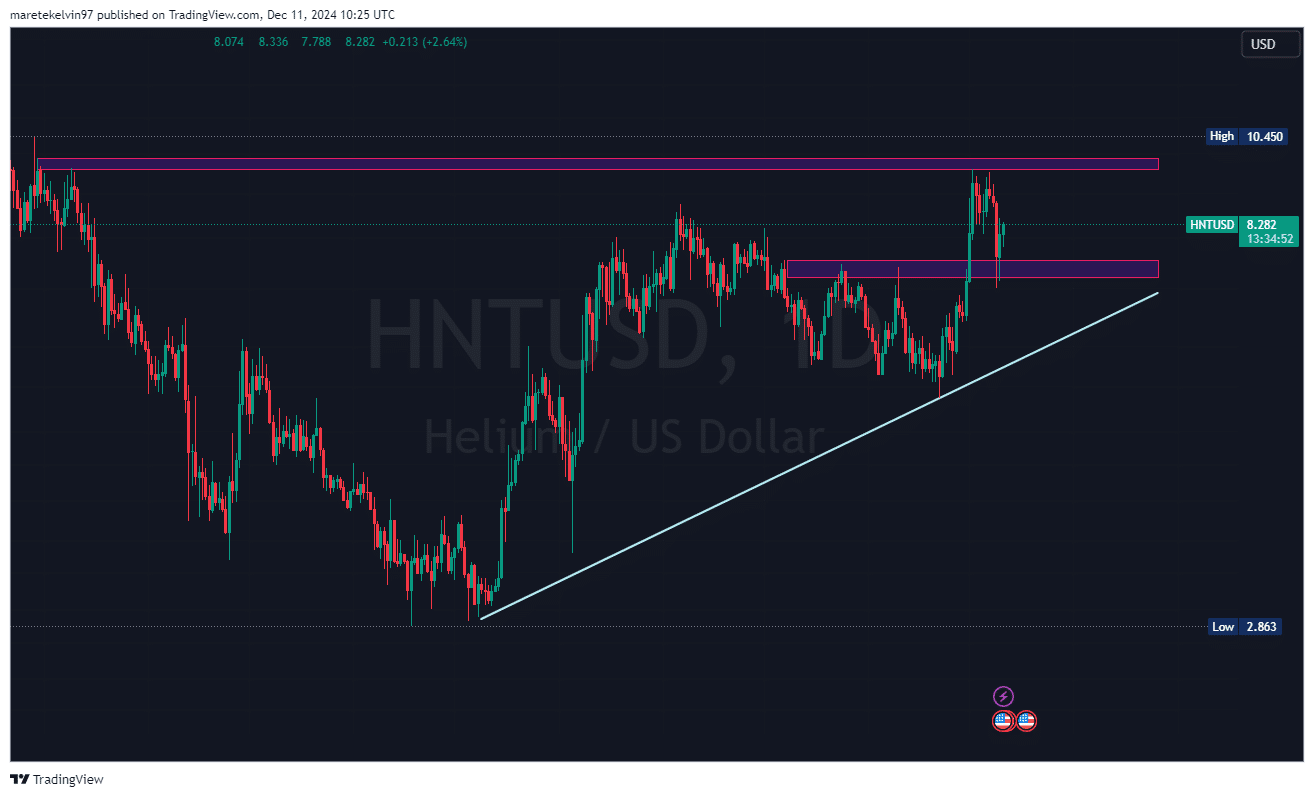

Helium stands out as a top performer in the last 24 hours, defying broader market fluctuations. The daily chart reveals a steady climb towards $9.5, a pivotal point that could shape the token’s future direction. A decisive breakout above this resistance could unlock a further bullish run, potentially targeting the psychologically significant $10 level. However, failure to breach this barrier might trigger a price pullback.

Technical Indicators Suggest Potential Upswing

The daily chart displays a clear uptrend supported by an ascending trendline formed since Helium’s recent lows near $2.8. The price is currently nearing the $8.2 support level, which previously acted as the resistance within the ascending triangle pattern.

