|

Getting your Trinity Audio player ready...

|

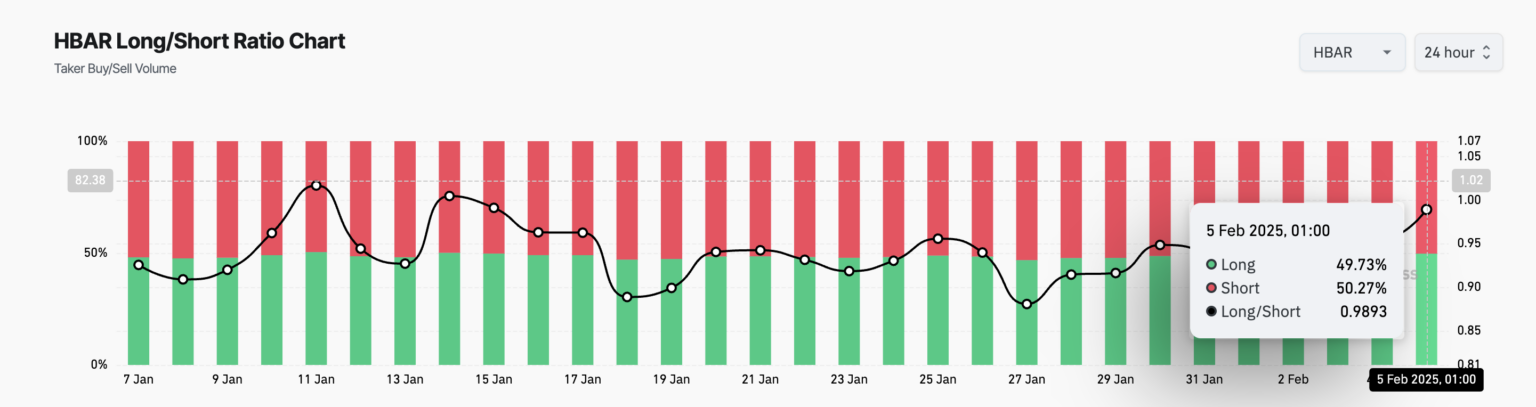

Hedera (HBAR) is currently grappling with strong bearish sentiment in the market, with short traders taking control of its futures market. As of now, the altcoin’s long/short ratio stands at a concerning 0.98, signaling that more traders are betting on HBAR’s price decline rather than an upward movement. This ratio, which compares long positions (bets that the price will rise) to short positions (bets that the price will fall), is crucial for gauging market sentiment. When the ratio is below one, it highlights a dominant bearish outlook, which is precisely the case for HBAR at this time.

Further reinforcing the bearish outlook are technical indicators that suggest a continuation of the downtrend. HBAR is trading below its Ichimoku Cloud on the daily chart, which signals weak demand and downward momentum. The Ichimoku Cloud is a well-regarded tool that tracks market trends and helps identify potential support and resistance levels. When an asset trades below this cloud, it signifies a downtrend, with the cloud acting as a resistance zone that could impede any attempts at a price reversal.

The Moving Average Convergence Divergence (MACD) indicator also confirms a lack of buying pressure for HBAR. With the MACD line (blue) below the signal line (yellow) and the zero line, selling activity is outpacing buying, suggesting further downside potential. This setup indicates that short traders are likely to continue driving the price lower unless a significant shift in market sentiment occurs.

Also Read: Hedera (HBAR) Crashes 13% in 24 Hours Below $10B Market Cap – Is a Drop Below $0.10 Next?

HBAR’s price could soon dip to the critical $0.20 support level. Should selling pressure persist, the altcoin could drop to as low as $0.14, a level not seen since November. However, if bulls regain control and drive demand higher, HBAR’s price could potentially rebound to $0.32, presenting an opportunity for those watching the market closely. For now, the market remains uncertain, with short traders clearly in the driver’s seat.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!