|

Getting your Trinity Audio player ready...

|

Hedera Hashgraph’s native token, HBAR, has captured market attention after recording a 3.34% gain over the last 24 hours. This builds on a 6.86% hike in recent weeks, signaling sustained growth and fueling speculation of further price hikes.

Key Resistance Levels: A Catalyst for Growth

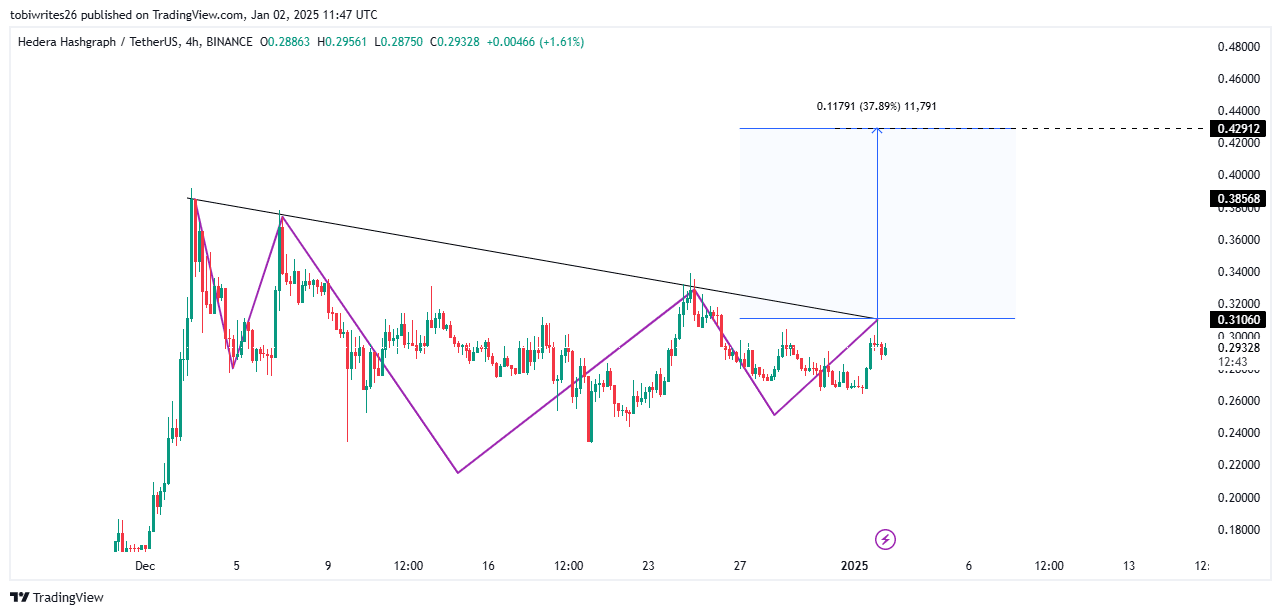

At the time of writing, HBAR trades within an inverse head-and-shoulders pattern—a bullish formation often indicative of an impending rally. The token must breach its key resistance, commonly referred to as the neckline, to realize its full potential. Analysts predict a successful breakout could propel HBAR by 37.89%, pushing its price to approximately $0.429.

However, resistance remains a critical hurdle. Temporary price stalling is possible, but technical indicators suggest that an upward move is likely to materialize soon.

Technical Indicators Signal Bullish Momentum

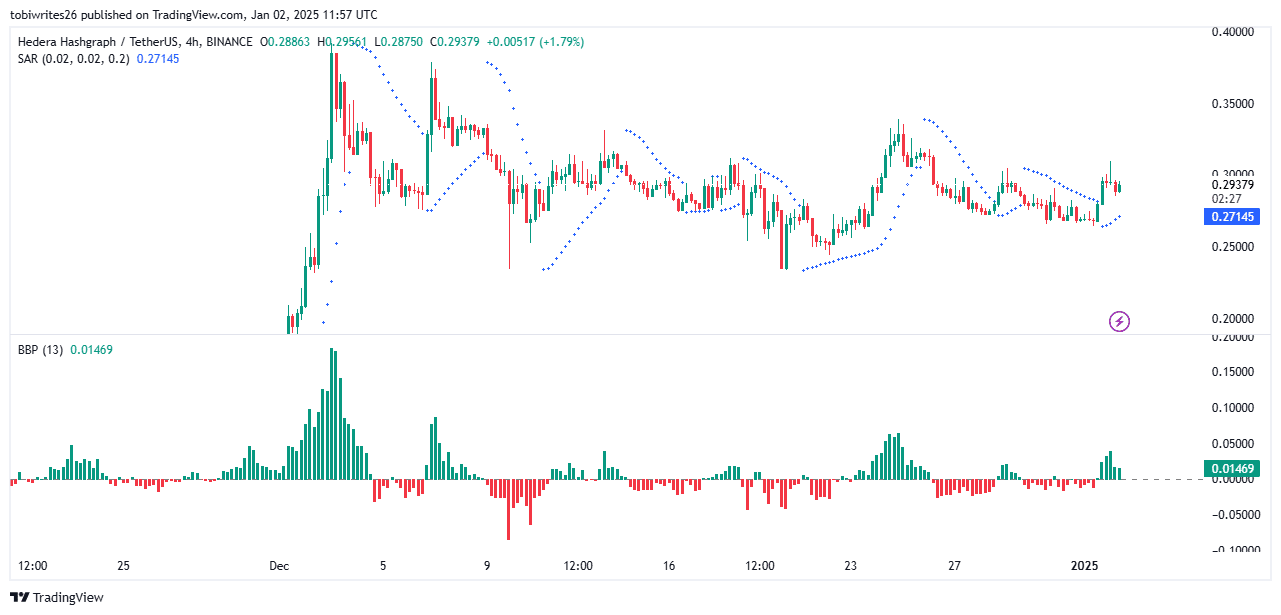

The Parabolic SAR (Stop and Reverse) indicator shows dotted markers forming beneath HBAR’s price candles—a classic sign of increasing buying activity and sustained upward momentum. Similarly, the Bull Bear Power (BBP) index has displayed six consecutive green histogram bars, highlighting the dominance of bullish traders.

