|

Getting your Trinity Audio player ready...

|

Hedera (HBAR) was among the standout performers in the crypto market last year, surging nearly 850% from November to January. The token erased a zero, skyrocketing from $0.04 before Trump’s victory to a peak of $0.37 when he took office. Investors who got in early enjoyed massive gains, but February brought a price dip as the broader market faced corrections.

Currently, HBAR is trading at $0.19 and experiencing bearish sentiment. The token has declined close to 7% in the latest trading session, showing no immediate signs of a bullish turnaround. However, could HBAR dust itself off and begin a steady recovery? Let’s analyze its mid-March price prospects.

HBAR Mid-March Price Forecast

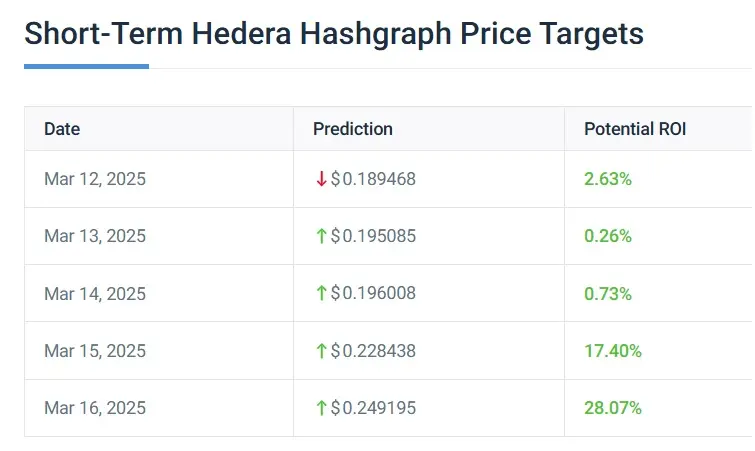

Leading on-chain metrics and price prediction firm CoinCodex remains optimistic about HBAR’s near-term outlook. According to their latest analysis, Hedera could recover and experience double-digit growth in mid-March, providing investors with solid returns.

The forecast suggests that HBAR could climb to a high of $0.24, reflecting a $0.05 increase from its current level. This would mark a 28% gain, meaning an investment of $1,000 could turn into $1,280 if the projection holds true.

Market Cap and Long-Term Prospects

HBAR’s market capitalization reached the $10 billion mark in January but has since dipped to $8 billion. A rebound in price could push it back above the $10 billion threshold, attracting renewed investor interest.

Looking ahead, analysts are also speculating on when HBAR could hit the coveted $1 milestone. If such a surge materializes, today’s investors could see exponential gains, significantly expanding their portfolios.

Also Read: HBAR Price Forecast: Is Hedera Poised for a Bullish Reversal?

While short-term volatility remains a concern, bullish price predictions suggest HBAR could recover in mid-March. If the broader market stabilizes, Hedera may regain momentum and offer attractive returns. Investors should monitor key resistance levels and market trends to make informed decisions.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.