|

Getting your Trinity Audio player ready...

|

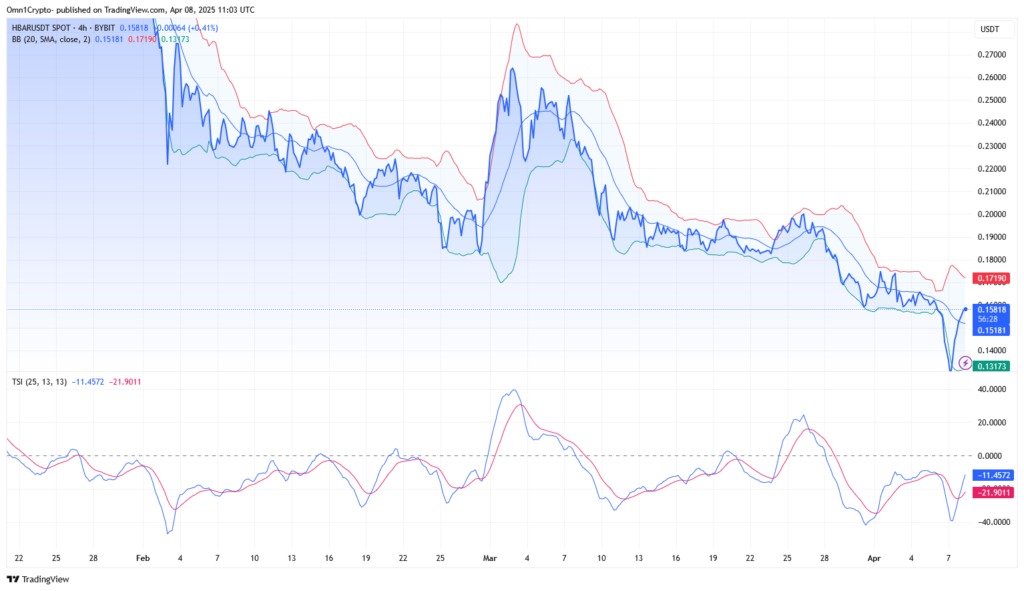

Hedera (HBAR) has made an impressive comeback, with its price soaring by 15% in the past 24 hours. On April 7, HBAR’s price surged to $0.13, and today it has reached $0.16, aligning with the broader altcoin market rally. However, despite this uptick, technical indicators suggest that HBAR may face resistance that could limit its further rise.

HBAR Battles Key Resistance Levels

From a technical analysis standpoint, HBAR’s price is still within a descending channel, which is a bearish pattern defined by lower highs and lower lows. As of now, HBAR is flirting with the upper trendline of this channel, and a breakout above it could signal a potential rally. However, the momentum doesn’t seem to support a sustained upward movement.

Both the Relative Strength Index (RSI) and the Awesome Oscillator (AO) readings suggest weak bullish momentum. The RSI remains below the neutral 50.00 line, signaling that bearish pressure could persist. Similarly, the AO has not managed to cross above the signal line, further indicating that HBAR might struggle to climb higher than $0.16.

Moreover, the Bull Bear Power (BBP) indicator is currently in negative territory, confirming that sellers (bears) are still in control of the market. The Supertrend indicator has also flipped to a bearish signal, as the red line is now above HBAR’s market value, indicating that price might struggle to break the key 0.382 Fibonacci resistance level.

Price Predictions for HBAR

If the bearish momentum continues, HBAR could retrace to the $0.13 level. A prolonged market downturn could push HBAR even lower, potentially testing the $0.10 level. However, should the bulls manage to overpower the bears, HBAR may see an increase to $0.18. In an ideal bullish scenario, HBAR could reach $0.26, a key Fibonacci level known as the golden pocket.

HBAR and Nvidia Partnership: A Game-Changer for the Network

HBAR’s recent rally was also fueled by news of a groundbreaking partnership between Nvidia and Hedera Hashgraph. Nvidia plans to integrate Hedera’s Distributed Ledger Technology (DLT) to track and verify AI workflows, marking a major step forward in combining blockchain and AI technologies. This collaboration, which aims for a carbon-negative architecture, has been a catalyst for HBAR’s recent price surge.

So this happened…@Nvidia posting about the “integration of Hedera Hashgraph (HBAR) into its AI systems” 🔥 https://t.co/h5VpCxLAKd pic.twitter.com/UmZWP4xDYj

— The HBAR Bull (@thehbarbull) April 7, 2025

As HBAR continues to gain attention, its ability to handle 10,000 transactions per second and offer immutable timestamping could make it a valuable player in sectors like finance, healthcare, and autonomous systems. The news has already seen HBAR’s price climb from intra-day lows of $0.13 to $0.16, and with increased trading volume, HBAR could potentially reclaim higher levels, especially if broader market conditions improve.

While HBAR’s recent price increase is a positive sign, technical indicators suggest that it may face significant resistance in the near term. The success of Hedera’s partnership with Nvidia adds a layer of optimism, but price action will largely depend on how the broader market and HBAR’s technical patterns evolve. If the bulls manage to push past resistance levels, HBAR could see further upside, but a return to lower levels remains a possibility.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

Also Read: Hedera (HBAR) Struggles at Resistance: Can Bulls Defend the $0.15 Level?

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!