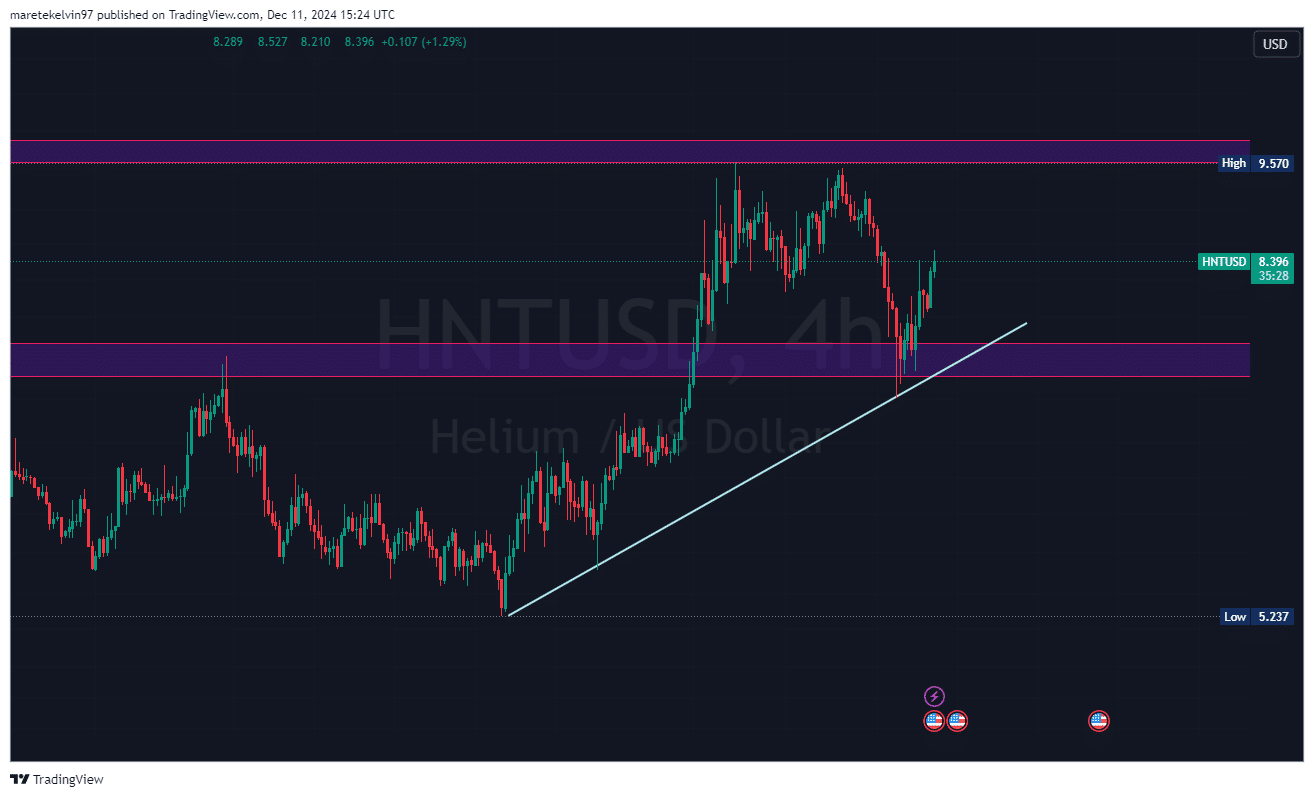

Shorter timeframes also hint at a potential rally, evidenced by the recent 10% surge. Notably, Coinglass liquidation data reveals an increase in leverage positions, with a liquidation pool of 56.70K concentrated at the $8.3648 price point. This indicates a heightened risk for over-leveraged traders but also suggests a bullish bias that could propel the price upwards.

Further bolstering this optimism are Open Interest (OI) trends showcasing sustained growth. This reflects growing investor confidence in Helium’s price movement. Additionally, trading volume aligns with these positive signals, experiencing a significant rise alongside the price, a typical characteristic of healthy bullish trends.

Bitcoin’s Influence and the Key Hurdle

The broader market environment has also been supportive, with Bitcoin’s relative price stability providing a favorable backdrop for altcoin performance, including HNT. However, the critical question remains: can Helium overcome the key resistance level of $9.5?

As Helium approaches this crucial point, bulls will require significant buying pressure to sustain the uptrend. The market’s reaction at this level will be paramount. A breakout may trigger a rapid surge towards $10, whereas rejection could send the price back down to the $7.8-$8 support zone.

Helium’s recent price surge has generated significant buzz in the cryptocurrency market. Whether the current momentum can translate into a sustained uptrend hinges on its ability to surpass the $9.5 resistance. Investors should closely monitor market movements and technical indicators in the coming days for further clues about the token’s next move.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.