Further growth in these indicators would reinforce market confidence, pointing to the possibility of new higher highs as HBAR trends towards its target price.

Rising Open Interest Bolsters Confidence

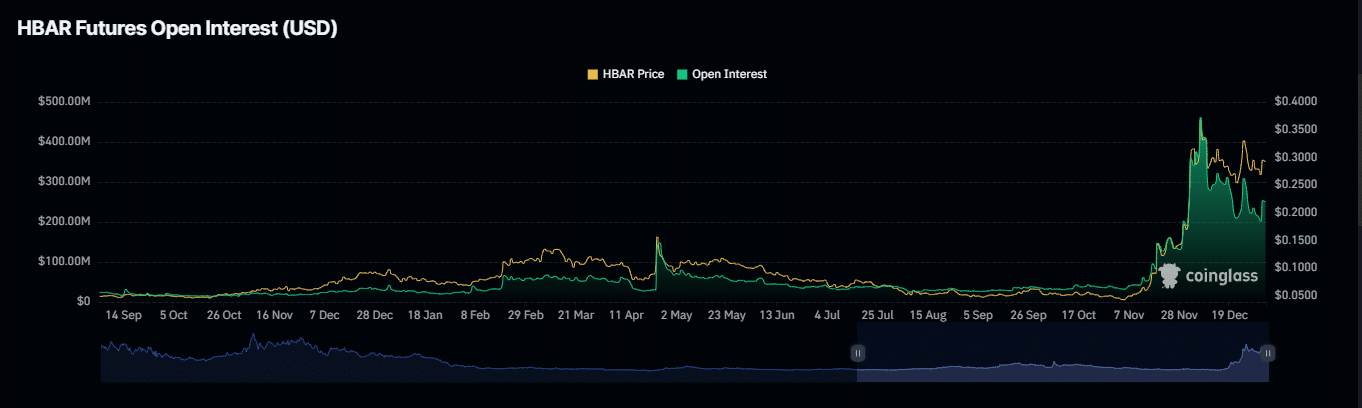

Data from Coinglass reveals a 9.90% increase in Open Interest (OI), now totaling $269.71 million. This surge indicates heightened trading activity and a strong bullish sentiment. Additionally, a positive funding rate of 0.0125% further underscores traders’ confidence in HBAR’s upward trajectory.

Exchange Netflows: A Temporary Setback

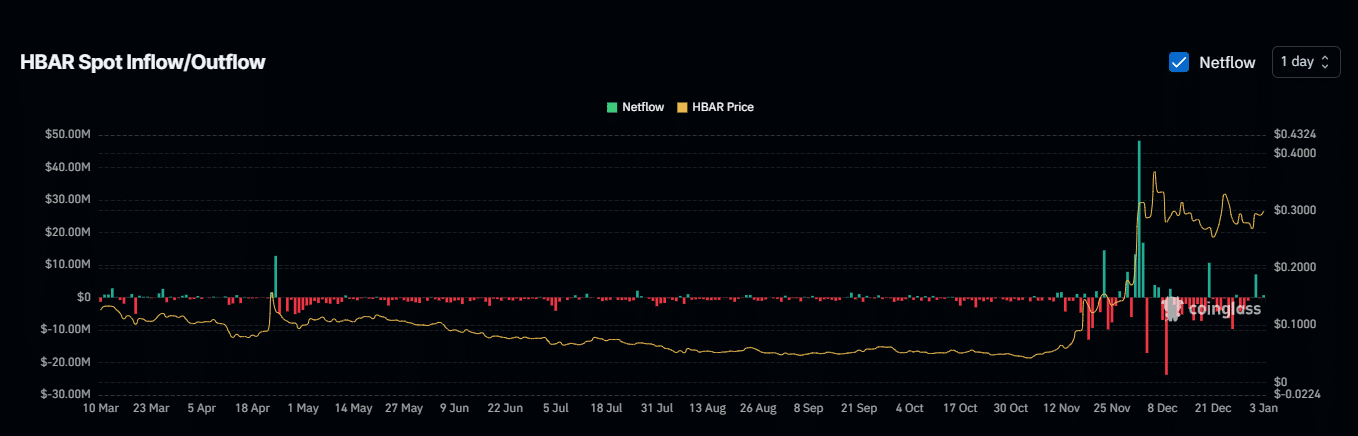

Despite the bullish outlook, recent positive exchange netflows of $1.79 million have temporarily delayed HBAR’s breakout. This selling activity suggests short-term profit-taking. If netflows turn negative, signaling long-term holding intentions, HBAR could resume its rally and breach the critical resistance level.

HBAR’s current momentum, coupled with strong market indicators, positions it as a token to watch, with a potential for significant gains in the near future.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

Also Read: Pro-XRP Lawyer Bill Morgan Predicts XRP & HBAR to Outperform Bitcoin, Ethereum, and Solana in 2025

Crypto and blockchain enthusiast.